Get the free 2011 - Annual Information Form - Baja Mining Corp.

Show details

BAA MINING CORP. Toronto Stock Exchange: BAD ANNUAL INFORMATION FORM For the year ended December 31, 2011, Dated: March 30, 2012, TABLE OF CONTENTS Preliminary Notes Cautionary Note to United States

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 2011 - annual information form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2011 - annual information form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2011 - annual information online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2011 - annual information. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

How to fill out 2011 - annual information

How to fill out 2011 - annual information?

01

Gather all necessary documents and information related to your finances and activities during the year 2011.

02

Start by filling out the basic details such as your name, address, and contact information.

03

Provide accurate information about your income for the year 2011, including details of your employment, business income, or any other sources of income you had during that year.

04

Report any deductions or expenses that you are eligible for, such as business expenses, medical expenses, or charitable contributions. Make sure to keep supporting documents for these deductions.

05

If you had investments or owned properties during the year 2011, disclose the relevant details such as rental income, capital gains, or dividends received.

06

If applicable, report any tax credits or deductions that you qualify for, such as education credits or energy-efficient home improvements.

07

Double-check your entries and make sure all the information provided is accurate and complete.

08

Sign and date the form, and attach any additional supporting documentation required.

09

Submit the filled-out 2011 - annual information form to the appropriate tax authority by the specified deadline.

Who needs 2011 - annual information?

01

Individuals who earned income during the year 2011, either through employment, self-employment, investments, or other sources.

02

Taxpayers who need to report their financial activities and income for the year 2011 to comply with the tax laws and regulations.

03

Individuals who want to ensure their tax returns are accurate and up to date for the year 2011.

04

Business owners or self-employed individuals who need to provide detailed financial information for the year 2011 to calculate their business income or losses.

05

Individuals who may qualify for tax credits or deductions for the year 2011 and need to report the necessary information to claim these benefits.

06

Anyone who is required by law to file a tax return for the year 2011 and needs to provide the requested annual information.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

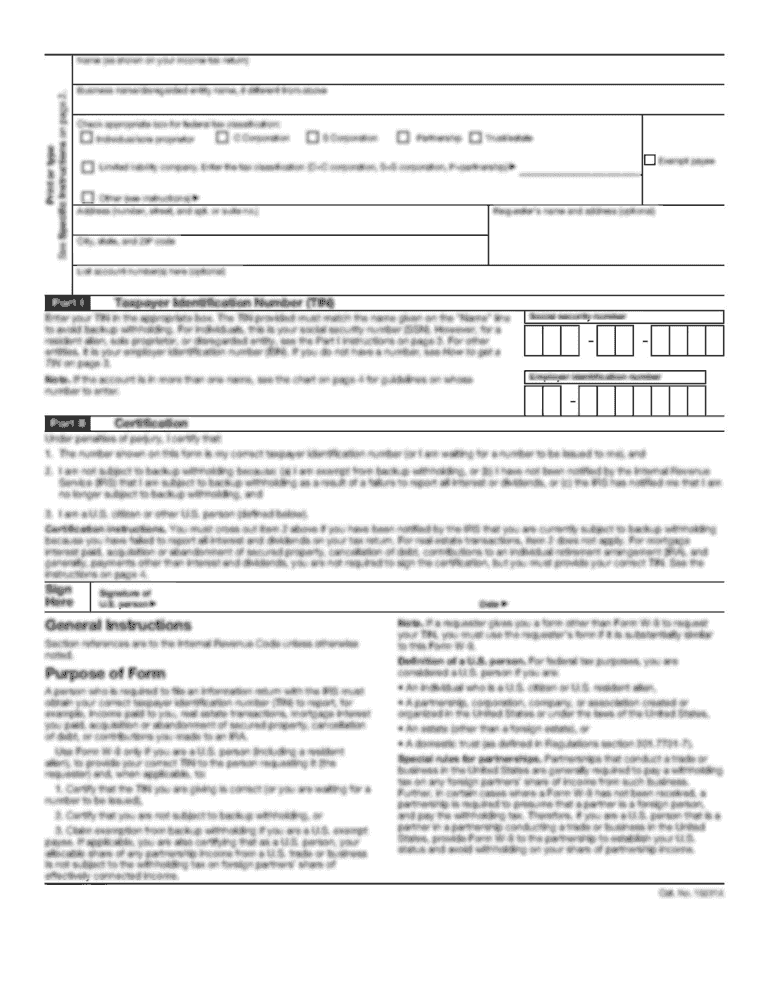

What is annual information form?

An annual information form (AIF) is a document that provides detailed information about a company's operations, financial condition, and management to its shareholders and the public.

Who is required to file annual information form?

Companies that are listed on stock exchanges and regulated by securities commissions or regulatory bodies are generally required to file an annual information form.

How to fill out annual information form?

Filling out an annual information form involves providing accurate and complete information about the company's operations, financial statements, risk factors, governance practices, and other relevant details as per the guidelines outlined by the securities commissions or regulatory bodies.

What is the purpose of annual information form?

The purpose of an annual information form is to ensure transparency and disclosure of pertinent information to shareholders, potential investors, and regulatory bodies. It helps stakeholders make informed decisions regarding their investments.

What information must be reported on annual information form?

The information reported on an annual information form may include the company's financial statements, risk factors, management discussion and analysis, corporate governance practices, executive compensation, major projects, regulatory compliance, and other relevant details as required by securities commissions or regulatory bodies.

When is the deadline to file annual information form in 2023?

The specific deadline to file an annual information form in 2023 may vary depending on the jurisdiction and regulatory requirements. It is advisable to consult the relevant securities commissions or regulatory bodies for the exact deadline.

What is the penalty for the late filing of annual information form?

Penalties for the late filing of an annual information form can vary depending on the jurisdiction and regulatory requirements. The penalties may include monetary fines, restrictions on trading, and negative consequences for the company's reputation. It is important to comply with the filing deadlines to avoid such penalties.

Where do I find 2011 - annual information?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific 2011 - annual information and other forms. Find the template you need and change it using powerful tools.

How do I make edits in 2011 - annual information without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing 2011 - annual information and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How can I edit 2011 - annual information on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing 2011 - annual information.

Fill out your 2011 - annual information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.