Get the free Form 6-K on IFRS Fin. Statements - Daimler

Show details

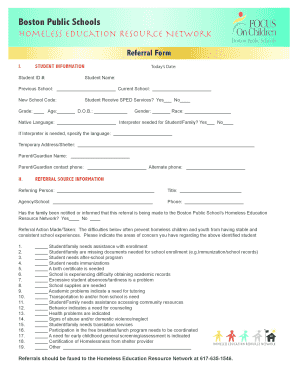

SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 6-K REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934 For the month of April

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 6-k on ifrs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 6-k on ifrs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 6-k on ifrs online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 6-k on ifrs. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out form 6-k on ifrs

How to fill out form 6-k on IFRS:

01

Gather all relevant financial information: Start by collecting all the necessary financial data, such as financial statements, quarterly or annual reports, and any other relevant information required for reporting under IFRS.

02

Understand the reporting requirements: Familiarize yourself with the specific reporting requirements outlined in IFRS for form 6-k. This will ensure that you accurately disclose all the necessary information in the correct format.

03

Complete the form: Fill out form 6-k by providing the required information in the appropriate sections. This may include details about the reporting entity, financial statements and notes, management reports, and any other relevant disclosures.

04

Review and verify the information: Take the time to review all the entered information for accuracy and completeness. Double-check that all the required disclosures have been included and that there are no errors or omissions.

05

Ensure compliance with IFRS: Cross-reference the form with the IFRS guidelines to ensure that all the disclosed information follows the required accounting principles. Make any necessary adjustments or revisions to ensure compliance.

06

Seek professional assistance if needed: If you are unsure about any aspect of filling out form 6-k on IFRS, consider seeking help from a professional, such as an accountant or an IFRS specialist. They can provide guidance and ensure that the form is completed correctly.

Who needs form 6-k on IFRS:

01

Publicly traded companies: Form 6-k on IFRS is typically required for publicly traded companies that are governed by international accounting standards. These companies need to disclose their financial results and other relevant information to regulators and stakeholders.

02

Companies with foreign listings: If a company has a foreign listing and is subject to the reporting requirements of different regulatory bodies, they may need to file form 6-k to ensure compliance with IFRS standards.

03

Companies in countries adopting IFRS: In countries that have adopted IFRS as their accounting standards, companies operating within these jurisdictions are required to comply with IFRS reporting requirements, including filing form 6-k if applicable.

Overall, form 6-k on IFRS is necessary for companies that need to provide timely and accurate financial information to regulators, investors, and other stakeholders in accordance with international accounting standards.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 6-k on ifrs?

Form 6-K on IFRS is a report filed by foreign private issuers to provide periodic updates and material information to the U.S. Securities and Exchange Commission (SEC).

Who is required to file form 6-k on ifrs?

Foreign private issuers registered with the SEC are required to file form 6-K on IFRS.

How to fill out form 6-k on ifrs?

Form 6-K on IFRS can be filled out electronically through the SEC's online filing system. Detailed instructions can be found on the SEC's official website.

What is the purpose of form 6-k on ifrs?

The purpose of form 6-K on IFRS is to provide important information about significant events or developments that could have an impact on the financial position or operations of the foreign private issuer.

What information must be reported on form 6-k on ifrs?

Form 6-K on IFRS requires reporting of a wide range of information, including financial statements, management reports, significant corporate events, and other information required to be disclosed under the applicable accounting standards.

When is the deadline to file form 6-k on ifrs in 2023?

The specific deadline to file form 6-K on IFRS in 2023 will depend on several factors, including the foreign private issuer's reporting calendar and the applicable SEC regulations. It is recommended to consult the SEC's official website or seek professional advice for the accurate deadline.

What is the penalty for the late filing of form 6-k on ifrs?

The penalties for late filing of form 6-K on IFRS are determined by the SEC and can vary depending on the circumstances. Penalties may include fines, loss of privileges, or other regulatory actions.

How do I edit form 6-k on ifrs in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your form 6-k on ifrs, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How can I edit form 6-k on ifrs on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing form 6-k on ifrs right away.

How do I edit form 6-k on ifrs on an Android device?

You can edit, sign, and distribute form 6-k on ifrs on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your form 6-k on ifrs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.