Get the free County Fuel-Energy Tax Application - www6 montgomerycountymd

Show details

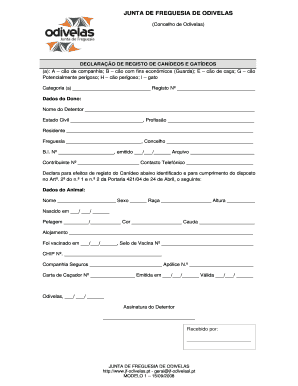

Application form for Certified Agricultural Producers to qualify for the County Fuel-Energy Tax.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign county fuel-energy tax application

Edit your county fuel-energy tax application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your county fuel-energy tax application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing county fuel-energy tax application online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit county fuel-energy tax application. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out county fuel-energy tax application

How to fill out County Fuel-Energy Tax Application

01

Obtain the County Fuel-Energy Tax Application form from the appropriate county office or website.

02

Fill out the applicant's contact information including name, address, and phone number.

03

Provide details regarding the type of fuel or energy you are applying for, including quantity and usage.

04

Complete any required sections concerning exemptions or specific tax rates applicable to your situation.

05

Attach any necessary documentation or proof of purchase, usage, or other relevant information.

06

Review the application for accuracy and completeness.

07

Submit the application either electronically or by mailing it to the designated county office.

Who needs County Fuel-Energy Tax Application?

01

Businesses that purchase fuel or energy for operational use and want to claim tax exemptions.

02

Individuals who use fuel or energy for specific qualifying purposes under county regulations.

03

Non-profit organizations that require fuel or energy for qualifying activities.

04

Government entities that seek to apply for refunds or exemptions on fuel and energy taxes.

Fill

form

: Try Risk Free

People Also Ask about

Is there a simplified Form 720?

Simple720 is an IRS-Approved 720 online portal designed to make your federal excise tax filings effortless and stress-free.

How much of my fuel is tax?

The United States federal excise tax on gasoline is 18.4 cents per gallon and 24.4 cents per gallon for diesel fuel. Proceeds from the tax partly support the Highway Trust Fund.

How to submit fuel tax credits?

Complete Form 4136, Credit for Federal Tax Paid on Fuels. Follow instructions on how to make a claim.

Can I claim GST on fuel?

To make a claim for fuel tax credits, you must be registered for: goods and services tax (GST) when you acquire the fuel. fuel tax credits when you lodge your claim.

What is the maximum fuel you can claim on tax?

Claiming fuel costs without receipts You can claim the fuel you use for work-related purposes without receipts if you use the cents per kilometre method. With this method, you can claim for up to 5,000 km of work-related trips without receipts for the financial year (the rate for 2025-26 is 88c per km).

How to get tax exempt gas?

Procedures to Apply for Gasoline Tax Exemption All oil companies require the submission of a business or fleet credit card application. Business credit card applications for personal gas tax exemption must include the residential address of the applicant and must be signed by the applicant.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is County Fuel-Energy Tax Application?

The County Fuel-Energy Tax Application is a form that businesses must complete to report their consumption of fuel and energy resources for tax assessment purposes at the county level.

Who is required to file County Fuel-Energy Tax Application?

Businesses that consume fuel or energy within the county boundaries and are subject to the county's fuel-energy tax are required to file the County Fuel-Energy Tax Application.

How to fill out County Fuel-Energy Tax Application?

To fill out the County Fuel-Energy Tax Application, businesses must provide accurate information about their fuel and energy consumption, including specific quantities, types of fuel, and usage periods, as well as any applicable business details.

What is the purpose of County Fuel-Energy Tax Application?

The purpose of the County Fuel-Energy Tax Application is to facilitate the assessment and collection of fuel-energy taxes, ensuring that businesses contribute to local funding through their consumption of these resources.

What information must be reported on County Fuel-Energy Tax Application?

The information that must be reported on the County Fuel-Energy Tax Application includes total fuel and energy consumption, types of fuels used, dates of consumption, and the business's contact and identification details.

Fill out your county fuel-energy tax application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

County Fuel-Energy Tax Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.