Get the free CHECKLIST FOR TAXABILITY OF TUITION WAIVER & EDUCATIONAL ASSISTANCE REIMBURSEMENT - ...

Show details

This document is a checklist to help determine the taxability of tuition waivers and educational assistance reimbursement for employees at the University of North Carolina at Chapel Hill.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign checklist for taxability of

Edit your checklist for taxability of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your checklist for taxability of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit checklist for taxability of online

Follow the steps down below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit checklist for taxability of. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

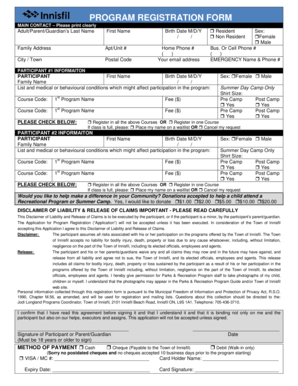

How to fill out checklist for taxability of

How to fill out CHECKLIST FOR TAXABILITY OF TUITION WAIVER & EDUCATIONAL ASSISTANCE REIMBURSEMENT

01

Gather all necessary documents related to your tuition waiver and educational assistance.

02

Review the eligibility criteria for taxability of tuition waivers and educational assistance.

03

Identify the type of educational assistance you received (i.e., tuition waiver, reimbursement).

04

Determine if the assistance was provided for a qualified educational program.

05

Assess whether the assistance was used for qualified expenses such as tuition, fees, and required books or supplies.

06

Note any employment conditions tied to the educational assistance.

07

Check for any specific tax benefits or exemptions related to tuition waivers or reimbursements based on your situation.

08

Complete the checklist by marking applicable sections and retaining documentation for your records.

Who needs CHECKLIST FOR TAXABILITY OF TUITION WAIVER & EDUCATIONAL ASSISTANCE REIMBURSEMENT?

01

Employees who receive tuition waivers or educational assistance from their employer.

02

Taxpayers seeking to understand the tax implications of educational assistance.

03

HR professionals who manage employee benefits related to education.

04

Individuals pursuing further education and utilizing assistance programs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CHECKLIST FOR TAXABILITY OF TUITION WAIVER & EDUCATIONAL ASSISTANCE REIMBURSEMENT?

The CHECKLIST FOR TAXABILITY OF TUITION WAIVER & EDUCATIONAL ASSISTANCE REIMBURSEMENT is a tool used to determine whether tuition waivers and educational assistance reimbursements provided by employers to employees are taxable under IRS regulations.

Who is required to file CHECKLIST FOR TAXABILITY OF TUITION WAIVER & EDUCATIONAL ASSISTANCE REIMBURSEMENT?

Employees receiving tuition waivers or educational assistance reimbursements must assess their taxability using the checklist. Employers who provide these benefits should also stay informed about how these benefits are reported for tax purposes.

How to fill out CHECKLIST FOR TAXABILITY OF TUITION WAIVER & EDUCATIONAL ASSISTANCE REIMBURSEMENT?

To fill out the checklist, individuals should review their educational benefits, compare them to IRS educational assistance guidelines, and indicate whether each benefit meets the tax-free criteria. Required documentation and eligibility criteria should be noted.

What is the purpose of CHECKLIST FOR TAXABILITY OF TUITION WAIVER & EDUCATIONAL ASSISTANCE REIMBURSEMENT?

The purpose of the checklist is to assist employees and employers in determining the tax implications of educational assistance programs, ensuring compliance with tax regulations and preventing unexpected tax liabilities.

What information must be reported on CHECKLIST FOR TAXABILITY OF TUITION WAIVER & EDUCATIONAL ASSISTANCE REIMBURSEMENT?

Information that must be reported includes the type of educational benefits received, the amount of the benefits, the educational institution, and any relevant IRS criteria that affect taxability, such as minimum course load or related qualifications.

Fill out your checklist for taxability of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Checklist For Taxability Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.