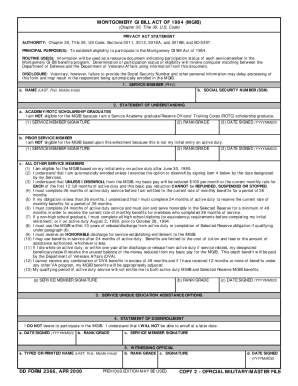

Get the free Mortgage protection should benefit you not just your lender

Show details

Mortgage protection should benefit you, not just your lender. Foresters quality life insurance and unique member benefits offer financial protection and exceptional value. Call me today for a free,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage protection should benefit

Edit your mortgage protection should benefit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage protection should benefit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mortgage protection should benefit online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit mortgage protection should benefit. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage protection should benefit

How to fill out mortgage protection should benefit:

01

Review your financial situation: Before filling out mortgage protection, it's essential to assess your financial situation. Consider your income, expenses, existing debts, and future financial goals. This evaluation will help you determine the appropriate level of coverage needed to protect your mortgage.

02

Understand the benefits: Familiarize yourself with the benefits offered by mortgage protection insurance. These benefits typically include coverage for mortgage payments in case of disability, unemployment, or death. You should carefully review the policy to ensure it aligns with your needs and provides adequate protection.

03

Gather necessary documents: Collect all the necessary documents required to fill out the mortgage protection application. This may involve providing proof of income, mortgage details, personal identification, and any other supporting documentation requested by the insurance provider. Ensuring you have all the required paperwork ready will help streamline the application process.

04

Compare insurance providers: Research and compare different insurance providers offering mortgage protection policies. Look for reputable companies with a track record of reliable coverage and prompt claim settlement. It's also advisable to consider the cost of coverage, policy terms, and customer reviews to make an informed choice.

05

Fill out the application form: Follow the instructions provided on the application form and accurately fill out all the required information. Pay attention to details and ensure that the information provided is correct and up-to-date. Any errors or omissions could cause delays or complications later on.

06

Seek professional guidance if needed: If you're unsure about any aspect of filling out the mortgage protection application, consider seeking advice from a professional, such as an insurance agent or financial advisor. They can provide you with valuable insights and help you navigate the process.

Who needs mortgage protection should benefit:

01

Homeowners with dependents: If you have a mortgage and dependents who rely on your income to cover living expenses, mortgage protection can provide financial security if something unexpected happens to you. It ensures that your loved ones can continue making mortgage payments and stay in their home.

02

Individuals with unstable employment: If you work in a field with unpredictable job security or have periods of self-employment, mortgage protection insurance can protect your mortgage payments during periods of unemployment or disability.

03

Homeowners with limited savings: If you don't have substantial savings to cover mortgage payments in times of financial hardship, mortgage protection offers a safety net. It can help you avoid foreclosure or the need to dip into retirement savings, providing peace of mind during challenging times.

In conclusion, filling out mortgage protection should benefit involves reviewing your financial situation, understanding the benefits, gathering necessary documents, comparing insurance providers, accurately completing the application form, and seeking professional guidance if needed. Mortgage protection is beneficial for homeowners with dependents, those with unstable employment, and individuals with limited savings.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit mortgage protection should benefit online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your mortgage protection should benefit and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an electronic signature for the mortgage protection should benefit in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your mortgage protection should benefit in minutes.

How do I fill out mortgage protection should benefit on an Android device?

Use the pdfFiller Android app to finish your mortgage protection should benefit and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is mortgage protection should benefit?

Mortgage protection should benefit is a type of insurance that pays off your mortgage in the event of death or disability.

Who is required to file mortgage protection should benefit?

Homeowners with a mortgage are typically required to have mortgage protection insurance.

How to fill out mortgage protection should benefit?

To fill out mortgage protection should benefit, you will need to contact an insurance provider to discuss options and complete an application form.

What is the purpose of mortgage protection should benefit?

The purpose of mortgage protection should benefit is to ensure that your mortgage can be paid off if you die or become disabled, so your loved ones are not burdened with the debt.

What information must be reported on mortgage protection should benefit?

You will need to provide basic personal information, mortgage details, and medical history when applying for mortgage protection insurance.

Fill out your mortgage protection should benefit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Protection Should Benefit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.