Get the free CLAIM FOR REAP CREDIT APPLIED TO GENERAL - nyc

Show details

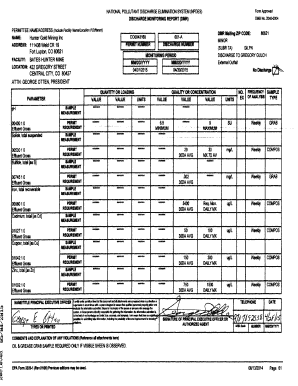

9.5 CLAIM FOR REAP CREDIT APPLIED TO GENERAL CORPORATION TAX AND BANKING CORPORATION TAX NYC *00711091* NEW YORK CITY DEPARTMENT OF FINANCE 2010 ATTACH TO FORM NYC-3L, NYC-3A, NYC-1 or NYC-1A For

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your claim for reap credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your claim for reap credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing claim for reap credit online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit claim for reap credit. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out claim for reap credit

How to fill out a claim for the reap credit:

01

Gather necessary documentation: Before filling out a claim for the reap credit, make sure you have all the required documents. This may include income statements, receipts, and any other relevant financial information.

02

Determine eligibility: Check the eligibility criteria for the reap credit to ensure you qualify for it. This credit is often available to low-income individuals or families, so ensure you meet the income requirements.

03

Download the claim form: Visit the official website or contact the relevant government agency to obtain the claim form for the reap credit. Most forms are available for download online or can be requested by mail.

04

Read instructions carefully: Take the time to go through the instructions provided with the claim form. Make sure you understand each step and the information required to complete the form accurately.

05

Provide personal information: Begin filling out the claim form by entering your personal information such as your name, address, phone number, and Social Security number. Ensure all the information is accurate.

06

Income details: Provide accurate information regarding your income, including details about your employment, self-employment, and any additional sources of income. Attach relevant documents to support your income claims.

07

Deductions and credits: If applicable, claim any deductions or credits that you are eligible for. These can include childcare expenses, education expenses, or any other applicable deductions.

08

Review and sign: Carefully review all the information provided on the claim form, ensuring its accuracy. Once you are satisfied, sign the form and date it. If necessary, have the form notarized as per the instructions.

09

Submit the claim: Follow the instructions provided on the claim form regarding the submission process. Typically, you may need to send the form by mail or electronically submit it through a designated portal.

Who needs a claim for the reap credit?

Individuals or families who meet the income requirements and qualify for the reap credit can submit a claim. The reap credit is often targeted towards low-income individuals who require financial assistance. It is essential to check the specific eligibility criteria to determine if you qualify for this credit before proceeding with the claim.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is claim for reap credit?

A claim for reap credit is a form or application that individuals or businesses file to request a credit for reaping benefits or incentives offered by a program or government agency.

Who is required to file claim for reap credit?

Any individual or business that meets the eligibility criteria and wants to receive the reap credit must file a claim.

How to fill out claim for reap credit?

To fill out a claim for reap credit, individuals or businesses need to gather the necessary supporting documentation and complete the claim form accurately, providing all required information. The completed form can then be submitted through the designated submission method, such as mail or online portal.

What is the purpose of claim for reap credit?

The purpose of a claim for reap credit is to formally request recognition and reimbursement for the benefits or incentives obtained through a program or government agency.

What information must be reported on claim for reap credit?

The specific information required on a claim for reap credit can vary depending on the program or agency. However, common information that may need to be reported includes personal or business details, proof of eligibility, documentation of benefits received, and any other required supporting evidence.

When is the deadline to file claim for reap credit in 2023?

The deadline to file a claim for reap credit in 2023 is usually specified by the program or government agency. It is important to refer to the program guidelines or contact the administering authority to determine the exact filing deadline.

What is the penalty for the late filing of claim for reap credit?

The penalty for the late filing of a claim for reap credit can vary depending on the program or agency. It is advisable to check the specific rules and regulations of the program to understand the consequences of late filing, which may include reduced or denied benefits, fines, or other penalties.

How can I manage my claim for reap credit directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign claim for reap credit and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Can I sign the claim for reap credit electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your claim for reap credit in seconds.

How do I edit claim for reap credit on an iOS device?

Use the pdfFiller mobile app to create, edit, and share claim for reap credit from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Fill out your claim for reap credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.