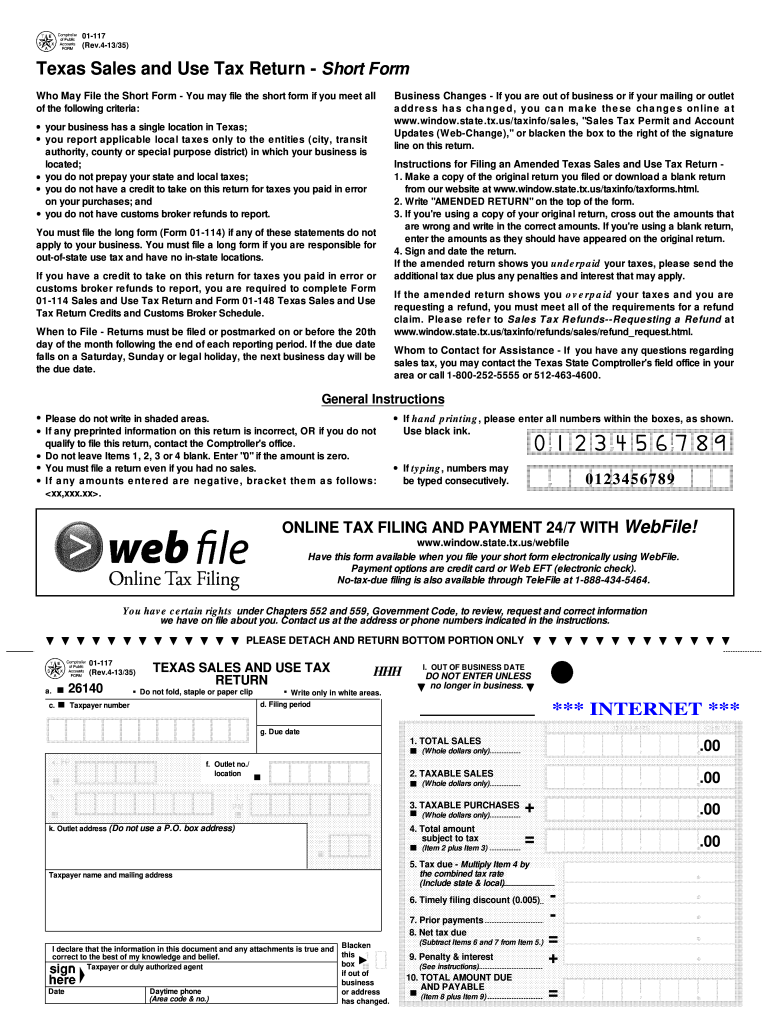

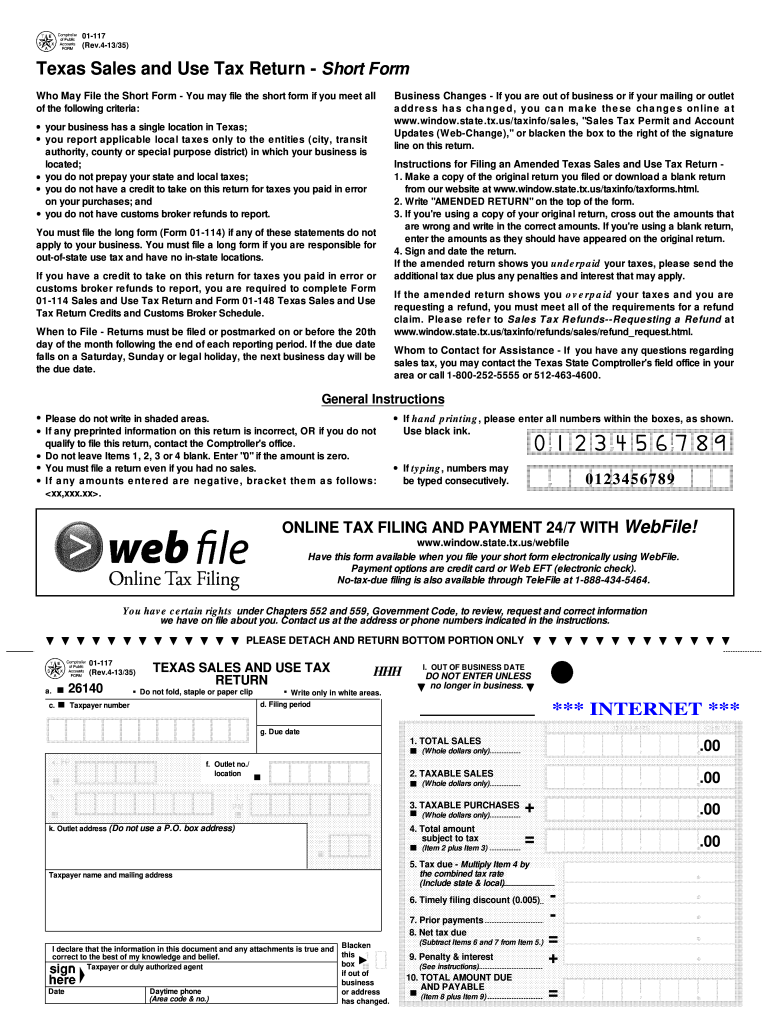

TX Comptroller 01-117 2013 free printable template

Get, Create, Make and Sign

How to edit texas sales tax short online

TX Comptroller 01-117 Form Versions

How to fill out texas sales tax short

How to fill out texas sales tax short:

Who needs texas sales tax short:

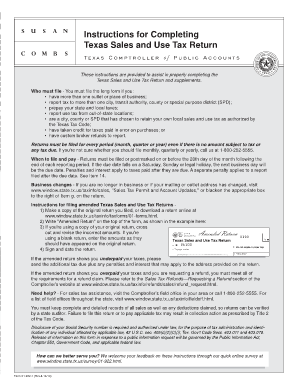

Instructions and Help about texas sales tax short

Hi this is Dr. Marc Osman and welcome to business spotlight interviews again for another episode, and today we're speaking with Jay Gunderson and jay is the CEO of prepare link now these are the guys that you want to talk to when it comes to getting your sales tax return ready to go over to the state, so Jay tell us a little about prepare link good morning Dr. mark thank you so much for having me yeah we manufacture and distribute sales tax preparation software primarily to tax professionals but also to independent companies those who want to prepare their own sales and use tax return right we call it STP that sales tax preparation software we release it by state we've been doing this since 1998 we started with STP California and have been adding additional States as we find the demand okay so just to summarize the value for STP well what it what the usage is you know you look at our subscriber base which falls into two categories those who print and mail their sales tax return with STP and those who prepare and e-file their sales tax return with SDP now both groups of our subscribers have a very direct relationship to a relationship to electronic filing and in the one sense print and mail it's a kind of in direct competition with the state tax board electronic filing in that the prepares are using that print and mail option that STB provides as an alternative to electronic filing they just prefer many prepares prefer to mail in that return they want the security they want the privacy, and you know a lot of our independence want that privacy and in addition our tax professionals they want to offer that option to their clients may have similar concerns about security and privacy so the other group to prepare and e-file is very much a partnership with electronic filing in that prepares use STP to prepare their sales tax return to STP then they'll print and have a copy on their desk, or they'll have it open in another window, and then they'll just transfer those prepared amounts directly into the electronic filing website they do that because these websites lack the features that are necessary that prepares demand and those features you know give them the confidence that their sales tax return is accurate it's complete, and it has the lowest possible sales tax do the websites are very lean they're very featureless STP is packed full of these features you know the guidance the help step-by-step the hand holding this sort of things that that help prepares have the confidence that they need great Jay well I appreciate you bringing up the whole issue of e filing because it's something I wanted to get into with you, I know there's a lot of confusion out there actually because I think people have the impression that they have to e-file their sales tax returns ever every month and so that's not true is it no it is not true we call that the e-file mandate myth you know when the state's moved away from their preprinted sales tax form to their electronic...

Fill form : Try Risk Free

People Also Ask about texas sales tax short

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your texas sales tax short online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.