Get the free cook county efile form

Show details

USER INSTRUCTIONS WELCOME TO THE CLERK'S OFFICE ELECTRONIC FILING SYSTEM Welcome to the Clerk of the Circuit Court of Cook County's Electronic Filing System (E-FilinSyst m”). The E-Filing System

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your cook county efile form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cook county efile form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cook county efile online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit cook county efile. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

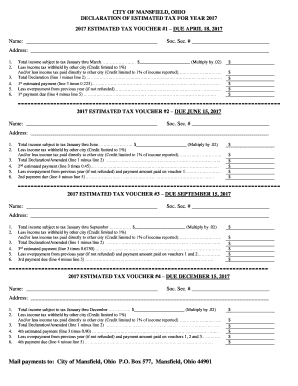

How to fill out cook county efile form

How to fill out Cook County efile:

01

Visit the official Cook County website or the designated efile platform.

02

Create an account or login if you already have one.

03

Enter your personal information, such as your name, address, and contact details.

04

Provide the required information regarding your tax information, including income, deductions, and any credits or exemptions applicable.

05

Double-check all the entered data for accuracy and completeness.

06

Submit your efiled tax return.

07

Wait for confirmation or acknowledgement of your efile submission.

Who needs Cook County efile:

01

Individuals who reside in Cook County, Illinois and are required to file their tax returns with the county.

02

People who have earned income in Cook County and need to report it for tax purposes.

03

Business entities or organizations operating within Cook County that have tax obligations to fulfill.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is cook county efile?

Cook County eFile is an electronic system for filing various types of documents and paperwork related to legal matters, such as court cases and land records, in Cook County, Illinois.

Who is required to file cook county efile?

Anyone involved in a legal matter in Cook County, including attorneys, litigants, and government agencies, may be required to file documents through the Cook County eFile system.

How to fill out cook county efile?

To fill out Cook County eFile, users need to register for an account on the official Cook County eFile website. After registration, users can log in and follow the prompts to complete the filing process, which may require uploading the necessary documents and providing relevant information.

What is the purpose of cook county efile?

The purpose of Cook County eFile is to streamline and digitize the filing process for legal documents, making it easier, more efficient, and more accessible for all parties involved in legal matters in Cook County.

What information must be reported on cook county efile?

The specific information required to be reported on Cook County eFile depends on the type of document being filed. Generally, it may include case details, party information, attorney information, relevant dates, and supporting documents.

When is the deadline to file cook county efile in 2023?

The specific deadline to file Cook County eFile in 2023 can be obtained from the official Cook County eFile website or by consulting the relevant court or agency handling the legal matter.

What is the penalty for the late filing of cook county efile?

The penalty for the late filing of Cook County eFile may vary depending on the specific rules and regulations set by the court or agency handling the legal matter. It is advisable to consult the official Cook County eFile website or seek legal advice for accurate information on penalties for late filing.

How can I send cook county efile for eSignature?

Once you are ready to share your cook county efile, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit cook county efile in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your cook county efile, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an electronic signature for signing my cook county efile in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your cook county efile right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Fill out your cook county efile form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.