Get the free Mortgage Pre-Qualification

Show details

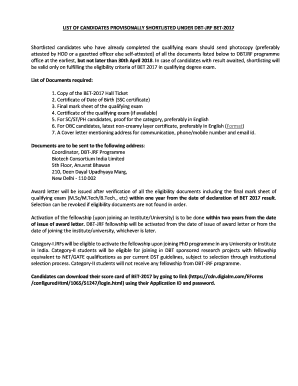

This document is a form for individuals seeking mortgage loan pre-qualification, collecting essential personal, employment, and loan information from applicants.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage pre-qualification

Edit your mortgage pre-qualification form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage pre-qualification form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mortgage pre-qualification online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit mortgage pre-qualification. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage pre-qualification

How to fill out Mortgage Pre-Qualification

01

Gather your financial documents, including income statements, tax returns, and information on debts.

02

Calculate your credit score to understand your creditworthiness.

03

Determine your desired loan amount and the price range of homes you are interested in.

04

Find local lenders or mortgage brokers and check their pre-qualification processes.

05

Fill out the mortgage pre-qualification application with all necessary information about your finances.

06

Submit the application along with any required documents to the lender.

07

Receive your pre-qualification letter, which indicates how much you are eligible to borrow.

Who needs Mortgage Pre-Qualification?

01

First-time homebuyers looking to understand their budget.

02

Current homeowners planning to buy a new home.

03

Individuals looking to refinance their existing mortgage.

04

Real estate investors seeking to secure funding for investment properties.

05

Anyone wanting to strengthen their position when making an offer on a home.

Fill

form

: Try Risk Free

People Also Ask about

What is a mortgage pre-qualification?

What is mortgage prequalification? Prequalification is an early step in your homebuying journey. When you prequalify for a home loan, you're getting an estimate of what you might be able to borrow, based on information you provide about your finances, as well as a credit check.

How long does it take to get prequalified for a mortgage?

How long does it take to get preapproved for a mortgage? You could be preapproved in one day, but you may end up having to wait up to a week. The exact timeline depends on your lender and whether you can quickly give them any missing information or track down extra documentation.

What is the meaning of pre-qualification?

Prequalification means the creditor has done at least a basic review of your creditworthiness to determine if you're likely to qualify for a loan or credit card. Consumers may initiate this process when they submit a prequalification application for a loan or card.

Does it hurt your credit to get pre-qualified for a mortgage?

Getting prequalified for a mortgage won't impact your credit score, but the soft inquiry will show up on your credit reports. Getting prequalified for a mortgage loan can help you get an idea of your eligibility and how much you can borrow.

What is the meaning of pre qualification?

Prequalification means the creditor has done at least a basic review of your creditworthiness to determine if you're likely to qualify for a loan or credit card. Consumers may initiate this process when they submit a prequalification application for a loan or card.

Is it better to be preapproved or prequalified for a mortgage?

Preapproval is an estimate based on a more thorough review of your finances and is, therefore, more accurate than prequalification. If you're wondering how to get preapproved, start by choosing a lender and applying. Your lender will run a hard credit check and ask to review your financial documents.

What is a pre-qualification estimate for a mortgage?

Mortgage prequalification is an informal evaluation of your creditworthiness and how much home you can afford based on self-reported information like your credit, debt, income and assets. Based on these inputs, prequalification estimates the amount a lender may be willing to lend you.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Mortgage Pre-Qualification?

Mortgage Pre-Qualification is the process by which a lender evaluates a potential borrower's financial situation to determine how much they are likely to be approved for when applying for a mortgage.

Who is required to file Mortgage Pre-Qualification?

Anyone looking to purchase a home or finance a property is recommended to file for Mortgage Pre-Qualification, especially first-time homebuyers and individuals seeking clarity on their borrowing capacity.

How to fill out Mortgage Pre-Qualification?

To fill out Mortgage Pre-Qualification, borrowers typically need to provide personal financial information including income, assets, debts, and credit history, either through an online form or by consulting directly with a lender.

What is the purpose of Mortgage Pre-Qualification?

The purpose of Mortgage Pre-Qualification is to help potential homebuyers understand how much they can afford to borrow, streamline the home buying process, and give sellers confidence in the buyer's capability to finance the purchase.

What information must be reported on Mortgage Pre-Qualification?

Information required for Mortgage Pre-Qualification typically includes personal identification details, income sources and amounts, assets, debts, credit score, and employment history.

Fill out your mortgage pre-qualification online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Pre-Qualification is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.