Get the free Lo- El - Foundation Center

Show details

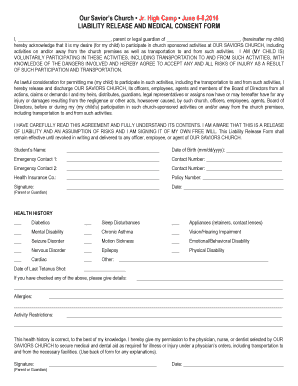

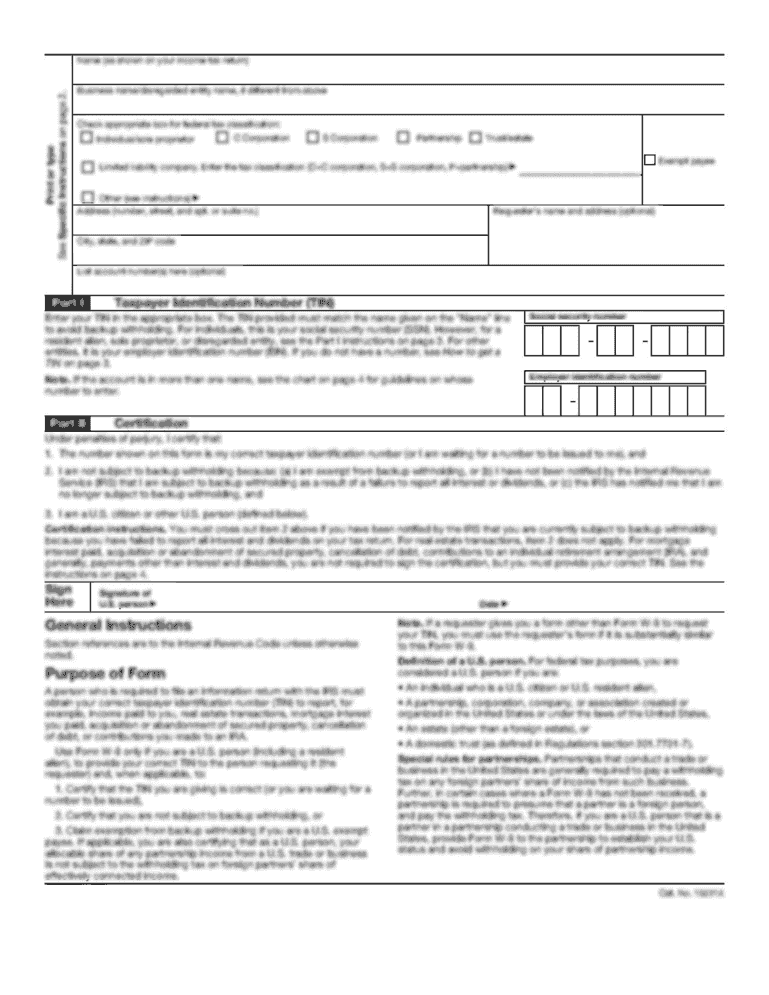

1 Form 116 Return of Organization Exempt From Income Tax 990 Name change Initial return Final return Amended return Application pending 2003 Under section 501(c), 527, or 4947(a)(1) of the Internal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your lo- el - foundation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lo- el - foundation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing lo- el - foundation online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit lo- el - foundation. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

How to fill out lo- el - foundation

Point by point instructions for filling out a lo-el foundation:

01

Start by gathering all the necessary documents and information. This may include personal identification, financial records, and any relevant supporting documents.

02

Begin by carefully reading the instructions and guidelines provided by the foundation. Make sure you understand the eligibility criteria and requirements for the application.

03

Fill out the application form, ensuring that all fields are completed accurately and thoroughly. Provide all requested information, including personal details, contact information, and any specific details required by the foundation.

04

If there are any additional sections or attachments required, make sure to include them as instructed. These may include financial statements, letters of recommendation, or proof of eligibility.

05

Take your time to review the completed application form for any mistakes or missing information. Double-check all the details to ensure accuracy before submitting.

06

Once you are confident that the application is complete and accurate, submit it as directed by the foundation. This may involve mailing it to a specific address, submitting it online, or delivering it in person.

Who needs lo-el foundation?

01

Individuals or organizations seeking financial support for educational projects or initiatives.

02

Students pursuing higher education who require scholarships or grants.

03

Non-profit organizations involved in educational programs or community development.

It is important to note that the specific criteria and eligibility for a lo-el foundation may vary. It is essential to review the foundation's guidelines and requirements to determine if you are eligible and if the foundation aligns with your needs or goals.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is lo- el - foundation?

Lo-el foundation is a non-profit organization that aims to support education and learning opportunities for underprivileged children.

Who is required to file lo- el - foundation?

Any individual or organization that operates a foundation and meets certain criteria, such as having a specific charitable purpose, may be required to file lo-el-foundation.

How to fill out lo- el - foundation?

To fill out lo-el-foundation, you will typically need to provide information about the foundation's purpose, activities, financial statements, and other relevant details. The specific forms and requirements may vary depending on the jurisdiction.

What is the purpose of lo- el - foundation?

The purpose of lo-el-foundation is to promote and support charitable activities, such as education, healthcare, poverty relief, and cultural preservation.

What information must be reported on lo- el - foundation?

The information reported on lo-el-foundation may include the foundation's financial statements, details of its activities, grants made, administrative expenses, and any other information required by the regulatory authorities.

When is the deadline to file lo- el - foundation in 2023?

The deadline to file lo-el-foundation in 2023 may vary depending on the jurisdiction. It is recommended to consult the relevant regulatory authorities or a tax professional for the specific deadline.

What is the penalty for the late filing of lo- el - foundation?

The penalty for the late filing of lo-el-foundation may vary depending on the jurisdiction. It can include financial penalties, loss of tax-exempt status, and other consequences as determined by the regulatory authorities.

How can I manage my lo- el - foundation directly from Gmail?

lo- el - foundation and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I edit lo- el - foundation on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing lo- el - foundation.

How do I fill out the lo- el - foundation form on my smartphone?

Use the pdfFiller mobile app to fill out and sign lo- el - foundation. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Fill out your lo- el - foundation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.