Get the free FORM 35-CERT

Show details

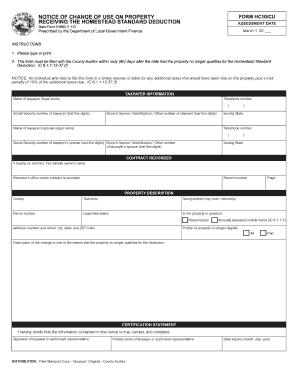

This document certifies compliance with terms and conditions relevant to Gulf Power Company as per SEC regulations, specifically for the third quarter of 2004.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 35-cert

Edit your form 35-cert form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 35-cert form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 35-cert online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form 35-cert. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 35-cert

How to fill out FORM 35-CERT

01

Obtain FORM 35-CERT from the relevant authority or official website.

02

Fill in your personal details, including your name, address, and contact information.

03

Provide any required documentation or identification as specified in the form.

04

Complete the sections related to the purpose of the certificate.

05

Review the form for accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the completed FORM 35-CERT to the appropriate office or online portal.

Who needs FORM 35-CERT?

01

Individuals applying for a specific certificate or verification.

02

Organizations or entities requiring certification for compliance or legal purposes.

Fill

form

: Try Risk Free

People Also Ask about

How do I write an appeal letter for income tax?

Dear Sir or Madam, I hereby appeal the income tax assessment for the year [TAX YEAR] dated [DATE]. Thank you in advance. ? You can include your mailing address either under your name or in your email signature to ensure the tax office can contact you by post.

What is the use of Form 35?

Overview. Form 35 is available for use to any assessee / deductor aggrieved by an order of the Assessing Officer (AO). In such a case, the appeal can be filed against the order of the AO before the Joint commissioner (Appeals) or Commissioner of Income Tax (Appeals) using Form 35.

What is Form 35 rule?

Any assessee/ deductor can use Form 35. Every appeal is accompanied by payment of an appeal fee which is required to be paid before filing of Form 35. The quantum of appeal fees is dependent on the total income as computed or assessed by the AO.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FORM 35-CERT?

FORM 35-CERT is a certification form used for reporting specific details related to tax exemptions and deductions in a structured manner as mandated by tax authorities.

Who is required to file FORM 35-CERT?

Individuals or entities claiming tax exemptions, deductions, or benefits under applicable tax laws are required to file FORM 35-CERT.

How to fill out FORM 35-CERT?

To fill out FORM 35-CERT, the filer must provide accurate personal or entity information, details regarding the tax exemptions or deductions claimed, and any supporting documentation as required.

What is the purpose of FORM 35-CERT?

The purpose of FORM 35-CERT is to ensure that taxpayers report their claims for tax benefits accurately and transparently, allowing tax authorities to verify and process these claims.

What information must be reported on FORM 35-CERT?

The information that must be reported on FORM 35-CERT includes the taxpayer's identification details, the specific exemptions or deductions claimed, relevant financial data, and any applicable supporting evidence.

Fill out your form 35-cert online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 35-Cert is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.