Get the free Chapter 1: Retirement Plans as Marital Assets

Show details

Table of ContentsxiTable of Contents

Chapter 1: Retirement Plans as Marital Assets

OverviewRetirement Plans as Marital Assets. . . . . . .

Introduction. . . . . . . . . . . . . . . . . . . . . . .

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign chapter 1 retirement plans

Edit your chapter 1 retirement plans form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your chapter 1 retirement plans form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit chapter 1 retirement plans online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit chapter 1 retirement plans. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out chapter 1 retirement plans

How to fill out chapter 1 retirement plans:

01

Gather necessary information: Start by gathering all the relevant information you need to complete chapter 1 of your retirement plans. This may include your personal details, financial information, and any documentation related to your retirement savings and investments.

02

Understand the requirements: Take the time to carefully read and understand the instructions and requirements laid out in chapter 1 of the retirement plans. This section may include specific guidelines on eligibility, contribution limits, and any applicable deadlines.

03

Provide personal details: Begin by filling out the section that requires your personal information, such as your full name, date of birth, and contact details. Ensure that the information provided is accurate and up-to-date.

04

Financial information: Fill in the section that pertains to your financial details, including your current income, savings, and any other assets or liabilities that may be relevant to your retirement planning. Be as thorough as possible to ensure a comprehensive overview of your financial situation.

05

Evaluate your investment options: This chapter might include a portion dedicated to exploring different investment options for your retirement savings. Take the time to review and evaluate these options, considering factors such as risk tolerance, long-term goals, and potential returns.

06

Seek professional guidance if needed: If you find the process of filling out chapter 1 retirement plans overwhelming or if you have complex financial circumstances, consider seeking advice from a financial advisor or retirement planning specialist. They can provide valuable insights and help ensure you make informed decisions.

Who needs chapter 1 retirement plans?

01

Employees: Many employers offer retirement plans as part of their benefits package, and employees usually need to fill out chapter 1 to enroll or make changes to their plan. It helps them plan and save for their retirement.

02

Self-employed individuals: If you are self-employed, it's crucial to have a retirement plan in place to ensure financial security in your later years. Filling out chapter 1 retirement plans helps you determine the contribution limits and investment options available to you.

03

Individuals approaching retirement age: Even if you are close to retirement, it's never too late to assess your retirement plans. Filling out chapter 1 can give you a clearer understanding of your current financial situation and help you make any necessary adjustments or catch-up contributions.

04

Those considering early retirement: If you are considering retiring early, it's essential to have a comprehensive retirement plan. Filling out chapter 1 retirement plans allows you to assess the feasibility of your early retirement goals and make necessary adjustments to your savings and investment strategy.

05

Anyone interested in financial planning: Even if retirement is still far off, it's never too early to start planning for your future. Filling out chapter 1 retirement plans can provide valuable insights into saving and investment strategies, helping you make smart financial decisions in the long run.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit chapter 1 retirement plans online?

The editing procedure is simple with pdfFiller. Open your chapter 1 retirement plans in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I fill out the chapter 1 retirement plans form on my smartphone?

Use the pdfFiller mobile app to complete and sign chapter 1 retirement plans on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I edit chapter 1 retirement plans on an iOS device?

Use the pdfFiller mobile app to create, edit, and share chapter 1 retirement plans from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

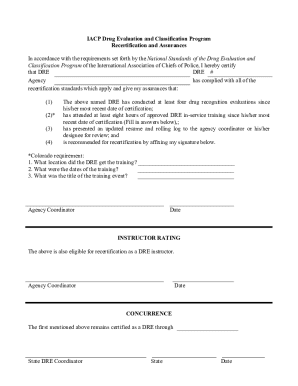

What is chapter 1 retirement plans?

Chapter 1 retirement plans refer to the section in a retirement plan document that outlines the rules and guidelines for retirement saving and investing.

Who is required to file chapter 1 retirement plans?

Employers or plan sponsors who offer retirement plans to their employees are required to file chapter 1 retirement plans.

How to fill out chapter 1 retirement plans?

Chapter 1 retirement plans can be filled out by following the instructions provided in the retirement plan document or by consulting a financial advisor.

What is the purpose of chapter 1 retirement plans?

The purpose of chapter 1 retirement plans is to establish the rules and procedures for saving and investing for retirement for employees.

What information must be reported on chapter 1 retirement plans?

Chapter 1 retirement plans typically require information on employee contributions, employer contributions, investment options, and plan eligibility.

Fill out your chapter 1 retirement plans online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Chapter 1 Retirement Plans is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.