Get the free vat carey tool hire form - irs

Show details

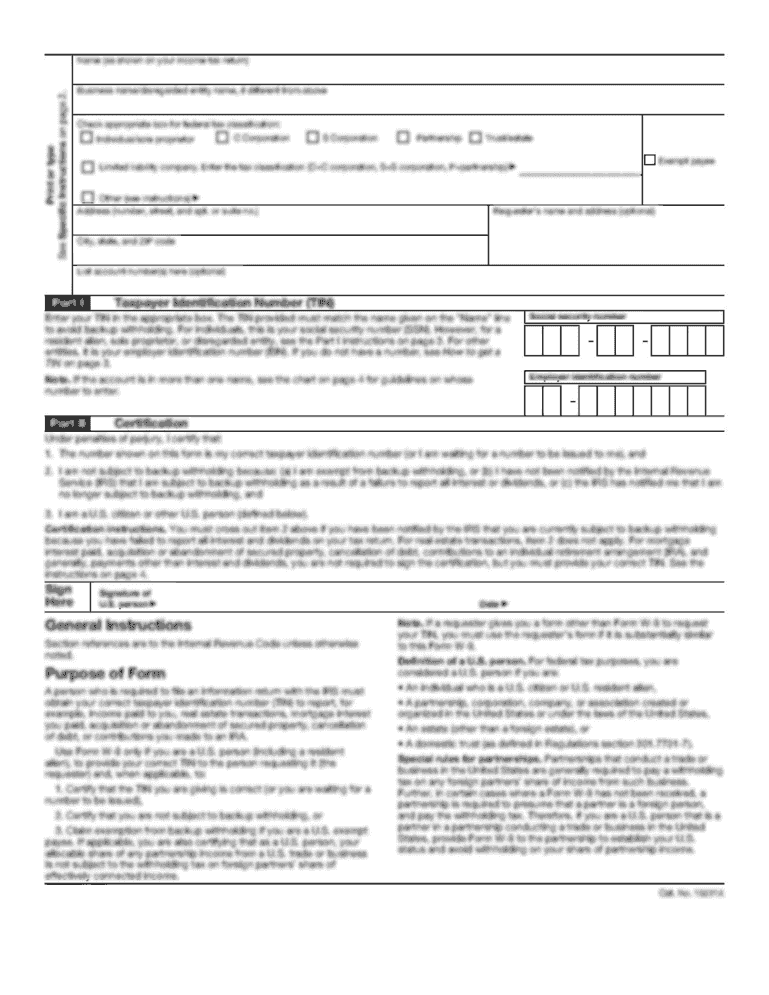

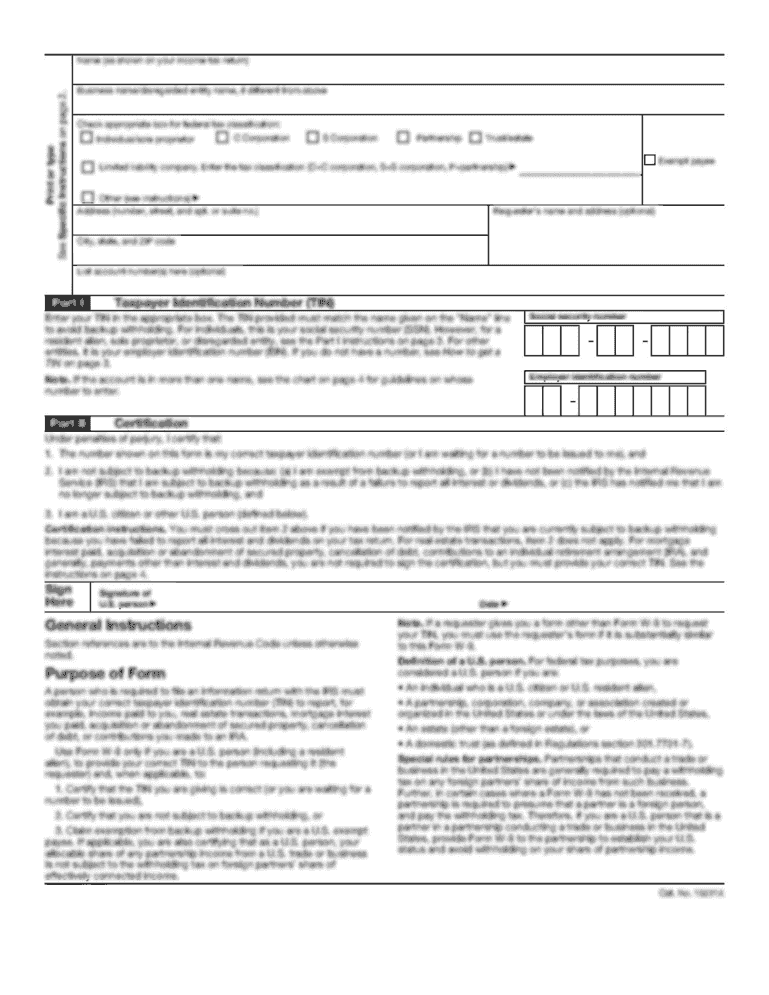

Form 5329 Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts Attach to Form 1040. See separate instructions. OMB No. 1545-0203 2002 Attachment Sequence No. Department

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your vat carey tool hire form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vat carey tool hire form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing vat carey tool hire online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit vat carey tool hire. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out vat carey tool hire

01

To fill out the VAT Carey Tool Hire, you will need to gather all the necessary information and documentation. This includes your company's VAT registration number, the date of the hire, the duration of the hire, and the total value of the tools hired.

02

Start by writing your company's VAT registration number in the designated field. This is a unique number assigned to your business by the tax authority.

03

Next, enter the date of the hire. This should be the date on which you rented the tools from Carey Tool Hire.

04

Fill in the duration of the hire. This refers to the period for which you have rented the tools. It could be a specific number of days, weeks, or months.

05

Lastly, provide the total value of the tools hired from Carey Tool Hire. This should include any additional charges or fees associated with the rental.

Who needs VAT Carey Tool Hire?

01

Any business or individual who requires the temporary use of tools and equipment can benefit from VAT Carey Tool Hire. This includes construction companies, contractors, maintenance personnel, event organizers, and even homeowners undertaking DIY projects.

02

VAT Carey Tool Hire is particularly useful for businesses or individuals who need specialized tools for a short period. Instead of investing in expensive equipment, they can rent the tools they need, saving both money and storage space.

03

Additionally, VAT Carey Tool Hire may be attractive for those who prefer the convenience of renting tools rather than maintaining and repairing their own equipment. It allows them to access a wide range of tools without the burden of ownership.

In summary, filling out the VAT Carey Tool Hire requires providing your VAT registration number, hire date, duration, and total value of the tools rented. This service is beneficial for a variety of businesses and individuals who need temporary access to specialized tools.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is vat carey tool hire?

VAT Carey Tool Hire is a system for reporting and paying Value Added Tax (VAT) for businesses in the tool hire industry.

Who is required to file vat carey tool hire?

Businesses in the tool hire industry that are registered for VAT are required to file VAT Carey Tool Hire.

How to fill out vat carey tool hire?

To fill out VAT Carey Tool Hire, businesses need to provide details of their taxable sales, VAT charged and any VAT adjustments.

What is the purpose of vat carey tool hire?

The purpose of VAT Carey Tool Hire is to accurately report VAT information and make VAT payments for businesses in the tool hire industry.

What information must be reported on vat carey tool hire?

On VAT Carey Tool Hire, businesses must report details of their taxable sales, VAT charged and any VAT adjustments.

When is the deadline to file vat carey tool hire in 2023?

The deadline to file VAT Carey Tool Hire in 2023 will be determined by the tax authorities and communicated to the businesses.

What is the penalty for the late filing of vat carey tool hire?

The penalty for the late filing of VAT Carey Tool Hire may vary depending on the tax regulations and specific circumstances of each case.

How can I modify vat carey tool hire without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including vat carey tool hire, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I complete vat carey tool hire online?

pdfFiller has made filling out and eSigning vat carey tool hire easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I complete vat carey tool hire on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your vat carey tool hire. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

Fill out your vat carey tool hire online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.