Get the free Consumer Credit (Administration) Act 1996 - legislation act gov

Show details

An Act relating to the administration of the consumer credit industry in the Australian Capital Territory, detailing regulations for credit providers and finance brokers, including their registration,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign consumer credit administration act

Edit your consumer credit administration act form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consumer credit administration act form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing consumer credit administration act online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit consumer credit administration act. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out consumer credit administration act

How to fill out Consumer Credit (Administration) Act 1996

01

Obtain the Consumer Credit (Administration) Act 1996 document from the relevant regulatory authority or website.

02

Review the key terms and definitions provided in the Act to understand its context.

03

Identify the sections relevant to your situation, such as those pertaining to licensing and compliance requirements.

04

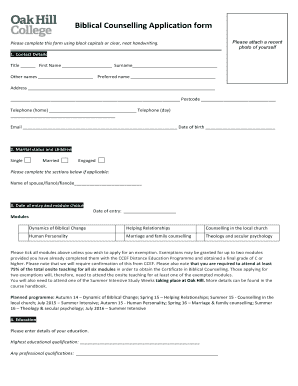

Gather necessary supporting documents related to your consumer credit activities, including financial statements and business information.

05

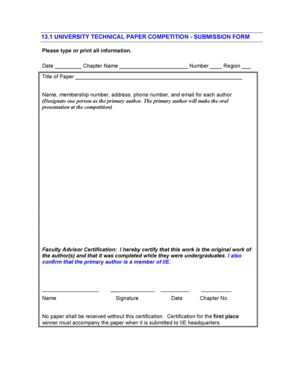

Complete the application or registration form as outlined in the Act, ensuring all required information is filled out accurately.

06

Attach any required documentation to your application based on the specified requirements of the Act.

07

Submit the completed application and documentation to the appropriate regulatory body, following the submission guidelines provided.

08

Pay any applicable fees associated with the application process as outlined in the Act.

09

Await confirmation of your application and any further instructions from the regulatory body.

Who needs Consumer Credit (Administration) Act 1996?

01

Individuals or businesses that provide consumer credit services.

02

Lenders who offer loans, credit cards, or other forms of credit to consumers.

03

Financial institutions that are involved in consumer finance.

04

Entities engaging in debt collection or credit reporting.

Fill

form

: Try Risk Free

People Also Ask about

What are the main points of the Consumer Credit Act 1974?

The act introduced new protection for consumers and new regulation for bodies trading in consumer credit and related industries. Such traders were required to have full licenses, originally issued by the Office of Fair Trading, which may be suspended or revoked in the event of irregularities.

What is the primary purpose of the consumer credit protection act?

A federal law (15 U.S.C. §§ 1601 to 1693r) that creates protections for consumers interacting with banks, credit card companies, and other lenders. The law is intended to assure the meaningful disclosure of credit terms so that consumers can compare and make informed use of credit.

What are the 5 C's of consumer credit?

Character, capacity, capital, collateral and conditions are the 5 C's of credit. Lenders may look at the 5 C's when considering credit applications. Understanding the 5 C's could help you boost your creditworthiness, making it easier to qualify for the credit you apply for.

What are the major components of the consumer credit Protection Act?

7 key components of the Consumer Credit Protection Act Equal Credit Opportunity Act. Federal Wage Garnishment Law (Title III) Truth in Lending Act. Fair Credit Billing Act. Fair Credit Reporting Act. Fair Debt Collection Practices Act. Electronic Fund Transfer Act.

What are the three main points of the consumer rights Act?

It consolidates multiple areas of consumer law into a single framework, ensuring clearer rights and remedies for consumers who purchase faulty goods or services. Its key remedies are “Repair, Replace, and Refund”. Each of these remedies are detailed in the Act and applies under specific conditions.

What are the key points of the Consumer Credit Act?

What's covered by the legislation? the information consumers should be provided with before they enter into a credit agreement. the content and form of credit agreements. the method of calculating annual percentage rates of interest (APR) procedures relating to events of default, termination and early settlement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Consumer Credit (Administration) Act 1996?

The Consumer Credit (Administration) Act 1996 is a legislative framework in Australia designed to regulate the activities of consumer credit providers and protect consumers in credit transactions.

Who is required to file Consumer Credit (Administration) Act 1996?

Entities that provide consumer credit services, such as banks, credit unions, and other lenders, are required to comply with the provisions of the Consumer Credit (Administration) Act 1996.

How to fill out Consumer Credit (Administration) Act 1996?

To fill out the Consumer Credit (Administration) Act 1996, entities must provide accurate information as required by the act, including details on credit terms, fees, and consumer rights. It's advisable to follow the specific guidelines provided by the relevant regulatory authority.

What is the purpose of Consumer Credit (Administration) Act 1996?

The purpose of the Consumer Credit (Administration) Act 1996 is to establish a legal framework that ensures fair and transparent consumer credit practices, protecting consumers from unfair treatment and providing them with access to reliable credit information.

What information must be reported on Consumer Credit (Administration) Act 1996?

The information that must be reported includes details of credit contracts, consumer data, fees charged, and compliance with consumer rights and protections as specified in the act.

Fill out your consumer credit administration act online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consumer Credit Administration Act is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.