Get the free Tennessee Property Tax Freeze Program

Show details

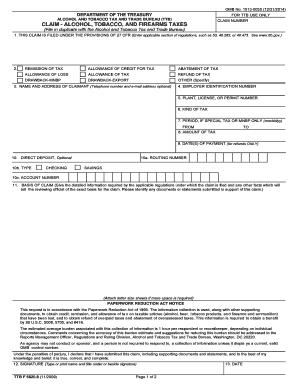

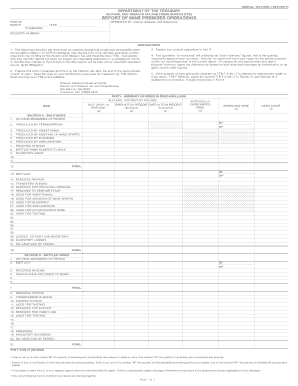

This document outlines the Tennessee property tax freeze program aimed at providing tax relief to homeowners aged 65 or older based on amendments to the state constitution.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tennessee property tax ze

Edit your tennessee property tax ze form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tennessee property tax ze form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tennessee property tax ze online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tennessee property tax ze. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tennessee property tax ze

How to fill out Tennessee Property Tax Freeze Program

01

Determine if you meet eligibility requirements (age, disability status, income limits).

02

Obtain the necessary forms from your local county property assessor's office or their website.

03

Complete the application form, providing all required information including personal details and property information.

04

Supply any necessary documentation to verify eligibility (e.g., proof of age, disability certification, income statements).

05

Submit the completed application and any documentation to your local property assessor's office before the deadline.

06

Await confirmation of your application status and any further instructions.

Who needs Tennessee Property Tax Freeze Program?

01

Senior citizens aged 65 and older who meet income requirements.

02

Individuals with a permanent disability who meet income limits.

03

Homeowners who wish to maintain their property tax base during times of economic uncertainty.

Fill

form

: Try Risk Free

People Also Ask about

How does property tax relief work in Tennessee?

Tax relief is payment by the State of Tennessee to reimburse homeowners meeting certain eligibility requirements, for a part or all of paid property taxes. Tax Relief is not an exemption. You still receive your tax bill(s) and are responsible for paying your property taxes each year.

How long can you go without paying property tax in Tennessee?

Taxes on real and personal property are barred, discharged and uncollectible after the lapse of 10 years from April 1 of the year following the year in which such taxes become delinquent, unless the property is sold at a tax sale during this period.

At what age do seniors stop paying property tax in Tennessee?

Under the program, qualifying homeowners age 65 or older, disabled homeowners, as well as disabled veteran homeowners or their surviving spouses receive tax relief from the taxes due on their property. Homeowners must have been 65 by December 31 of the tax year for which they are applying.

What age do you stop paying taxes in Tennessee?

Any person 65 years of age or older having a total annual income below specific limits is completely exempt from the tax. Total annual income means income from any and all sources, including social security. All income should be included, regardless of whether it is taxable for federal purposes.

Who is exempt from property taxes in TN?

Under general exemption law, property owned by a religious, charitable, scientific, or non-profit educational institution and used for an exempt purpose may qualify for exemption.

What states do you not have to pay property tax after 65?

The following states offer partial exemption on property taxes for seniors and people over 65. Hawaii. In Hawaii, if you're 65 or older, you could knock $160,000 off your home's assessed value, reducing your property tax liability. Louisiana. Alaska. New York. Washington. Mississippi. Florida. South Dakota.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Tennessee Property Tax Freeze Program?

The Tennessee Property Tax Freeze Program is a program designed to help eligible seniors and permanently disabled individuals by freezing their property taxes at the amount they were when they first qualified for the program, preventing increases due to rising property values.

Who is required to file Tennessee Property Tax Freeze Program?

Eligible applicants, which typically include individuals who are aged 65 or older or permanently disabled, must file for the Tennessee Property Tax Freeze Program to take advantage of the benefits.

How to fill out Tennessee Property Tax Freeze Program?

To fill out the Tennessee Property Tax Freeze Program application, eligible individuals must complete a specific application form available through their local county assessor's office or the state’s Department of Revenue, providing necessary documentation of age, disability, and income.

What is the purpose of Tennessee Property Tax Freeze Program?

The purpose of the Tennessee Property Tax Freeze Program is to provide financial relief to senior citizens and disabled persons by stabilizing their property tax burden, allowing them to remain in their homes despite potential increases in property values and taxes.

What information must be reported on Tennessee Property Tax Freeze Program?

Applicants must report personal information including name, address, date of birth, Social Security number, and information about their household income, as well as documentation confirming age, disability status, and property ownership.

Fill out your tennessee property tax ze online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tennessee Property Tax Ze is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.