Get the free CYBER RISK INSURANCE DETAILED APPLICATION Notes All

Show details

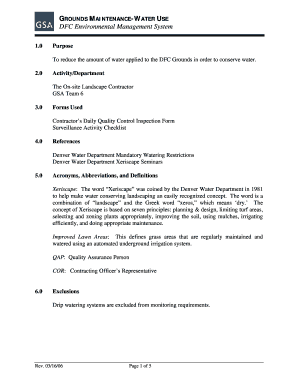

Frank Conan Company Limited 75 Main Street North, Princeton, ON N0J 1V0 Phone: 5194584331 Fax: 5194584366 Toll Free: 18002654000 www.frankcowan.com CYBER RISK INSURANCE DETAILED APPLICATION Notes:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cyber risk insurance detailed

Edit your cyber risk insurance detailed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cyber risk insurance detailed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cyber risk insurance detailed online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit cyber risk insurance detailed. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cyber risk insurance detailed

How to fill out cyber risk insurance detailed:

01

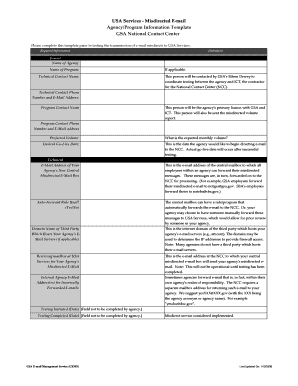

Gather information: Start by collecting all relevant information about your business, including its size, industry, and the types of sensitive data it handles. This will help determine the level of coverage you need.

02

Assess potential risks: Identify the potential cyber risks your business may face, such as data breaches, hacking, or malware attacks. Evaluate the potential financial impact these risks could have on your business.

03

Research insurance providers: Find reputable insurance providers that offer cyber risk insurance. Compare their offerings, including coverage limits, deductibles, and premiums. Consider their reputation, financial stability, and claims handling process.

04

Customize your policy: Work with the insurance provider to tailor the policy to your business's specific needs. This may include selecting coverage for particular risks, such as data breach response or legal expenses.

05

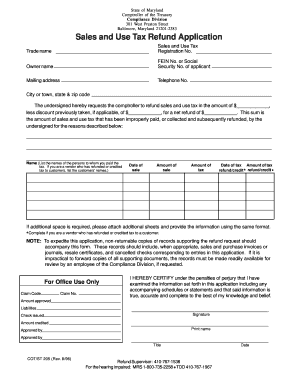

Fill out the application: Complete the application form provided by the insurance provider. Ensure accuracy and provide all requested information, as any omissions or misrepresentations may affect your coverage.

06

Provide supporting documentation: Attach any necessary supporting documents, such as your business's risk management policies, security measures, or incident response plans. These can help demonstrate your commitment to cybersecurity.

07

Review and sign: Thoroughly review the completed application before signing it. Make sure you understand the terms, coverage limits, and any exclusions or conditions. Seek clarification if needed.

08

Submit the application: Submit the filled-out application form and any required documentation to the insurance provider. Confirm receipt and request acknowledgment.

09

Pay premiums: Once the insurance provider approves your application, you will need to pay the agreed-upon premium. Set up a payment plan if necessary, and ensure timely payments to maintain coverage.

10

Review and update regularly: Regularly review and update your cyber risk insurance policy as your business evolves and new risks emerge. Stay informed about changes in the cybersecurity landscape and adjust coverage accordingly.

Who needs cyber risk insurance detailed?

01

Businesses of all sizes: Cyber risk insurance detailed is crucial for businesses of all sizes, from small startups to large corporations. Any business that collects, stores, or processes sensitive customer information or relies on digital systems is vulnerable to cyber threats.

02

Industries with high data sensitivity: Certain industries, such as finance, healthcare, and technology, handle highly sensitive information. They are attractive targets for cybercriminals and should prioritize having detailed cyber risk insurance.

03

Regulatory compliance requirements: Businesses subject to regulatory requirements, such as the General Data Protection Regulation (GDPR) or the Payment Card Industry Data Security Standard (PCI DSS), may need detailed cyber risk insurance to meet compliance obligations and protect against potential fines or penalties.

04

Businesses dependent on digital operations: As digitalization becomes more prevalent, businesses heavily reliant on digital operations, such as e-commerce platforms or online service providers, need to safeguard against cyber risks to ensure uninterrupted business activities and protect their reputation.

05

Businesses with limited IT resources: Small businesses or those with limited IT resources may lack the expertise or financial means to recover from a cyber-attack. Cyber risk insurance detailed can provide financial support and access to specialized resources in the event of a breach.

06

Businesses involved in cloud computing or third-party data handling: If your business relies on cloud service providers or outsources data handling to third parties, you should consider detailed cyber risk insurance to cover potential breaches or data security incidents beyond your control.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my cyber risk insurance detailed in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your cyber risk insurance detailed right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How can I edit cyber risk insurance detailed on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing cyber risk insurance detailed, you need to install and log in to the app.

How do I fill out the cyber risk insurance detailed form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign cyber risk insurance detailed and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is cyber risk insurance detailed?

Cyber risk insurance detailed includes coverage for financial losses as a result of cyber attacks, data breaches, and other cyber-related incidents.

Who is required to file cyber risk insurance detailed?

Certain businesses and organizations may be required to file cyber risk insurance detailed based on industry regulations or contractual obligations.

How to fill out cyber risk insurance detailed?

Cyber risk insurance detailed can be filled out by providing detailed information about the company's cyber security policies, practices, and history of cyber incidents.

What is the purpose of cyber risk insurance detailed?

The purpose of cyber risk insurance detailed is to help companies mitigate financial losses and reputational damage resulting from cyber attacks and data breaches.

What information must be reported on cyber risk insurance detailed?

Information that must be reported on cyber risk insurance detailed includes details of cyber security measures, past cyber incidents, and coverage limits.

Fill out your cyber risk insurance detailed online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cyber Risk Insurance Detailed is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.