Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

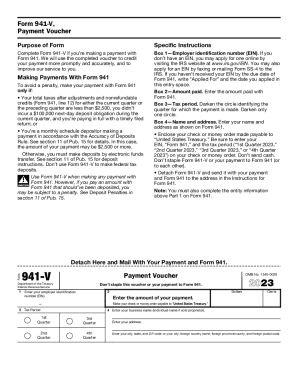

941 V is likely a reference to Form 941-V, which is a payment voucher. This form is used by employers to remit their federal tax deposits, typically when filing Form 941 - Employer's Quarterly Federal Tax Return. The voucher helps ensure that the correct tax amount is paid and properly applied.

Who is required to file 941 v?

Form 941-V, Payment Voucher, is not required to be filed separately. It is only used to accompany the payment when submitting Form 941, Employer's Quarterly Federal Tax Return. The filing of Form 941 is required by employers who have employees and withhold income taxes, Social Security tax, or Medicare tax from wages or who must pay the employer's portion of Social Security or Medicare tax.

To fill out IRS Form 941-V, follow these steps:

1. Enter the employer's name, address, and EIN (Employer Identification Number) at the top of the form.

2. Write the tax period (quarter and year) for which the payment is being made.

3. Indicate the type of return being filed (Form 941).

4. Enter the total tax liability for the quarter for all wages, tips, and other compensation (line 13).

5. Subtract any adjustment for sick pay from line 7 (line 14).

6. Calculate the total tax after adjustment (line 15).

7. Enter the amount of any deposits made for the quarter, including any overpayment applied to the current quarter (line 16).

8. Subtract line 16 from line 15 to determine the balance due or overpayment (line 17).

9. If there is a balance due, make a payment to the IRS using electronic funds withdrawal, EFTPS, or by mailing a check or money order with Form 941-V. Include the EIN, tax period, and "Form 941" on the payment.

10. If there is an overpayment, a refund can be requested or applied to the next quarter's liabilities. Select the appropriate option on line 19.

11. Attach a copy of the payment voucher (Form 941-V) and a check or money order if not paying electronically.

12. Mail the completed Form 941, along with any payment, to the IRS.

It is important to note that these instructions are just a general guide. For more specific details and additional instructions, consult the IRS instructions for Form 941 or consult a tax professional.

What is the purpose of 941 v?

Form 941-V is a payment voucher used by employers to submit the payment for their federal payroll taxes with their Form 941, which is the employer's quarterly federal tax return. The purpose of Form 941-V is to ensure that employers include the correct payment amount and identify their tax liability for a specific period. It helps the IRS track and process the payments accurately while ensuring that the funds are allocated correctly towards the employer's tax obligations.

What information must be reported on 941 v?

Form 941-V, also known as the Payment Voucher, is used to submit payments along with Form 941, Employer's Quarterly Federal Tax Return. The purpose of Form 941-V is to indicate the tax period covered and provide the necessary information to ensure accurate and timely processing of the payment.

The information to be reported on Form 941-V includes:

1. Tax Period: Indicate the quarter and year for which the payment is being made. The tax periods for Form 941 are January-March (Q1), April-June (Q2), July-September (Q3), and October-December (Q4).

2. EIN (Employer Identification Number): Provide the employer's unique nine-digit tax identification number assigned by the IRS.

3. Name and Address: Enter the employer's legal name and mailing address as recorded with the IRS.

4. Payment Amount: Specify the total payment amount being remitted for the corresponding tax period as reported on Form 941.

5. Signature and Date: The employer or an authorized person must sign and date the form to certify the accuracy of the information provided.

It's important to note that Form 941-V is separate from Form 941, which reports various employment taxes such as federal income tax withholding, Social Security tax, and Medicare tax. While Form 941 focuses on reporting tax liabilities, Form 941-V is solely for the payment voucher.

When is the deadline to file 941 v in 2023?

The deadline to file IRS Form 941 and the accompanying payment (if any) for the fourth quarter of 2022 is January 31, 2023. Please note that this information is based on the current tax rules and regulations, and it is always recommended to consult with a tax professional or check the official IRS website for any updates or changes.

What is the penalty for the late filing of 941 v?

The penalty for the late filing of Form 941-V, the Payment Voucher, may vary depending on the circumstances. If you fail to file the form by its due date, the penalty may be assessed at a rate of 2% to 15% of the unpaid tax amount per month. The specific penalty rate depends on the number of days past the due date. In some cases, the penalty can reach a maximum of 25% of the unpaid tax amount. It is important to note that penalties are typically calculated based on the amount of unpaid tax, not the amount of the late payment voucher itself. It is always recommended to file and pay the taxes on time to avoid any penalties.

How can I send 941 v for eSignature?

When you're ready to share your form 941 v, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How can I edit 941v on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing what is form 941 v.

How do I edit 941 v form on an Android device?

You can make any changes to PDF files, such as form 941v, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.