Get the free Consumer Credit (Administration) Act 1996 (repealed) - legislation act gov

Show details

This document details the regulations and provisions surrounding the administration of the consumer credit industry in the Australian Capital Territory, including registration, occupational discipline,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign consumer credit administration act

Edit your consumer credit administration act form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consumer credit administration act form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing consumer credit administration act online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit consumer credit administration act. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

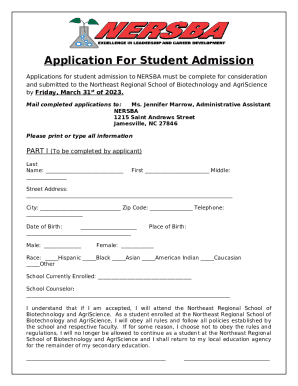

How to fill out consumer credit administration act

How to fill out Consumer Credit (Administration) Act 1996 (repealed)

01

Obtain a copy of the Consumer Credit (Administration) Act 1996 (repealed) for reference.

02

Read through the entire document to understand the sections relevant to your situation.

03

Identify the specific form or application related to the Consumer Credit process you need to fill out.

04

Gather all necessary documentation required for filling out the form, such as personal identification, income statements, and credit history.

05

Fill out the form accurately based on the information provided in the Act, ensuring all required fields are completed.

06

Review the completed form for any errors or missing information before submission.

07

Submit the form to the appropriate authority or financial institution as indicated in the Act.

Who needs Consumer Credit (Administration) Act 1996 (repealed)?

01

Consumers seeking credit or loans from financial institutions previously regulated under the Act.

02

Financial service providers who need to understand historical compliance requirements related to consumer credit.

03

Legal and financial professionals requiring knowledge of past legislation for advisory or litigation purposes.

04

Government and regulatory bodies for reference in historical audits and analyses of consumer credit practices.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Consumer Credit (Administration) Act 1996 (repealed)?

The Consumer Credit (Administration) Act 1996 was legislation that governed the provision of consumer credit in a specific jurisdiction, outlining the responsibilities of lenders and protections for consumers. It has been repealed, meaning it is no longer in effect.

Who is required to file Consumer Credit (Administration) Act 1996 (repealed)?

Entities that were involved in providing consumer credit, such as financial institutions and lenders, were required to comply with the filing and reporting requirements outlined in the Consumer Credit (Administration) Act 1996 before its repeal.

How to fill out Consumer Credit (Administration) Act 1996 (repealed)?

Since the Consumer Credit (Administration) Act 1996 has been repealed, there is no longer a requirement to fill out any forms associated with this legislation. Previously, lenders were guided by specific forms and instructions provided by regulatory bodies.

What is the purpose of Consumer Credit (Administration) Act 1996 (repealed)?

The purpose of the Consumer Credit (Administration) Act 1996 was to regulate the consumer credit industry, ensuring fair treatment of consumers, promoting transparency in credit agreements, and preventing unfair lending practices. Its repeal may indicate a shift towards other forms of regulation.

What information must be reported on Consumer Credit (Administration) Act 1996 (repealed)?

While the Act was in force, lenders were required to report information such as details of credit agreements, fees charged, consumer protection measures, and other relevant data. However, since the Act has been repealed, these reporting requirements are no longer applicable.

Fill out your consumer credit administration act online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consumer Credit Administration Act is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.