Get the free BERARDI MARTIN

Show details

SEC Form 4 FORM 4 OMB APPROVAL UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP Check this box if no longer subject to Section 16.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your berardi martin form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your berardi martin form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit berardi martin online

To use the professional PDF editor, follow these steps below:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit berardi martin. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

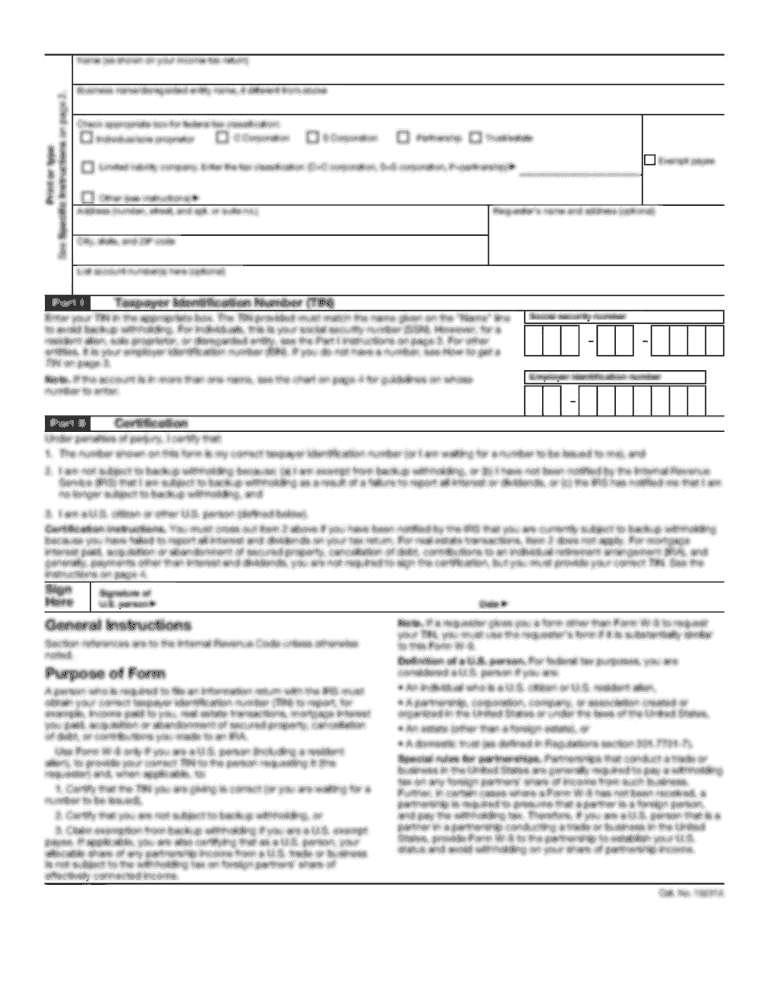

How to fill out berardi martin

How to fill out Berardi Martin:

01

Start by gathering all the required information and documents for filling out the Berardi Martin form. This may include personal details, financial information, and any supporting documents needed.

02

Follow the instructions provided on the form carefully. Read through each section and ensure that you understand what information is being requested. If you have any doubts, seek clarification from the relevant authority or consult an expert.

03

Begin by filling out the personal details section. This typically includes your full name, contact information, date of birth, and social security number. Double-check the accuracy of the information you provide to avoid any discrepancies.

04

Move on to the financial information section. This may require you to disclose your income, assets, liabilities, and any other relevant financial details. Be honest and provide accurate information to the best of your knowledge.

05

If the form includes any specific sections related to your employment or business, ensure that you provide the requested details accurately. This may include information on your employer, job title, and business income.

06

Carefully review the completed form before submitting it. Check for any errors or missing information. Make sure that you have signed and dated the form where required.

Who needs Berardi Martin:

01

Individuals or businesses who require expert advice and assistance in managing their financial affairs.

02

Those facing complex financial situations such as tax planning, business restructuring, or estate planning.

03

People who are seeking professional guidance in matters related to investments, insurance, retirement planning, or wealth management.

Remember to consult with a qualified professional or advisor to ensure that your specific needs are met and that you receive the appropriate guidance throughout the process.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

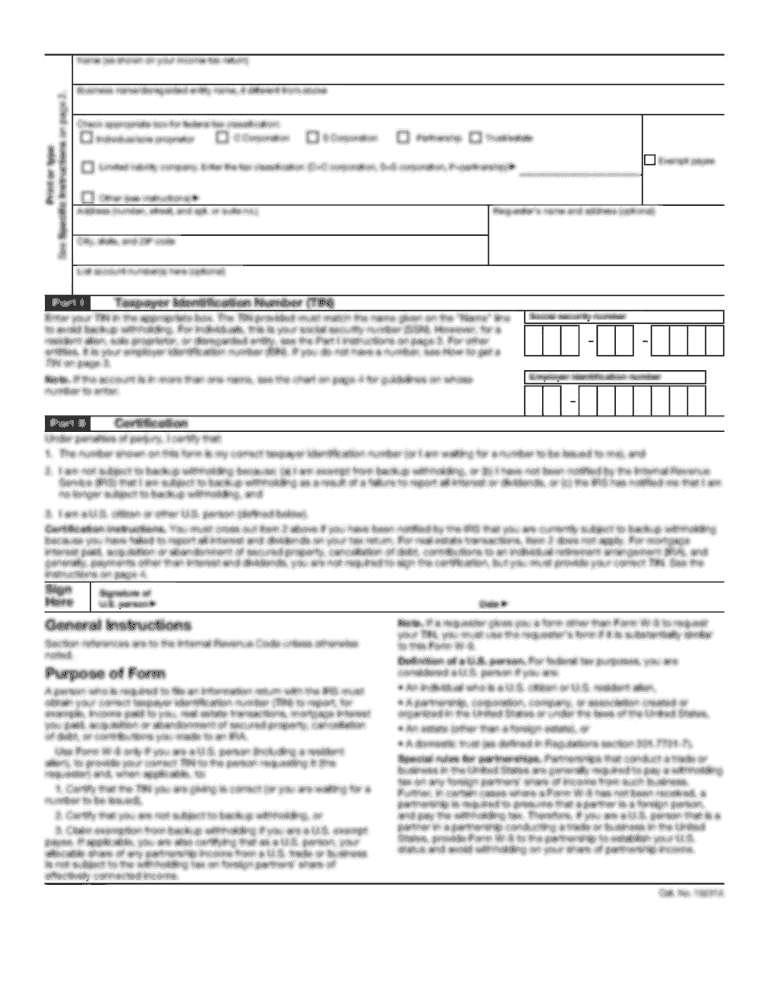

What is berardi martin?

Berardi Martin is a form that needs to be filed for tax purposes.

Who is required to file berardi martin?

Individuals who meet certain criteria specified by the tax authorities are required to file Berardi Martin.

How to fill out berardi martin?

Berardi Martin can be filled out by providing accurate financial information and completing all the required sections according to the guidelines provided by the tax authorities.

What is the purpose of berardi martin?

The purpose of Berardi Martin is to provide the tax authorities with detailed financial information of individuals in order to determine their tax liabilities.

What information must be reported on berardi martin?

Berardi Martin typically requires individuals to report their income, assets, deductions, and any other relevant financial information as per the instructions provided.

When is the deadline to file berardi martin in 2023?

The deadline to file Berardi Martin in 2023 is typically April 15th.

What is the penalty for the late filing of berardi martin?

The penalty for the late filing of Berardi Martin can vary depending on the tax laws and regulations of the jurisdiction. It is recommended to consult with a tax professional or refer to the guidelines provided by the tax authorities to determine the specific penalty for late filing.

How do I modify my berardi martin in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your berardi martin and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I fill out berardi martin using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign berardi martin and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I complete berardi martin on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your berardi martin, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

Fill out your berardi martin online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.