Get the free Credit Counseling Service of North Central Indiana - fsahc

Show details

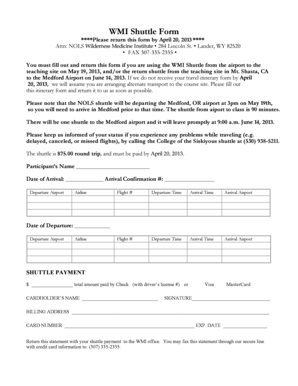

Credit Counseling Service of North Central Indiana 618 S Main Kokomo IN 46901 A Program of Family Service Association of Howard County, Inc Phone 7654547290 Fax 7654547294 RELEASE OF INFORMATION I

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit counseling service of

Edit your credit counseling service of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit counseling service of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit counseling service of online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit credit counseling service of. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit counseling service of

How to fill out credit counseling service:

01

Research credit counseling agencies: Start by researching reputable credit counseling agencies in your area or online. Look for agencies that are accredited and have experienced credit counselors.

02

Schedule an appointment: Contact the credit counseling agency and schedule an appointment to meet with a credit counselor. Most agencies offer free initial consultations.

03

Gather necessary documents: Before your appointment, gather all relevant financial documents such as credit card statements, bills, income statements, and any other financial information that can help the credit counselor assess your financial situation.

04

Be prepared to discuss your financial goals: During the counseling session, be prepared to discuss your financial goals and what you hope to achieve through the credit counseling service. Whether it's debt consolidation, budgeting assistance, or understanding your credit report, be clear about your objectives.

05

Provide accurate information: Answer the credit counselor's questions honestly and provide accurate information about your income, expenses, debts, and assets. This will help the credit counselor evaluate your situation accurately and provide appropriate solutions.

06

Review proposed solutions: After assessing your financial situation, the credit counselor will propose various solutions tailored to your needs. Consider these solutions carefully, ask questions if needed, and make sure you understand the implications of each option.

07

Take action: Once you've decided on a course of action, take the necessary steps to implement the recommended solutions. This may involve signing up for a debt management plan, adjusting your budget, or taking other steps to improve your financial situation.

08

Stay in touch with your credit counselor: Keep in touch with your credit counselor throughout the process. They can provide guidance, answer questions, and monitor your progress.

09

Evaluate your progress: Regularly evaluate your progress and make adjustments as needed. If a particular solution isn't working, communicate with your credit counselor to explore alternative options.

Who needs credit counseling service:

01

Individuals struggling with debt: If you're finding it difficult to manage your debt payments or are falling behind on bills, credit counseling can help you explore options to regain control of your finances.

02

People looking to improve their financial literacy: Credit counseling services often offer educational resources and guidance on budgeting, saving, and managing credit. If you want to improve your financial knowledge and skills, credit counseling can be beneficial.

03

Individuals considering bankruptcy: If you're contemplating bankruptcy, credit counseling is often a requirement before filing. It helps you understand the implications of bankruptcy and explore alternatives.

04

Individuals with irregular income or financial challenges: If you have irregular income, face specific financial challenges, or need assistance with managing your money effectively, credit counseling can provide valuable guidance and support.

05

Anyone seeking personalized financial advice: Credit counseling services offer personalized advice based on your unique financial situation. Whether you're facing immediate crises or want to plan for the future, credit counseling can offer tailored solutions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my credit counseling service of directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your credit counseling service of along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I make changes in credit counseling service of?

The editing procedure is simple with pdfFiller. Open your credit counseling service of in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an electronic signature for the credit counseling service of in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your credit counseling service of in seconds.

What is credit counseling service of?

Credit counseling service offers financial education and assistance to individuals struggling with their debts.

Who is required to file credit counseling service of?

Individuals who are seeking bankruptcy protection are required to file credit counseling service.

How to fill out credit counseling service of?

Credit counseling service can be filled out either online, over the phone, or in person with a certified credit counselor.

What is the purpose of credit counseling service of?

The purpose of credit counseling service is to help individuals understand their financial situation, create a budget, and explore options to manage their debts.

What information must be reported on credit counseling service of?

Information such as income, expenses, debts, assets, and a proposed repayment plan must be reported on credit counseling service.

Fill out your credit counseling service of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Counseling Service Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.