Get the free office depot tax exempt form

Show details

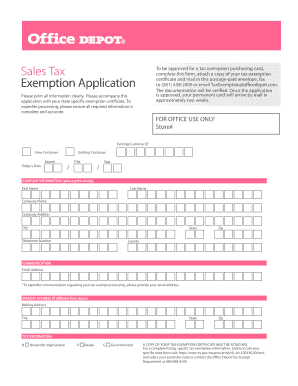

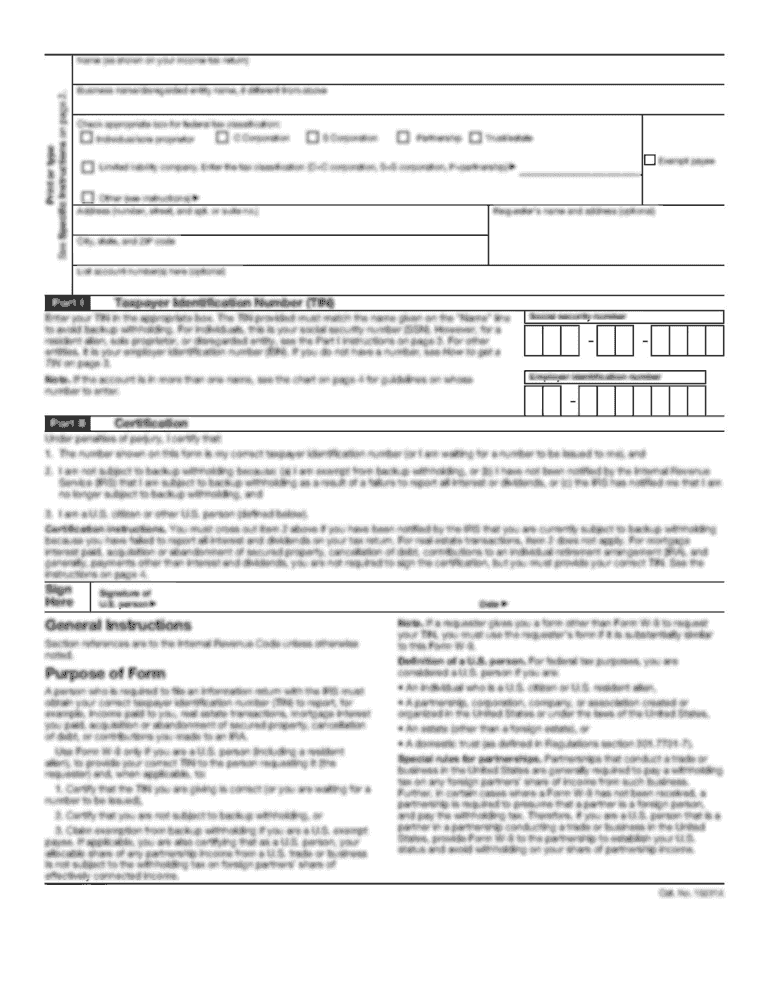

Sales Tax Exemption Application To be approved for a tax exemption purchasing card complete this form attach a copy of your tax-exemption certi cate and mail in this postage-paid envelope or fax to 678 397-0678. The documentation will be veri ed and once the application is approved your permanent card should arrive by mail in approximately two weeks. Please print all information clearly. FOR OFFICE USE ONLY Store Day Month Today s Date / Year ORIGINAL INFORMATION please print clearly First...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your office depot tax exempt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your office depot tax exempt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit office depot tax exempt online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit office depot tax exempt form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

How to fill out office depot tax exempt

How to fill out office depot tax exempt:

01

Obtain the tax exempt form from the office depot website or visit a physical office depot store to request a copy.

02

Carefully read through the instructions provided on the form to understand the requirements and ensure accurate completion.

03

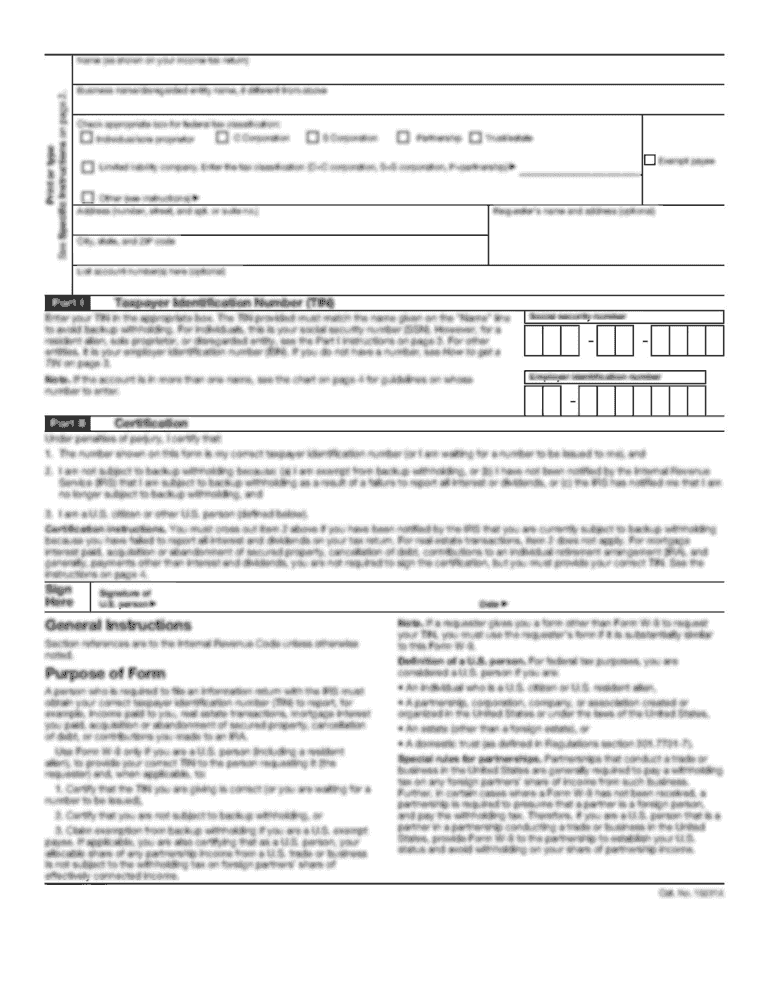

Enter your organization's legal name, address, and tax identification number (TIN) in the designated fields.

04

Provide the necessary proof of tax-exempt status, such as a copy of your organization's IRS determination letter or state tax exemption certificate.

05

Fill in the form sections related to the specific purchases you intend to make. Include detailed descriptions, quantities, and prices for each item.

06

Sign and date the completed form, certifying that the information provided is accurate to the best of your knowledge.

07

Submit the filled-out form to the office depot store where your purchase will be made, or follow the instructions to submit it electronically if applicable.

Who needs office depot tax exempt:

01

Non-profit organizations: Non-profit organizations, including charities, religious institutions, and educational establishments may need to apply for office depot tax exempt status.

02

Government entities: Municipalities, government agencies, and other governmental bodies that are eligible for tax exemption may require office depot tax exempt status.

03

Businesses reselling products: Resellers who plan to purchase office supplies from office depot for the purpose of selling those goods to end consumers can benefit from tax exempt status to avoid paying sales tax on their purchases.

Fill a customerservice taxexemptionrules : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is office depot tax exempt?

Office Depot does not offer tax exempt services. Customers can shop at Office Depot and pay sales tax on their purchases, depending on the applicable state sales tax rate.

Who is required to file office depot tax exempt?

Anyone who is eligible for a tax exemption must file the appropriate forms with Office Depot in order to take advantage of the exemption. Eligibility requirements vary by state, so it is important to check with your local Office Depot to determine the specific requirements in your state.

What is the purpose of office depot tax exempt?

Office Depot Tax Exempt is a program that allows customers to purchase certain items from Office Depot without paying sales tax. This program is designed to provide savings to customers who are tax-exempt organizations, such as government agencies, non-profits, and educational institutions.

What is the penalty for the late filing of office depot tax exempt?

The penalty for late filing of office depot tax exempt is that the taxpayer may be liable for any taxes owed plus applicable interest and penalties.

How to fill out office depot tax exempt?

To fill out the Office Depot tax exempt form, you need to follow these steps:

1. Download the tax exempt form: Visit the Office Depot website or contact their customer service to request a copy of their tax exempt form. They may have a specific form for each state, so ensure you have the correct form based on your location.

2. Gather the necessary information: Before filling out the form, gather all the required information, which typically includes your organization's name, address, tax identification number, and any additional documentation or identification details that may be needed.

3. Complete the form: Fill out the form with accurate and up-to-date information. Provide your organization's details in the designated fields as required. Make sure to read the instructions carefully and include any necessary supporting documents or attachments.

4. Verify and sign the form: Double-check all the information you have entered on the form to ensure its accuracy. Once you are satisfied, sign the form in the appropriate section. If there are multiple authorized signatories, they should also sign the form.

5. Submit the form: You can submit the completed tax exempt form to Office Depot in person at one of their retail locations or through email, fax, or mail, as specified on the form. Ensure that you retain a copy of the completed form for your records.

It's always recommended to consult with a tax professional or your organization's finance department if you have any specific questions or concerns while filling out a tax exempt form.

What information must be reported on office depot tax exempt?

When making a tax-exempt purchase at Office Depot, the following information may need to be reported:

1. Tax-exempt identification number: This is the unique identification number provided to qualifying organizations by the tax authorities. It is used to verify the tax-exempt status.

2. Organization's legal name: The official name of the tax-exempt organization must be provided to ensure accurate identification.

3. Organization's address: The physical address of the tax-exempt organization is required for record-keeping purposes.

4. Purchaser's name and title: The name and title of the person making the tax-exempt purchase should be provided for verification purposes.

5. Type of exemption: The reason for the tax exemption must be specified, such as being a registered nonprofit or educational institution.

6. Exemption certificate: Some states and jurisdictions may require a physical or electronic exemption certificate to be presented at the time of purchase. This certificate serves as proof of the organization's tax-exempt status.

It is important to note that the specific information required may vary based on local tax laws and regulations. Organizations should consult their local tax authorities or Office Depot's tax-exempt purchasing policies to ensure compliance.

Can I create an eSignature for the office depot tax exempt in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your office depot tax exempt form and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

Can I edit officemax tax exempt on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign office depot tax id number. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How do I complete tax officedepot com on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your office depot tax exempt online form, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

Fill out your office depot tax exempt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Officemax Tax Exempt is not the form you're looking for?Search for another form here.

Keywords relevant to office depot tax exemption form

Related to taxexemption officedepot com

If you believe that this page should be taken down, please follow our DMCA take down process

here

.