Get the free loan assignment agreement template form

Show details

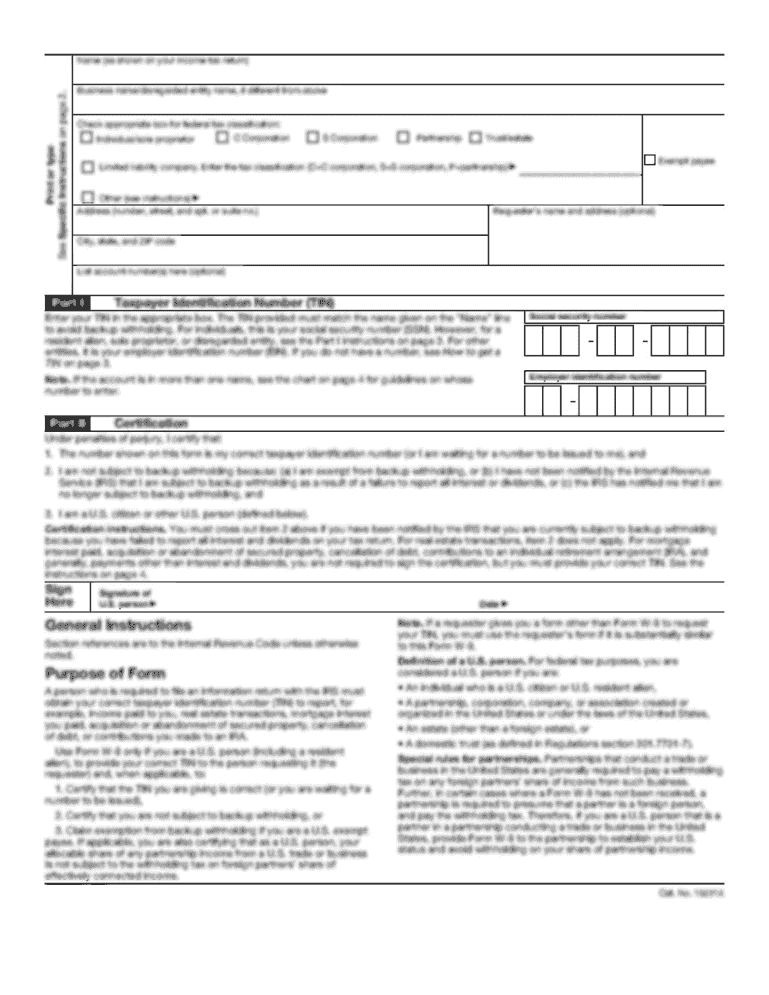

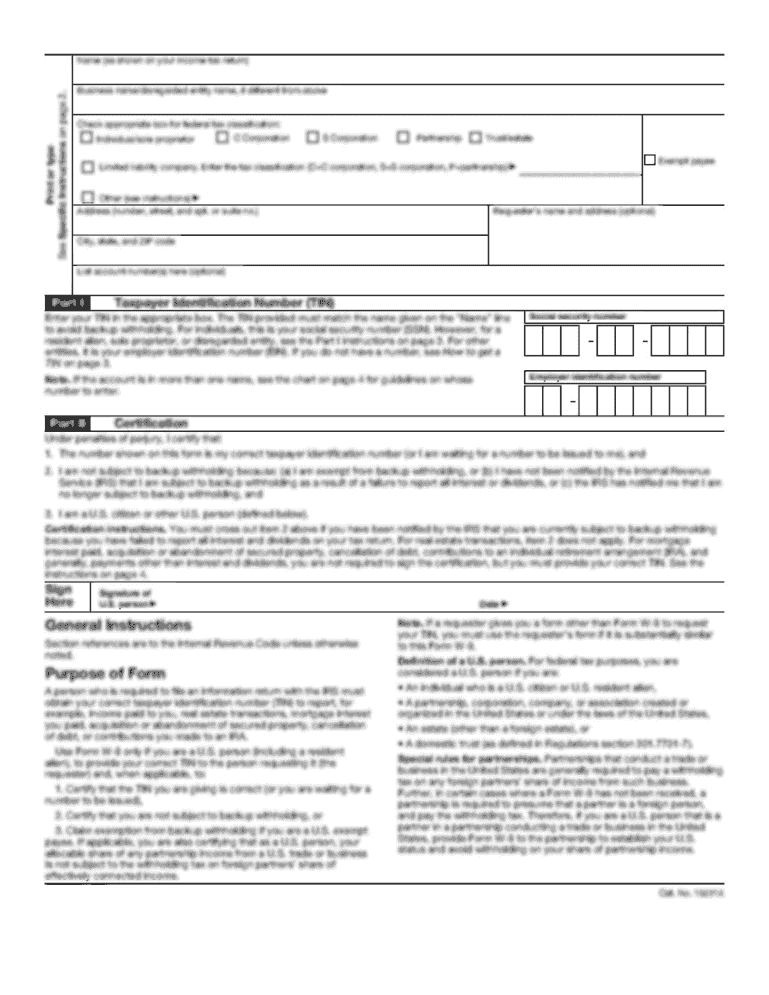

Loan agreement assignment sample assignment assumption agreement Houston into Philadelphia Florida Debt Assignment contract template Name of Assigner (the Assigner) and Assignee) hereby enter this

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your loan assignment agreement template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan assignment agreement template form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit loan assignment agreement template online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit loan assignment agreement pdf form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out loan assignment agreement template

01

Firstly, you need to gather all relevant information about the loan assignment, including the parties involved, the original loan agreement, and any other supporting documentation. It's important to have a clear understanding of the terms and conditions of the loan before proceeding.

02

Open the loan assignment agreement template and carefully review each section. Make sure you understand the purpose and scope of each provision and how it relates to your specific loan assignment.

03

Fill in the necessary information in the template, starting with the introductory section that identifies the parties involved. This usually includes the assignor (current lender), the assignee (transferee of the loan), and the borrower (the party obligated to repay the loan).

04

Proceed to the assignment clause, which outlines the terms of the loan assignment. Specify the effective date of the assignment, the amount being assigned, and any conditions or limitations related to the transfer of the loan.

05

Include any necessary representations and warranties that the parties are providing, ensuring that both the assignor and assignee are accurately representing their legal capacity and authority to enter into the agreement.

06

Add any additional clauses or provisions that are deemed necessary or requested by the parties involved. This may include clauses related to confidentiality, indemnification, jurisdiction, or dispute resolution.

07

Once you have completed all the required sections, carefully review the entire agreement to ensure accuracy and consistency. Pay attention to details such as spelling, punctuation, and formatting.

08

Have all parties involved sign and date the loan assignment agreement. It is advisable to seek legal advice or consult with an attorney to ensure that the document is legally binding and enforceable.

Who needs a loan assignment agreement template?

01

Lenders who wish to transfer their rights and obligations of a loan to another party may need a loan assignment agreement template.

02

Borrowers who have been notified of a loan assignment may need a loan assignment agreement template as well to document the transfer of their loan to a new lender.

03

Financial institutions or companies involved in loan servicing or debt restructuring may also use loan assignment agreement templates to streamline the loan assignment process.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is loan assignment agreement template?

A loan assignment agreement template is a pre-made document that outlines the terms and conditions of transferring the rights, benefits, and obligations of a loan from one party to another. This agreement is used when the original borrower (assignor) wants to transfer the loan to a new borrower (assignee). The template typically includes details such as the names and contact information of the parties involved, the loan amount, interest rate, repayment terms, and any applicable fees or penalties. It also states the rights and responsibilities of each party regarding the loan, including the assignment process, warranties, and indemnification. A loan assignment agreement template provides a standardized format to ensure clarity and legal protection for both parties involved in the loan transfer.

Who is required to file loan assignment agreement template?

There is no specific requirement for who is required to file a loan assignment agreement template. It is typically filed by the parties involved in the loan transaction, such as the lender and the assignor (the current lender assigning the loan to a new lender). However, it is recommended to consult with a legal professional or a relevant authority to determine any specific filing requirements based on the jurisdiction and applicable laws.

How to fill out loan assignment agreement template?

Filling out a loan assignment agreement template may involve the following steps:

1. Header section: Begin by typing the title "Loan Assignment Agreement" at the top of the document. Include the current date and the names and addresses of the parties involved.

2. Introductory paragraph: Write a brief statement outlining the purpose and intent of the agreement. This paragraph should state that the agreement is made between the "Assignor" (the current lender) and the "Assignee" (the new lender).

3. Loan information: Include the loan details such as the original loan amount, the current outstanding balance, the interest rate, repayment terms, and other important loan information.

4. Assignment clause: Clearly state the purpose of the agreement and explicitly state that the Assignor is assigning all rights, title, and interest in the loan to the Assignee, who agrees to assume all responsibilities and obligations associated with the loan.

5. Consideration clause: If any consideration is being exchanged between the Assignor and Assignee, state the details of the consideration, whether it's a monetary amount or any other form of payment.

6. Representations and warranties: Include a section where both parties make statements about the accuracy of the information provided, ownership of the loan, and their ability to enter into the agreement.

7. Governing law and jurisdiction: Specify the jurisdiction and the governing law that will apply to the agreement.

8. Execution and signatures: Provide space for both parties to sign and date the agreement. Include their printed names and contact information below the signature lines.

9. Notarization (optional): Depending on the jurisdiction and the importance of the agreement, you may need to consider notarizing the document.

Remember that each loan assignment agreement may have specific requirements depending on the terms and conditions of the loan and the specific jurisdiction it falls under. It is always advisable to consult with a legal professional to ensure the template is correctly filled and meets all legal requirements.

What is the purpose of loan assignment agreement template?

The purpose of a loan assignment agreement template is to outline the terms and conditions under which a creditor can assign their rights and obligations to another party. This agreement is typically used when a lender wants to transfer the loan to another party, such as a financial institution or investor. The template sets forth the conditions and requirements for the assignment, including the effective date, the outstanding loan amount, the borrower's consent, and any fees or considerations involved in the transfer.

What information must be reported on loan assignment agreement template?

When drafting a loan assignment agreement template, the following information should typically be included:

1. Parties Involved: The template must specify the names and addresses of the borrower, the original lender, and the new lender (assignee).

2. Agreement Date: The date on which the loan assignment agreement is being executed should be mentioned.

3. Loan Details: Provide the details of the loan being assigned, including the loan amount, the original loan agreement number, the interest rate, and the repayment terms.

4. Assignment Terms: Clearly state that the original lender is assigning its rights, title, and interest in the loan to the new lender. Specify that the borrower acknowledges and consents to the loan assignment.

5. Representations and Warranties: Both the original lender and the new lender should make certain representations and warranties, such as the fact that the loan is in good standing, free from any encumbrances or legal claims, and that there are no existing defaults or breaches.

6. Assumed Obligations: The agreement should outline the obligations that the new lender will assume upon the loan assignment, such as collecting loan payments, handling borrower correspondence, and account maintenance.

7. Notice of Assignment: Include a provision requiring the borrower to be notified of the loan assignment and provide instructions for future loan payments.

8. Governing Law: Specify the governing law under which any disputes or legal issues arising from the loan assignment agreement will be resolved.

9. Entire Agreement: Include a clause stating that the loan assignment agreement contains the entire agreement between the parties and supersedes any prior understandings or representations.

10. Signatures: Each party should sign the agreement, indicating their acceptance and understanding of the terms.

Please note that this information is generalized, and specific requirements may vary depending on the jurisdiction and the nature of the loan. It is important to consult with a legal professional to ensure that the loan assignment agreement template complies with all applicable laws and regulations.

What is the penalty for the late filing of loan assignment agreement template?

The penalty for late filing of a loan assignment agreement template can vary depending on the specific jurisdiction and legislation governing the loan assignment. It is advisable to consult with a legal professional or government authority to determine the exact penalties involved. In general, late filing may result in monetary fines or penalties, delay in processing or approval of the assignment, or potential legal consequences.

How can I send loan assignment agreement template for eSignature?

Once your loan assignment agreement pdf form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit loan assignment agreement template in Chrome?

loan assignment agreement sample can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I fill out the loan assignment agreement form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign loan assignment template form and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Fill out your loan assignment agreement template online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loan Assignment Agreement Template is not the form you're looking for?Search for another form here.

Keywords relevant to loan assignment agreement pdf form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.