Get the free Chapter 7 Pro formas and Templates

Show details

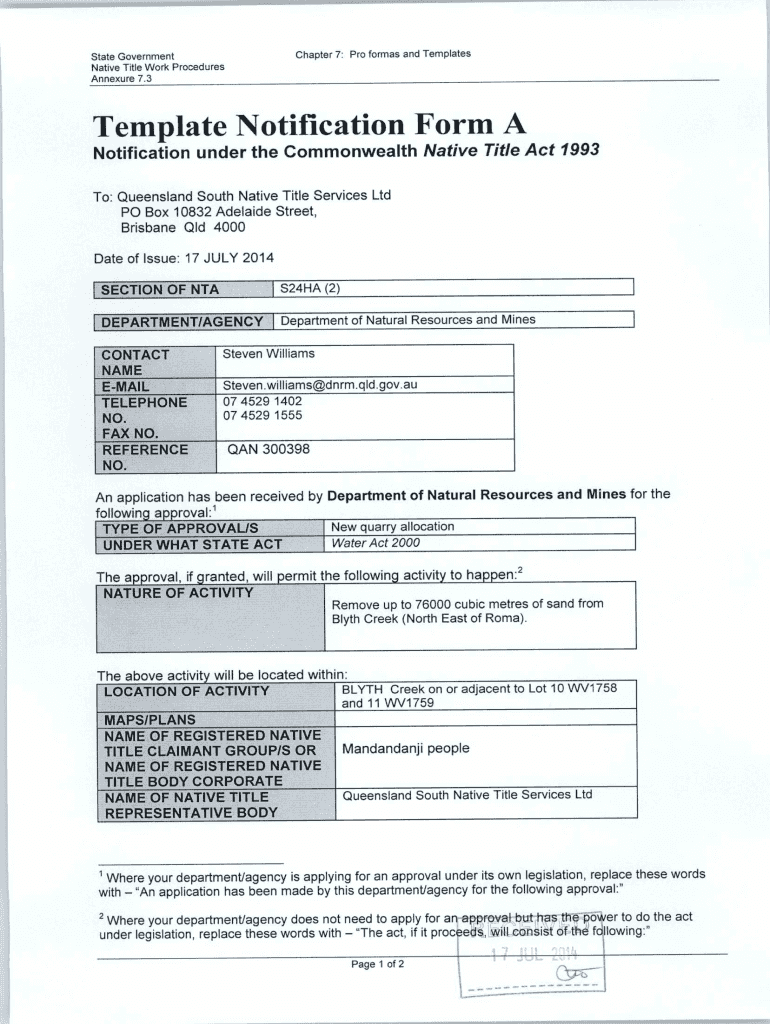

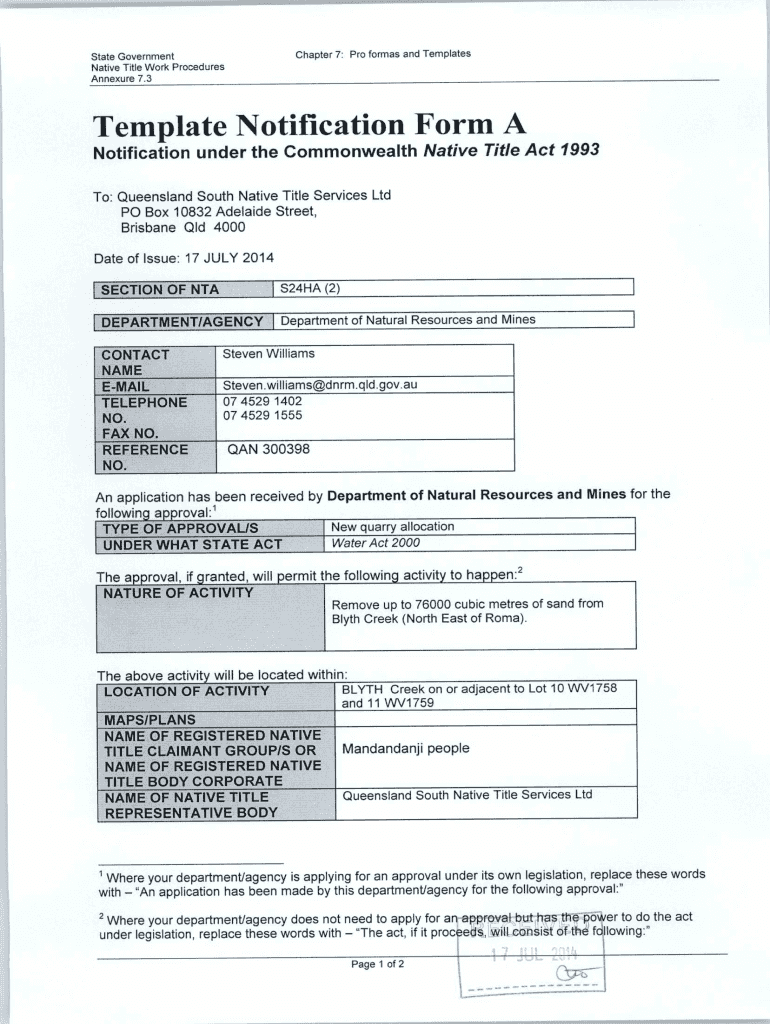

Chapter 7: Pro format and Templates State Government Native Title Work Procedures Appendix 7.3 Template Notification Form A Notification under the Commonwealth Native Title Act 1993 To: Queensland

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign chapter 7 pro formas

Edit your chapter 7 pro formas form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your chapter 7 pro formas form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit chapter 7 pro formas online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit chapter 7 pro formas. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out chapter 7 pro formas

How to Fill Out Chapter 7 Pro Formas:

01

Familiarize yourself with the requirements: Before filling out chapter 7 pro formas, it is essential to understand the specific requirements of your business or organization. These requirements may vary depending on the industry, location, and legal regulations.

02

Gather relevant financial information: Collect all the necessary financial data that is needed to complete the pro formas. This may include income statements, balance sheets, cash flow statements, and any other financial records relevant to your business. It is essential to ensure that this information is accurate and up to date.

03

Determine the purpose of the pro formas: Pro formas can serve multiple purposes, such as predicting future financial performance, evaluating potential investments, or securing financing. Clearly define the purpose of your pro formas to ensure they are tailored to meet your specific needs.

04

Calculate revenue projections: Estimate your future revenue by analyzing historical sales data, market trends, and potential growth opportunities. Consider factors such as seasonality, market demand, and competition to ensure realistic revenue projections.

05

Estimate expenses: Determine and itemize all the anticipated expenses that your business may incur. This may include costs related to production, operations, marketing, personnel, and overhead. It is crucial to be thorough and accurate to ensure that your pro formas provide an accurate picture of your financial situation.

06

Analyze cash flow: Assess the cash flow projections by considering both incoming and outgoing cash streams. This will help you understand how much money will be available at different points in time and whether your business can meet its financial obligations.

07

Calculate profitability: Use the pro formas to determine your business's potential profitability. Calculate the gross profit margin, net profit margin, and other relevant financial ratios to evaluate the financial viability of your operations.

Who Needs Chapter 7 Pro Formas?

01

Startups and new businesses: Entrepreneurs and startups may need chapter 7 pro formas to demonstrate their financial projections and viability to potential investors, lenders, or partners.

02

Small business owners: Chapter 7 pro formas can be useful for small business owners who want to assess their current financial situation and plan for future growth. It can help them make informed decisions about resource allocation, budgeting, and strategic planning.

03

Financial institutions and investors: Banks, lenders, and investors often require chapter 7 pro formas to evaluate the financial health and viability of a business before providing funding or making investment decisions.

04

Government agencies and regulatory bodies: Certain industries or sectors may be required to submit chapter 7 pro formas to comply with regulations or obtain licenses. These pro formas help ensure that businesses meet the financial standards set by the governing bodies.

In summary, filling out chapter 7 pro formas involves understanding the requirements, gathering relevant financial information, estimating revenue and expenses, analyzing cash flow and profitability. These pro formas are valuable for startups, small business owners, financial institutions, investors, and government agencies to assess financial performance and make informed decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit chapter 7 pro formas from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including chapter 7 pro formas, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I create an electronic signature for the chapter 7 pro formas in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your chapter 7 pro formas in seconds.

How do I complete chapter 7 pro formas on an Android device?

Use the pdfFiller app for Android to finish your chapter 7 pro formas. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is chapter 7 pro formas?

Chapter 7 pro formas are financial statements that estimate the future financial performance of a company under certain conditions.

Who is required to file chapter 7 pro formas?

Companies going through Chapter 7 bankruptcy are required to file chapter 7 pro formas.

How to fill out chapter 7 pro formas?

Chapter 7 pro formas are filled out by inputting financial data and assumptions into a template or software program.

What is the purpose of chapter 7 pro formas?

The purpose of chapter 7 pro formas is to help assess the financial viability of a company and its ability to emerge from bankruptcy.

What information must be reported on chapter 7 pro formas?

Chapter 7 pro formas must report projected income, expenses, cash flow, and balance sheet figures.

Fill out your chapter 7 pro formas online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Chapter 7 Pro Formas is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.