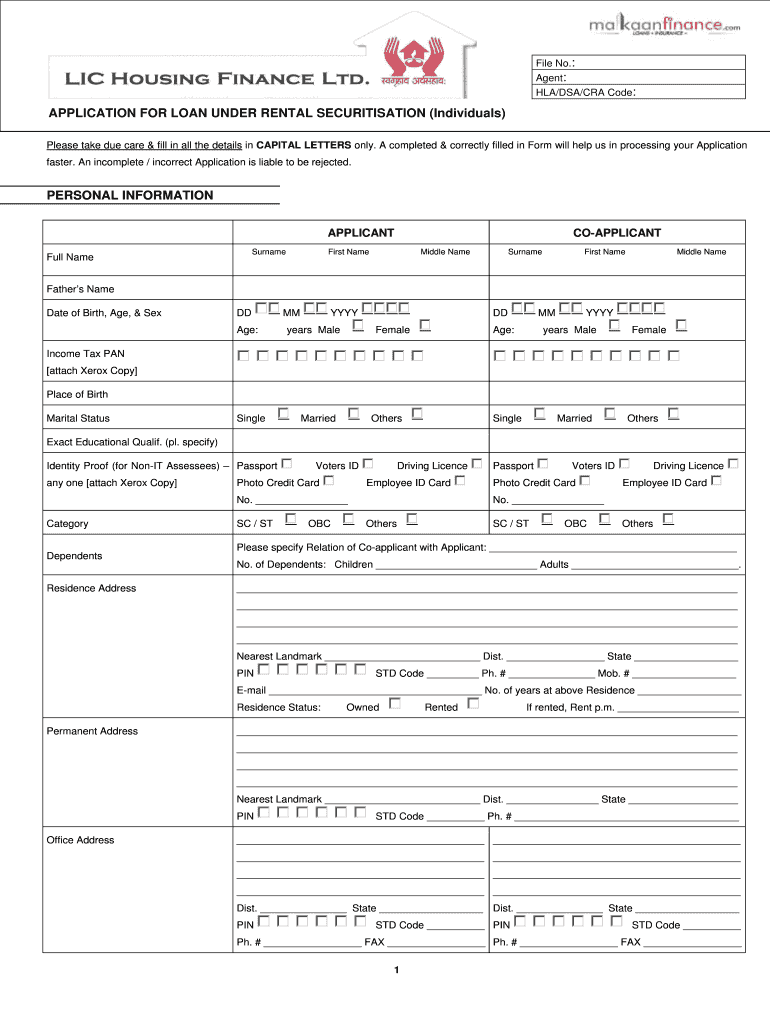

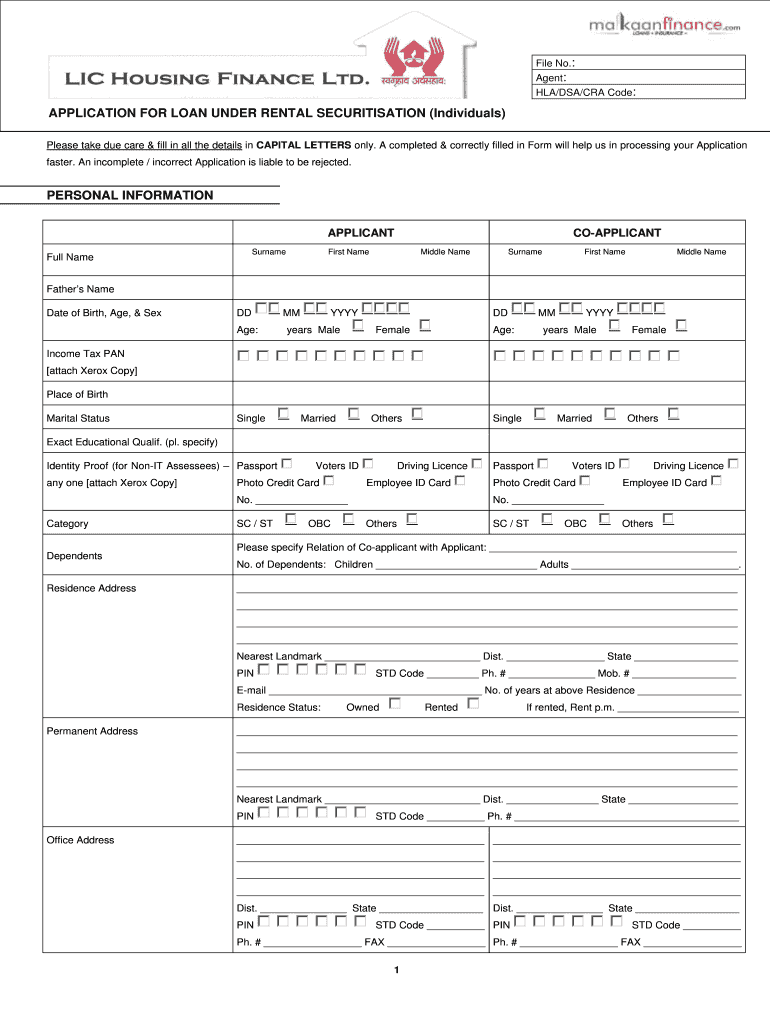

Get the free APPLICATION FOR LOAN UNDER RENTAL SECURITISATION

Show details

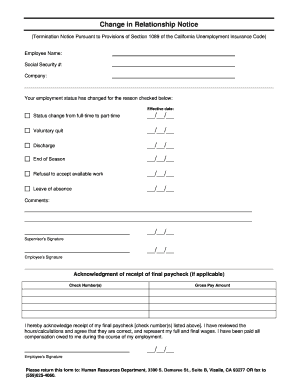

This document serves as an application form for individuals seeking a loan under rental securitisation. It requires detailed personal, financial, and property information to process the application.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for loan under

Edit your application for loan under form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for loan under form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for loan under online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit application for loan under. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for loan under

How to fill out APPLICATION FOR LOAN UNDER RENTAL SECURITISATION

01

Gather necessary documentation such as proof of income, rental agreements, and property details.

02

Obtain the APPLICATION FOR LOAN UNDER RENTAL SECURITISATION form from the lending institution.

03

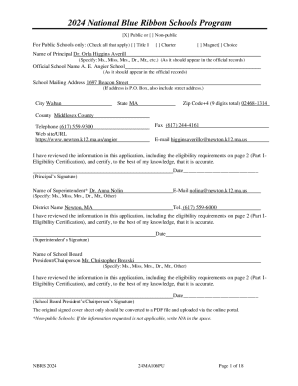

Fill in personal information including name, address, and contact details accurately.

04

Provide details about the rental property, including its location, type, and rental income.

05

Specify the loan amount being requested and the purpose of the loan.

06

Include information about current tenants and lease agreements.

07

Attach all required documents, ensuring they are clearly labeled and organized.

08

Review the completed application for any errors or omissions before submission.

09

Submit the application along with the necessary paperwork to the lender.

Who needs APPLICATION FOR LOAN UNDER RENTAL SECURITISATION?

01

Individuals or property owners looking to secure financing against rental income.

02

Investors aiming to leverage the value of rental properties for additional funding.

03

Landlords seeking to refinance existing loans or invest in new rental properties.

Fill

form

: Try Risk Free

People Also Ask about

What are the three types of securitization?

CDOs, pass-through securitization, and pay-through debt instruments each offer different levels of risk and potential returns, catering to various investor preferences and risk tolerances.

What is securitization of loans?

Securitization is a way of raising funds by selling receivables, which are then turned into asset–backed loan and securities. This method of financing brings various benefits such as diversification of funding sources and improvement of cash flow.

Who buys securitized loans?

Securitized products are typically purchased by institutional investors, including banks, insurance companies, hedge funds, pension funds, and asset managers.

What is a loan against rent receivables?

Loan against Rent Receivables is a loan that can be used in lieu of a Personal Loan for improving the conditions of the property in question, taking up new projects, repair/renovation, and expenses pertaining to education, marriage, or even helping out in a business activity.

What is an example of a securitized loan?

Securitization involves taking a group of illiquid, income-producing assets and turning them into a single product that can be invested in. Anything with a stable cash flow can be securitized and turned into an ABS. Classic examples include auto, student, and home loans.

What happens when loans are securitized?

Most mortgages are securitized, meaning the loans are sold and pooled together to create a mortgage security that is traded in the capital markets for profit. Though these securitizations can take many different forms, they are generally referred to as mortgage-backed securities, or MBS.

What is a securitization loan?

Securitization is the process in which certain types of assets are pooled so that they can be repackaged into interest-bearing securities. The interest and principal payments from the assets are passed through to the purchasers of the securities.

Which type of loans are securitized most often?

Most mortgages are securitized, meaning the loans are sold and pooled together to create a mortgage security that is traded in the capital markets for profit. Though these securitizations can take many different forms, they are generally referred to as mortgage-backed securities, or MBS.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR LOAN UNDER RENTAL SECURITISATION?

APPLICATION FOR LOAN UNDER RENTAL SECURITISATION is a formal request submitted by property owners or developers to financial institutions seeking loans backed by the anticipated rental income from their properties, which are securitized.

Who is required to file APPLICATION FOR LOAN UNDER RENTAL SECURITISATION?

Property owners, real estate developers, and companies that generate rental income from their properties are typically required to file this application when seeking financing.

How to fill out APPLICATION FOR LOAN UNDER RENTAL SECURITISATION?

To fill out the APPLICATION, applicants must provide personal and business information, details about the properties involved, projected rental income, and any relevant financial documentation to support the loan request.

What is the purpose of APPLICATION FOR LOAN UNDER RENTAL SECURITISATION?

The purpose of the APPLICATION is to obtain financing against the future rental income from a property, enabling property owners to access liquidity and invest in further developments or meet current financial obligations.

What information must be reported on APPLICATION FOR LOAN UNDER RENTAL SECURITISATION?

The application must report information including applicant details, property descriptions, current rental agreements, expected rental income, and relevant financial statements along with any existing liabilities.

Fill out your application for loan under online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Loan Under is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.