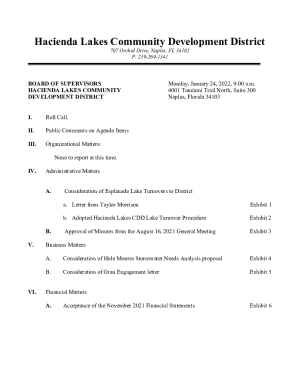

Get the free Investor Questionnaire

Show details

This document is designed to establish a pre-existing relationship and verify that the individual or entity is qualified to invest in potential offerings. It includes sections on investor qualifications,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign investor questionnaire

Edit your investor questionnaire form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your investor questionnaire form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing investor questionnaire online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit investor questionnaire. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

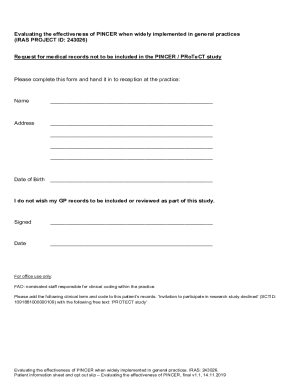

How to fill out investor questionnaire

How to fill out Investor Questionnaire

01

Start by reading the instructions provided at the beginning of the questionnaire.

02

Fill in your personal information including your name, address, and contact details.

03

Provide details about your financial background, including income, assets, and liabilities.

04

Answer questions regarding your investment experience and knowledge.

05

Indicate your investment objectives, such as growth, income, or preservation of capital.

06

Assess your risk tolerance by selecting from the options provided.

07

Review your answers for accuracy and completeness.

08

Sign and date the questionnaire where required.

Who needs Investor Questionnaire?

01

Individuals looking to make investments in securities or financial products.

02

Financial advisors to assess the suitability of investment options for their clients.

03

Investment firms conducting due diligence on potential clients.

04

Regulatory bodies to ensure compliance with investment suitability standards.

Fill

form

: Try Risk Free

People Also Ask about

What is my risk tolerance?

Simply put, your risk tolerance is how comfortable you are with risk. Along with other factors such as your savings goals, investment experience, and when you need to access the money, it can help you decide which investment option is best for you.

How do you impress an investor?

Ways to attract investors Research relevant investors. Network and build relationships. Develop a solid business plan. Create a persuasive pitch deck. Build a strong management team. Showcase a unique value proposition. Demonstrate market potential. Develop financial projections and a clear path to profitability.

What are good investor relations questions?

6. Describe your experience with earnings calls and the preparation involved in them. Detail your role in preparing financial reports and presentations. Explain how you coordinate with different departments for accurate data. Discuss your experience in addressing investor questions during calls.

What are 5 questions you should ask when investing?

5 questions to ask before you invest Am I comfortable with the level of risk? Can I afford to lose my money? Do I understand the investment and could I get my money out easily? Are my investments regulated? Am I protected if the investment provider or my adviser goes out of business? Should I get financial advice?

What questions should I ask an investor?

14 essential questions to ask investors What is their expected level of involvement? What value do they bring beyond capital? What is the typical check size of their investments? Would they lead a round of investment? What is their investment timeline and exit strategy preferences?

What are the questions asked by an investor?

Ideally, your main pitch should answer these core questions: What problem (or want) are you solving? What kinds of people, groups, or organizations have that problem? How are you different? Who will you compete with? How will you make money? How will you make money for your investors?

What is an investor suitability questionnaire?

Investor suitability questions help gauge whether an investor and their Investing Account is a match for the types of deals that will launch on the Marketplace.

What is an investor questionnaire?

The Investor Questionnaire suggests an asset allocation based on information you enter about your investment objectives and experience, time horizon, risk tolerance, and financial situation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Investor Questionnaire?

An Investor Questionnaire is a document that gathers information about an individual's or entity's financial situation, investment experience, and objectives to assess their suitability for certain investment products or strategies.

Who is required to file Investor Questionnaire?

Typically, individuals or entities looking to invest in specific financial products, such as private placements or hedge funds, are required to file an Investor Questionnaire to determine their qualifications as accredited or sophisticated investors.

How to fill out Investor Questionnaire?

To fill out an Investor Questionnaire, an individual or entity should carefully review each question, providing accurate and complete information regarding their financial status, investment knowledge, and risk tolerance, while following any specific instructions provided by the investment firm.

What is the purpose of Investor Questionnaire?

The purpose of an Investor Questionnaire is to assess the investor's eligibility for particular investment opportunities, ensuring compliance with regulatory requirements and helping investment firms understand the appropriate products for their clients.

What information must be reported on Investor Questionnaire?

Information typically reported on an Investor Questionnaire includes personal identification details, financial status, investment experience, risk tolerance, and specific investment objectives, along with any regulatory-related disclosures.

Fill out your investor questionnaire online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Investor Questionnaire is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.