Get the free Tax on Digital Downloads a first step towards levelling the GST playing field

Show details

Position Statement July 2015Tax on Digital Downloads a first step towards levelling the GST playing field The National Retail Association endorses the Federal Governments move to levy the Goods and

We are not affiliated with any brand or entity on this form

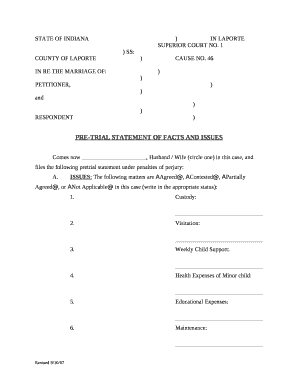

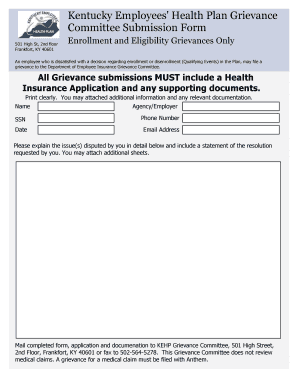

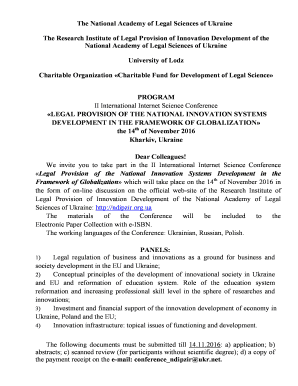

Get, Create, Make and Sign

Edit your tax on digital downloads form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax on digital downloads form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax on digital downloads online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit tax on digital downloads. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

How to fill out tax on digital downloads

How to fill out tax on digital downloads?

01

Determine your tax obligations: Before you start filling out your tax forms for digital downloads, it's important to understand the tax laws and regulations that apply to your specific situation. Check with your local tax authority or consult a tax professional to ensure you are aware of any specific requirements or exemptions.

02

Keep accurate records: To properly fill out your tax forms, you'll need to have accurate and comprehensive records of all your digital downloads and related income. This includes sales receipts, transaction details, and any applicable sales tax collected or paid.

03

Determine your taxable income: Calculate your total income from digital downloads for the tax year. This should include all revenue you have generated, excluding any expenses or deductions.

04

Report your income: On your tax forms, locate the section or schedule where you are required to report your income. Depending on your jurisdiction, this might be on your personal tax return or a separate business tax form. Ensure you enter the correct figures and follow the provided instructions carefully.

05

Consider sales tax requirements: In some jurisdictions, digital downloads may be subject to sales tax. Check whether you are required to collect and remit sales tax on your digital sales. If so, you may need to register for a sales tax permit and file regular sales tax returns.

Who needs tax on digital downloads?

01

Digital goods sellers: Individuals or businesses who sell digital downloads, such as e-books, music, software, or online courses, may need to pay taxes on the income they generate from these sales. The specific tax obligations vary depending on the seller's jurisdiction.

02

Local tax authorities: Taxing digital downloads can generate revenue for local governments, and they may impose taxes on these transactions to fund public services and programs.

03

Consumers in certain jurisdictions: In some areas, consumers may need to pay sales tax when purchasing digital downloads. This tax is typically added to the purchase price and collected by the seller on behalf of the relevant tax authority.

It's important to note that tax requirements for digital downloads can differ significantly depending on your jurisdiction. Therefore, it's crucial to consult with a tax professional or local tax authority for accurate and up-to-date information regarding your specific tax obligations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit tax on digital downloads from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including tax on digital downloads, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I send tax on digital downloads to be eSigned by others?

Once your tax on digital downloads is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an eSignature for the tax on digital downloads in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your tax on digital downloads and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

Fill out your tax on digital downloads online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.