Get the free SAOF form 2009-10 - Huskers.com

Show details

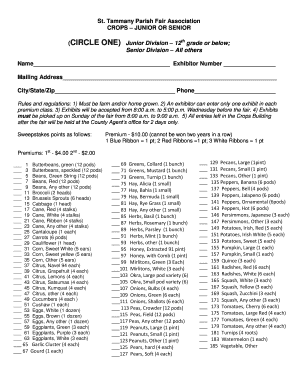

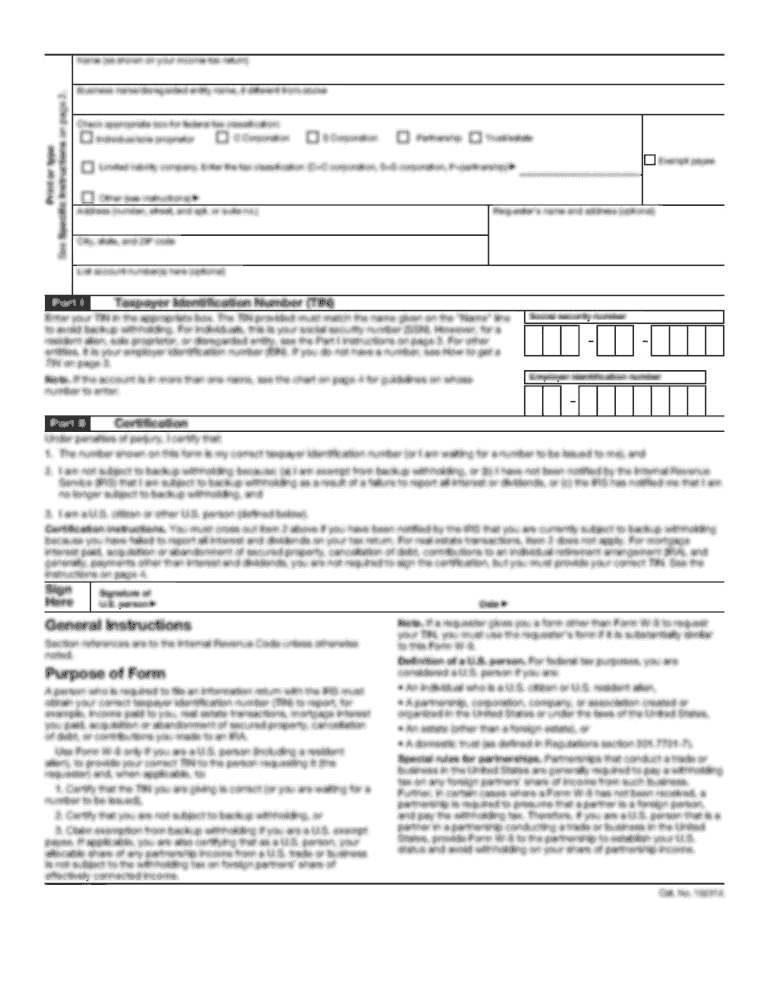

2009-10 Athletic Department Compliance University of Nebraska NCAA STUDENT-ATHLETE OPPORTUNITY FUND APPLICATION FORM Name: NU ID#: (Legal) Sport: Phone #: International Student-Athlete ? ? ? ? Input

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your saof form 2009-10 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your saof form 2009-10 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit saof form 2009-10 online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit saof form 2009-10. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

How to fill out saof form 2009-10

How to fill out saof form 2009-10:

01

Gather all necessary documents and information: Before starting to fill out the saof form 2009-10, make sure you have all the required documents and information handy. This may include personal identification documents, income statements, tax information, and any relevant financial records. Having everything organized will make the process smoother.

02

Follow the instructions: The saof form 2009-10 comes with detailed instructions. Read them carefully and follow each step to ensure accurate and complete completion of the form. The instructions will guide you through each section and provide information on what needs to be filled in.

03

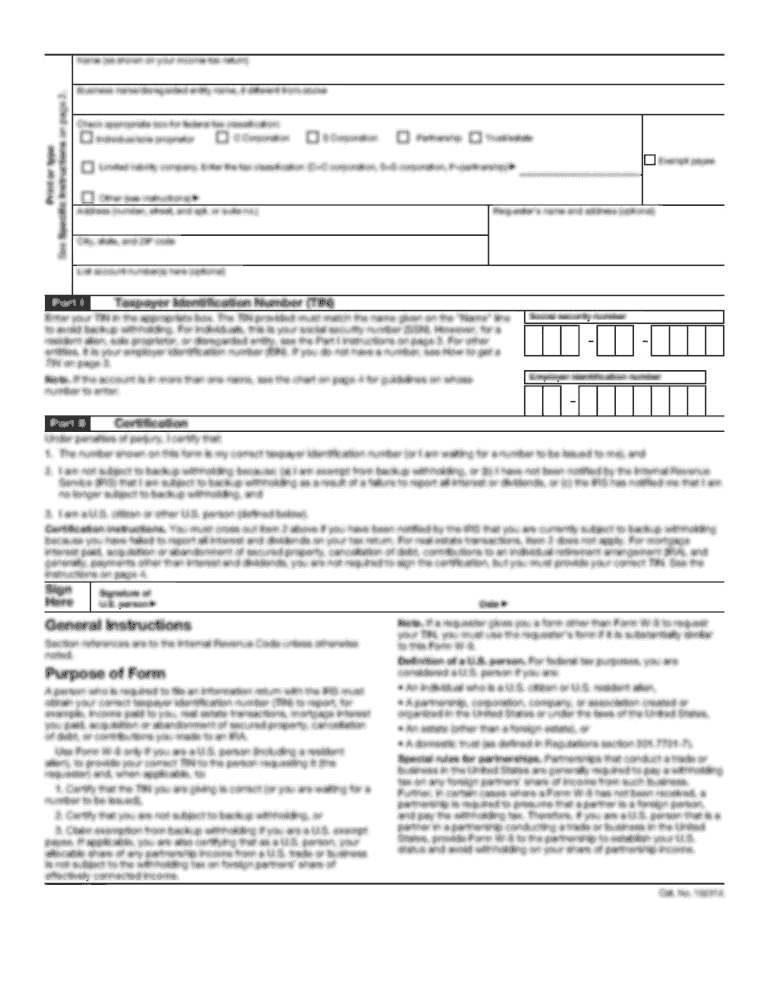

Provide personal details: Begin by filling in your personal information such as your full name, address, contact information, and social security number. Make sure to double-check the accuracy of these details.

04

Report your income: In the saof form 2009-10, there will be a section dedicated to reporting your income. Fill in all the required information regarding your sources of income, including any financial assistance, loans, or grants you may have received during the specified period. Be transparent and provide accurate figures.

05

Declare any deductions or exemptions: If applicable, report any deductions or exemptions that you are eligible for. This could include expenses related to education, healthcare, or specific tax credits. Review the instructions to understand which deductions are applicable and provide the necessary documentation.

06

Provide supporting documents: As part of the saof form process, you may need to provide supporting documents to validate the information you have provided. Attach copies of any required documents, such as income statements, tax returns, or identification documents. Ensure that all attachments are legible and appropriately labeled.

07

Review and submit the form: Once you have completed filling out the saof form 2009-10, carefully review all the information you have entered. Make sure there are no errors or omissions. It is crucial to ensure the accuracy of the form, as any mistakes could lead to delays or complications. Once you are confident with the form, sign and date it, and submit it as instructed.

Who needs saof form 2009-10:

01

Students seeking financial aid: The saof form 2009-10 is typically required for students who are applying for financial aid, grants, or scholarships. They need to fill out this form to disclose their financial information and demonstrate their eligibility for assistance.

02

Universities and colleges: Educational institutions use the saof form 2009-10 to assess the financial need of students and determine the amount of aid or assistance they may be eligible for. It helps institutions in evaluating applicants' financial status and making informed decisions regarding financial aid allocation.

03

Financial aid offices and government agencies: The saof form 2009-10 is utilized by financial aid offices and government agencies responsible for the distribution of financial assistance. They require this form to collect accurate financial data from students and process their applications for financial aid programs.

Overall, filling out the saof form 2009-10 accurately and completely is crucial for both the applicants and the entities responsible for assessing financial need and distributing aid. It ensures transparency and helps determine the appropriate financial assistance for eligible students.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is saof form 10?

SAOF Form 10 is a financial reporting form used to gather information about a company's financial activities.

Who is required to file saof form 10?

All companies are required to file SAOF Form 10.

How to fill out saof form 10?

To fill out SAOF Form 10, you need to provide accurate information about your company's financial activities, including income, expenses, assets, and liabilities. Follow the instructions given with the form to ensure proper completion.

What is the purpose of saof form 10?

The purpose of SAOF Form 10 is to collect financial data from companies for analysis and regulatory purposes.

What information must be reported on saof form 10?

SAOF Form 10 requires companies to report their income, expenses, assets, liabilities, and other financial information as specified in the form.

When is the deadline to file saof form 10 in 2023?

The deadline to file SAOF Form 10 in 2023 is April 30th.

What is the penalty for the late filing of saof form 10?

The penalty for late filing of SAOF Form 10 is a monetary fine imposed by the regulatory authorities. The amount of the penalty may vary depending on the duration of the delay.

How do I execute saof form 2009-10 online?

pdfFiller has made filling out and eSigning saof form 2009-10 easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I complete saof form 2009-10 on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your saof form 2009-10. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

How do I complete saof form 2009-10 on an Android device?

Complete your saof form 2009-10 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

Fill out your saof form 2009-10 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.