Get the free Loan Evaluation Form - Westcon UCC

Show details

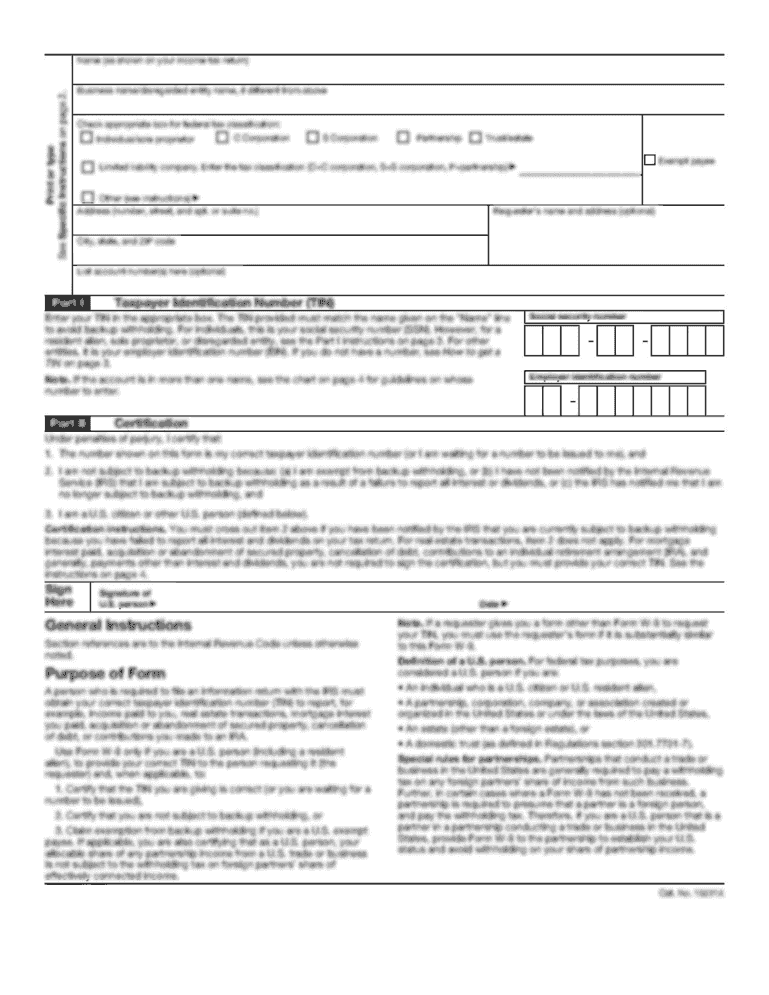

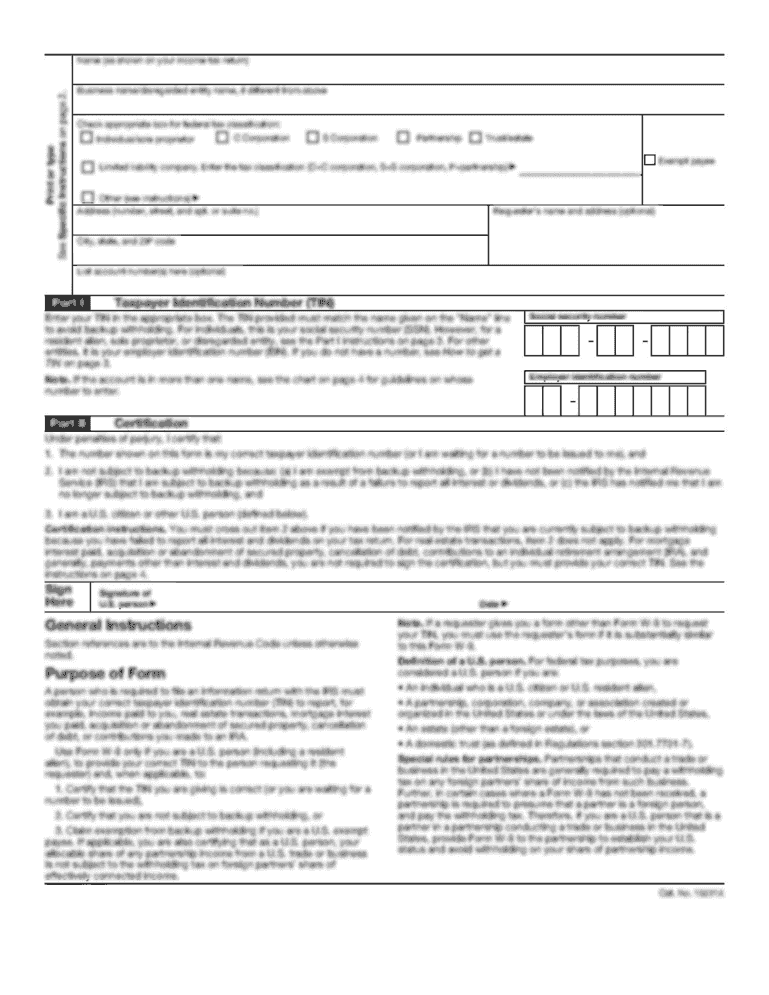

Loan Evaluation Form COMMUNICATIONS SOLUTIONS Please send completed Loan Evaluation Forms to: e. polynomials westcon.com f. 01753 979887 Customer Details (For Shipment) End User Name: End User Contact

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your loan evaluation form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan evaluation form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit loan evaluation form online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit loan evaluation form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

How to fill out loan evaluation form

How to fill out a loan evaluation form?

01

Start by carefully reading all the instructions provided on the loan evaluation form. It is essential to understand what information is being requested and how to accurately fill it out.

02

Begin by providing your personal information, including your full name, contact details, social security number, and date of birth. Ensure that this information is accurate and up to date.

03

Proceed to fill out the section regarding your current employment status. Include details such as your employer's name, job title, length of employment, and monthly income. If you are self-employed, be prepared to provide additional documentation and financial statements.

04

Next, move on to the section related to your financial information. This usually includes providing details about your assets, liabilities, monthly expenses, and any existing loans or credit card debts. It is crucial to be thorough and honest when reporting your financial situation.

05

If the loan evaluation form requires information about the purpose of the loan, be sure to specify how you intend to use the funds. This can include home renovations, debt consolidation, education expenses, or any other applicable reason.

06

If the form asks for references, provide the requested information accurately. Usually, you will need to provide the names, contact numbers, and relationships of individuals who can vouch for your character and financial responsibility.

07

Once you have completed filling out the loan evaluation form, double-check all the provided information for accuracy. Ensure that there are no errors or missing details that may negatively impact the evaluation process.

08

Finally, submit the completed loan evaluation form according to the provided instructions. This may involve mailing it to a specific address or submitting it electronically through an online platform.

Who needs a loan evaluation form?

01

Individuals who are applying for a loan from a financial institution or lender may need to fill out a loan evaluation form. This form allows the lender to assess the borrower's financial situation and determine their eligibility for the loan.

02

Businesses or organizations that are seeking financing or loans for various purposes may also require a loan evaluation form. This helps the lender evaluate the business's financial health and determine the level of risk associated with approving the loan.

03

Loan evaluation forms are also used by financial advisors or consultants who assist clients in determining their borrowing capacity and finding suitable loan options. These professionals use the form to gather relevant financial information and analyze it to provide appropriate recommendations and guidance.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit loan evaluation form from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your loan evaluation form into a dynamic fillable form that you can manage and eSign from anywhere.

How can I get loan evaluation form?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the loan evaluation form in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I edit loan evaluation form on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as loan evaluation form. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your loan evaluation form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.