Get the free Gift Form - St. Martin's in the Pines

Show details

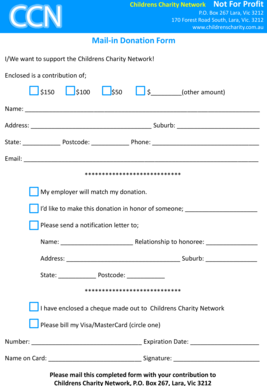

Enclosed is my contribution of $ Please designate my gift for: Greatest Need Friends Fund The Cottages at St. Martins Other Donor Name Address City & State Zip Telephone Email Tribute Information:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your gift form - st form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gift form - st form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gift form - st online

To use the services of a skilled PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit gift form - st. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out gift form - st

How to fill out a gift form - ST:

01

Gather all required information: Before filling out the gift form - ST, make sure to collect all necessary information such as the recipient's name, address, and contact details, as well as the sender's details and the gift's description.

02

Download or request the form: Depending on the organization or institution, you may be able to download the gift form - ST from their website. Alternatively, you can contact them and request a physical copy of the form.

03

Read the instructions: Once you have the gift form - ST, read the instructions carefully. Familiarize yourself with the specific guidelines and requirements mentioned in the form.

04

Provide the recipient's information: Start filling out the gift form - ST by entering the recipient's full name, title (if applicable), and their complete mailing address. Ensure the accuracy of this information as any mistakes might delay the delivery of the gift.

05

Enter the sender's details: Next, provide the sender's information. This typically includes the sender's full name, contact number, and mailing address. If required, you might also be asked to fill in the relationship between the sender and the recipient.

06

Describe the gift: In this part of the form, provide a detailed description of the gift. Include information such as the item's name, brand, model (if applicable), quantity, and any special features or characteristics.

07

Declare the value: Indicate the estimated value of the gift. This might be required for customs or other purposes. If you are unsure about the value, you can consult a professional or refer to any receipts or appraisals.

08

Sign and submit the form: Review all the information you have filled in the gift form - ST, making sure there are no mistakes or missing details. Once you are satisfied with the accuracy, sign the form and follow the instructions for submission. This may involve mailing the form, submitting it electronically, or handing it over in person.

Who needs a gift form - ST?

01

Individuals sending gifts internationally: If you plan to send a gift to someone residing in another country, especially for customs purposes, you might be required to fill out a gift form - ST. This form helps in providing the necessary documentation and declaring the value of the gift.

02

Organizations or institutions receiving gifts: In some cases, organizations or institutions may have their own gift form - ST that they require individuals or entities to fill out when sending them gifts. This helps them keep track of incoming gifts, manage any tax implications, and ensure compliance with relevant regulations.

03

Gift recipients: While gift recipients might not directly fill out a gift form - ST, they may need to provide their information to the sender so that the form can be completed accurately. The recipient's details are usually needed to facilitate the delivery of the gift and to comply with any customs or legal requirements.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my gift form - st in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your gift form - st as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I complete gift form - st online?

Filling out and eSigning gift form - st is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I fill out gift form - st on an Android device?

Use the pdfFiller app for Android to finish your gift form - st. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your gift form - st online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.