Get the free Factoring Application

Show details

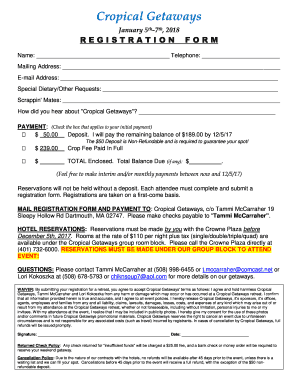

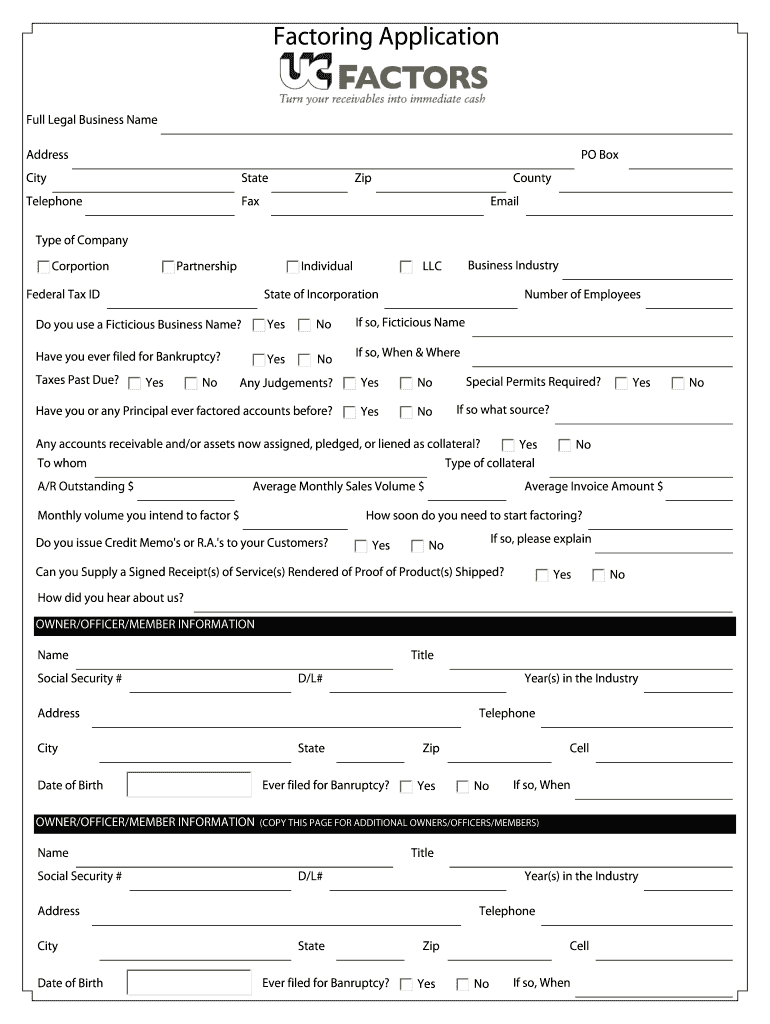

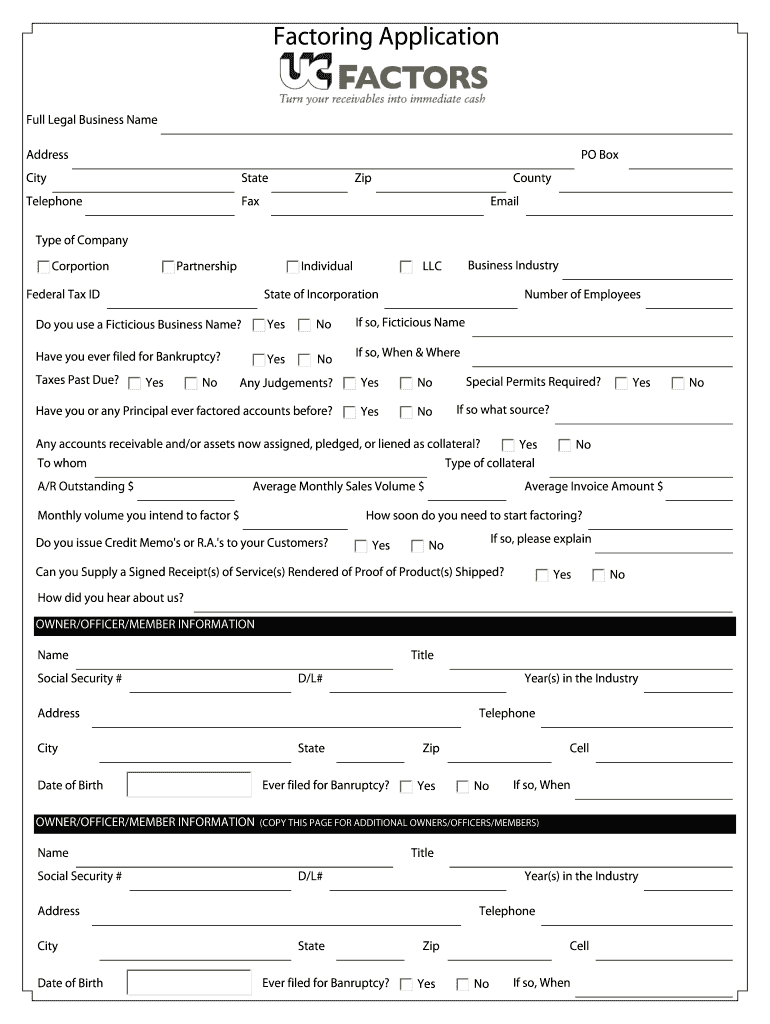

Factoring Application Reset Form Print Form Full Legal Business Name Address PO Box City State Telephone Fax Zip County Email Type of Company Corporation Partnership Individual Federal Tax ID State

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign factoring application

Edit your factoring application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your factoring application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing factoring application online

Follow the steps below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit factoring application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out factoring application

How to fill out a factoring application:

01

Start by gathering all the necessary documents and information that will be required for the application process. This may include financial statements, tax returns, accounts receivable aging reports, and any other relevant documents.

02

Fill out the basic information section of the application form, which typically includes the name and contact details of your business, as well as the legal structure of your company.

03

Provide details about your company's industry and the nature of your business operations. This can include information about your products or services, target market, and any major clients or contracts.

04

Disclose your company's financial information, such as the annual revenues, accounts payable, and cash flow statements. You may also need to provide information about any outstanding loans or debts.

05

Include details about your accounts receivable, which is a crucial aspect of factoring applications. This typically involves providing information about your clients, their payment terms, and the amount of outstanding invoices.

06

Review the application form thoroughly before submission to ensure all the information provided is accurate and complete. Contact the factoring company if you have any questions or need assistance with filling out any sections.

07

Submit the completed application form along with any supporting documents required by the factoring company. Some companies may have an online application process, while others may require physical copies to be sent via mail or email.

Who needs factoring application:

01

Small businesses or startups that are facing cash flow issues and need to improve their working capital.

02

Companies in industries where receivables make up a significant portion of their assets, such as manufacturing, construction, or wholesale trade.

03

Businesses that have a high volume of accounts receivable and experience delays in receiving payments from their customers.

04

Companies that are experiencing rapid growth and need to access funds quickly to fund their expansion plans.

05

Businesses that want to outsource the collection of their receivables and streamline their cash flow management processes.

06

Companies that do not qualify for traditional bank loans or lines of credit but have a strong customer base with creditworthy clients.

Overall, a factoring application is helpful for businesses that require immediate cash flow solutions and want to optimize their working capital by leveraging their accounts receivable.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete factoring application online?

pdfFiller has made it easy to fill out and sign factoring application. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I edit factoring application on an iOS device?

Use the pdfFiller mobile app to create, edit, and share factoring application from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Can I edit factoring application on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute factoring application from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is factoring application?

Factoring application is a process where a business sells its accounts receivable to a third party (called a factor) at a discount in exchange for immediate cash.

Who is required to file factoring application?

Businesses that want to improve cash flow by selling their accounts receivable to a factor are required to file a factoring application.

How to fill out factoring application?

To fill out a factoring application, businesses need to provide information about their company, financial statements, accounts receivable details, and other relevant documents requested by the factor.

What is the purpose of factoring application?

The purpose of a factoring application is to help businesses access immediate cash by selling their accounts receivable and improving their cash flow.

What information must be reported on factoring application?

The information reported on a factoring application typically includes company details, financial statements, accounts receivable aging report, and any other documents required by the factor.

Fill out your factoring application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Factoring Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.