Get the free Chapter 13 Plan (Variable Rate) - United States Bankruptcy Court ... - dcb uscourts

Show details

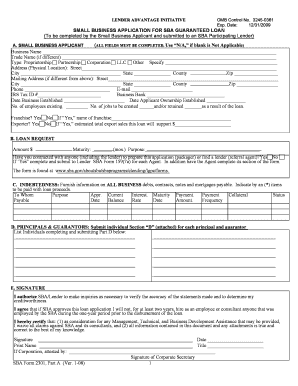

Revised 12×11 UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF COLUMBIA IN RE: SSN’S): (Last 4 Digits Only) Chapter 13 Case No.: Confirmation Hearing: CHAPTER 13 PLAN (VARIABLE RATE) & NOTICE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign chapter 13 plan variable

Edit your chapter 13 plan variable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your chapter 13 plan variable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit chapter 13 plan variable online

To use the professional PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit chapter 13 plan variable. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out chapter 13 plan variable

How to fill out chapter 13 plan variable?

01

Start by gathering all the necessary financial information, including your income, expenses, debts, and assets.

02

Determine the duration of your plan. Chapter 13 bankruptcy plans typically last for three to five years, so consider your financial situation and choose an appropriate timeframe.

03

Calculate your disposable income, which is the amount of money you have left after subtracting your necessary expenses from your monthly income.

04

Take into account any priority debts that must be paid in full through your plan, such as child support or tax debts.

05

Consult with your bankruptcy attorney to ensure you understand the specific requirements and regulations in your jurisdiction.

06

Draft a proposed chapter 13 plan that details how you will repay your creditors over the designated period. This plan should outline your proposed monthly payments, the amount each creditor will receive, and the length of the payment plan.

07

Submit your proposed plan to the bankruptcy court for approval.

08

Attend the meeting of creditors, also known as the 341 meeting, where you will be questioned under oath by the trustee and any interested creditors.

09

If necessary, make any revisions to your plan as directed by the trustee or creditors.

10

Once your plan is approved by the court, make the scheduled payments as outlined in the plan to successfully complete your chapter 13 bankruptcy.

Who needs chapter 13 plan variable?

01

Individuals or families who have a regular income but are struggling with overwhelming debt may benefit from a chapter 13 plan variable.

02

This type of bankruptcy allows debtors to reorganize their debts and create a plan to repay creditors over a specific period, usually three to five years.

03

Chapter 13 plans are suitable for those who want to retain their assets, such as a home or car, but need assistance in restructuring their debts to make them more manageable.

04

It is especially beneficial for individuals who have fallen behind on mortgage or car loan payments and want to avoid foreclosure or repossession.

05

Chapter 13 can also be an option for debtors who do not qualify for chapter 7 bankruptcy due to their income exceeding the means test threshold.

06

It provides an opportunity to repay priority debts, such as tax or child support arrears, in a controlled manner without the risk of legal action or wage garnishment.

07

However, it is essential to consult with a bankruptcy attorney to evaluate your specific financial situation and determine whether chapter 13 plan variable is the right solution for you.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify chapter 13 plan variable without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your chapter 13 plan variable into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I edit chapter 13 plan variable straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing chapter 13 plan variable, you need to install and log in to the app.

How do I fill out chapter 13 plan variable using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign chapter 13 plan variable and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is chapter 13 plan variable?

Chapter 13 plan variable is a detailed repayment plan that outlines how a debtor will repay their debts over a period of three to five years.

Who is required to file chapter 13 plan variable?

Individual debtors who have a regular income and unsecured debts less than $394,725 and secured debts less than $1,184,200 are required to file a chapter 13 plan variable.

How to fill out chapter 13 plan variable?

To fill out a chapter 13 plan variable, debtors must provide detailed information about their income, expenses, debts, and proposed repayment plan.

What is the purpose of chapter 13 plan variable?

The purpose of chapter 13 plan variable is to allow debtors to restructure their debts and repay them over time in a manageable way.

What information must be reported on chapter 13 plan variable?

Chapter 13 plan variable must include information about the debtor's income, expenses, assets, debts, and proposed repayment plan.

Fill out your chapter 13 plan variable online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Chapter 13 Plan Variable is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.