Get the free Going Out of Business Sale Permit Application Yes No - Texas ...

Show details

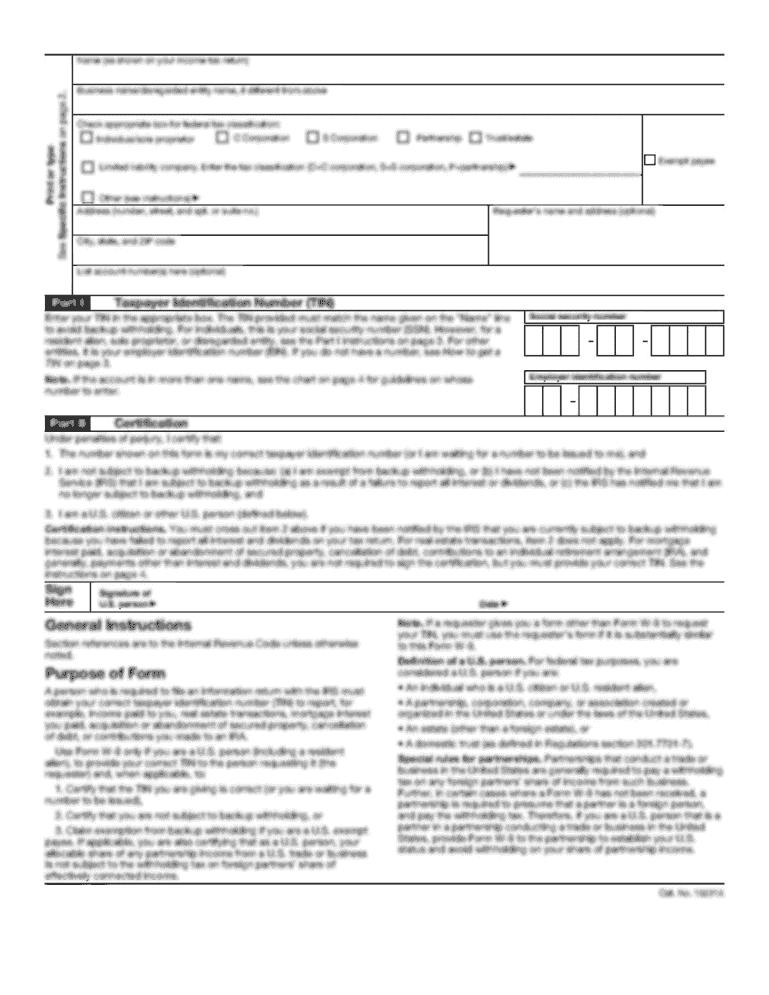

P r o p e r t y Ta x ? Going Out of Business Sale? Permit Application Form 50-290 Appraisal District Name Phone (area code and number) Address This application is to secure the necessary permit for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your going out of business form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your going out of business form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing going out of business online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit going out of business. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out going out of business

How to fill out going out of business:

01

Gather all necessary financial documents: Start by collecting all relevant financial documents such as income statements, balance sheets, tax returns, and any legal or contractual agreements related to the business.

02

Notify relevant parties: Inform all stakeholders, including employees, customers, suppliers, and business partners about the decision to go out of business. Provide clear and timely communication about the closure process, including any changes in operations or services.

03

Liquidate assets: Evaluate and determine the value of your business assets, including inventory, equipment, and property. Decide whether to sell, donate, or dispose of these assets based on their marketability and potential salvage value.

04

Settle outstanding obligations: Prioritize settling any outstanding debts, loans, or financial obligations before closing the business. Contact creditors, vendors, and service providers to discuss repayment plans or negotiate potential settlements.

05

Cancel licenses and permits: Reach out to the appropriate government agencies or regulatory bodies to cancel any licenses, permits, or registrations that are no longer needed. This may include business licenses, tax registrations, or professional certifications.

06

Cease operations and close accounts: Close all business bank accounts and ensure that all outstanding checks are cleared. Cancel or transfer any business-related contracts, utilities, phone lines, and internet services.

07

File the necessary paperwork: Depending on your jurisdiction, you may need to file specific forms or paperwork to formally dissolve your business. This typically includes submitting a final tax return and notifying the appropriate authorities.

Who needs going out of business:

01

Business owners facing financial difficulties: If a business is struggling financially and unable to turn a profit, going out of business may be a necessary option to mitigate further losses and preserve personal assets.

02

Business owners planning retirement or career change: Some entrepreneurs choose to go out of business as part of their retirement plan or to pursue other career opportunities. They may sell their assets, liquidate the business, or transfer ownership to someone else.

03

Businesses affected by external factors: Economic downturns, changes in market demand, or unforeseen circumstances (like the COVID-19 pandemic) can force businesses to consider going out of business as a means of survival or to minimize losses.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is going out of business?

Going out of business refers to the process of closing down a business permanently and liquidating its assets in order to settle debts and cease operations.

Who is required to file going out of business?

Any business that is planning to close down and liquidate its assets is required to file going out of business.

How to fill out going out of business?

To fill out going out of business, the business owner or authorized representative must provide relevant information about the business, its assets, debts, and plans for liquidation.

What is the purpose of going out of business?

The purpose of going out of business is to formally notify relevant authorities, creditors, and the public about the closure of a business and the process of liquidating its assets.

What information must be reported on going out of business?

The information that must be reported on going out of business includes details about the business, its assets, debts, the planned liquidation process, and any other relevant information requested by the authorities.

When is the deadline to file going out of business in 2023?

The deadline to file going out of business in 2023 may vary depending on the jurisdiction and specific regulations. It is advisable to consult with local authorities or legal professionals for accurate information regarding the deadline.

What is the penalty for the late filing of going out of business?

The penalty for the late filing of going out of business may vary depending on the jurisdiction and specific regulations. It could include financial penalties, additional administrative requirements, or legal consequences. It is advisable to consult with local authorities or legal professionals for accurate information regarding the penalties.

How can I get going out of business?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific going out of business and other forms. Find the template you want and tweak it with powerful editing tools.

How do I execute going out of business online?

Completing and signing going out of business online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I make changes in going out of business?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your going out of business to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Fill out your going out of business online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.