Get the free (1) - The option is exercisable in three equal annual installments beginning on June...

Show details

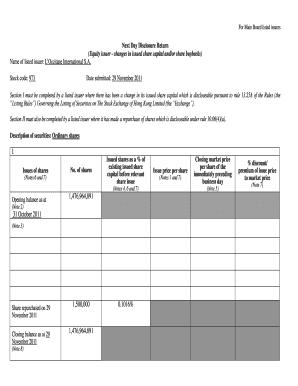

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 OMB APPROVAL STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES OMB Number: 3235-0287 Expires: January 31, 2008, Estimated

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 1 - form option form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1 - form option form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 1 - form option online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 1 - form option. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

How to fill out 1 - form option

How to fill out 1 - form option:

01

Start by gathering all the necessary information required for the form. This may include personal details such as name, address, and contact information.

02

Carefully read and understand each section of the form before filling it out. Make sure you comprehend the instructions and guidelines provided.

03

Begin filling out the form by entering your personal information in the designated fields. Double-check the accuracy of your inputs to avoid any errors or discrepancies.

04

If there are any checkboxes or multiple-choice options, select the appropriate ones that apply to you. Ensure that you understand the choices before making a selection.

05

In case there are sections that require explanations or additional details, provide clear and concise responses. Be honest and accurate in your answers to provide relevant information.

06

Review the completed form thoroughly. Make sure all fields have been filled out correctly and no sections have been skipped unintentionally.

07

If there is a need to attach any supporting documents, ensure that they are properly prepared and securely attached to the form as instructed.

08

Sign and date the form if required. Keep in mind any specific instructions or requirements regarding signatures.

09

Before submitting the form, make copies or take pictures of the completed document for your records. This will help you maintain a record of your submission.

Who needs 1 - form option:

01

Individuals applying for a specific service or program may require 1 - form option. This could include applications for various types of licenses, permits, or registrations.

02

Employers who need to collect information from their employees or potential candidates may use 1 - form option. This can include job applications, employee information forms, or consent forms.

03

Government agencies or institutions may also require individuals to fill out 1 - form option. This could be related to tax filings, census surveys, or applications for government benefits.

04

Educational institutions often use 1 - form option for admissions, enrollment, or scholarship applications. Students may need to fill out forms to provide their personal and academic details.

05

Financial institutions may use 1 - form option for opening new accounts, applying for loans or credit cards, or updating customer information.

Overall, anyone who needs to provide specific information or apply for a particular service or program may come across 1 - form option. It is important to carefully read and understand the purpose of the form to accurately fill it out.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 1 - form option?

The 1 - form option refers to a specific tax form used for reporting certain information to the tax authorities.

Who is required to file 1 - form option?

The requirement to file the 1 - form option depends on the specific tax regulations of each jurisdiction. It is typically required for certain individuals or businesses who meet specific criteria set by the tax authorities.

How to fill out 1 - form option?

Filling out the 1 - form option involves providing the requested information accurately and completely as per the instructions provided by the tax authorities. It may require disclosing financial information, transactions, or other relevant data.

What is the purpose of 1 - form option?

The purpose of the 1 - form option is to gather specific information from taxpayers that is necessary for tax compliance and enforcement. It helps the tax authorities monitor and ensure that individuals and businesses are fulfilling their tax obligations.

What information must be reported on 1 - form option?

The specific information required to be reported on the 1 - form option varies depending on the jurisdiction and the purpose of the form. It typically includes personal or business details, financial information, income, expenses, and other relevant data.

When is the deadline to file 1 - form option in 2023?

The exact deadline to file the 1 - form option in 2023 will depend on the specific tax jurisdiction. It is advisable to consult the tax authorities or refer to the official tax website for the precise due date.

What is the penalty for the late filing of 1 - form option?

Penalties for late filing of the 1 - form option also depend on the tax regulations of each jurisdiction. It can include financial fines, interest charges, or other consequences determined by the tax authorities. The penalty amount may vary based on the duration of the delay and the taxpayer's compliance history.

How do I complete 1 - form option online?

pdfFiller has made filling out and eSigning 1 - form option easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit 1 - form option online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your 1 - form option to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out 1 - form option using my mobile device?

Use the pdfFiller mobile app to complete and sign 1 - form option on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Fill out your 1 - form option online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.