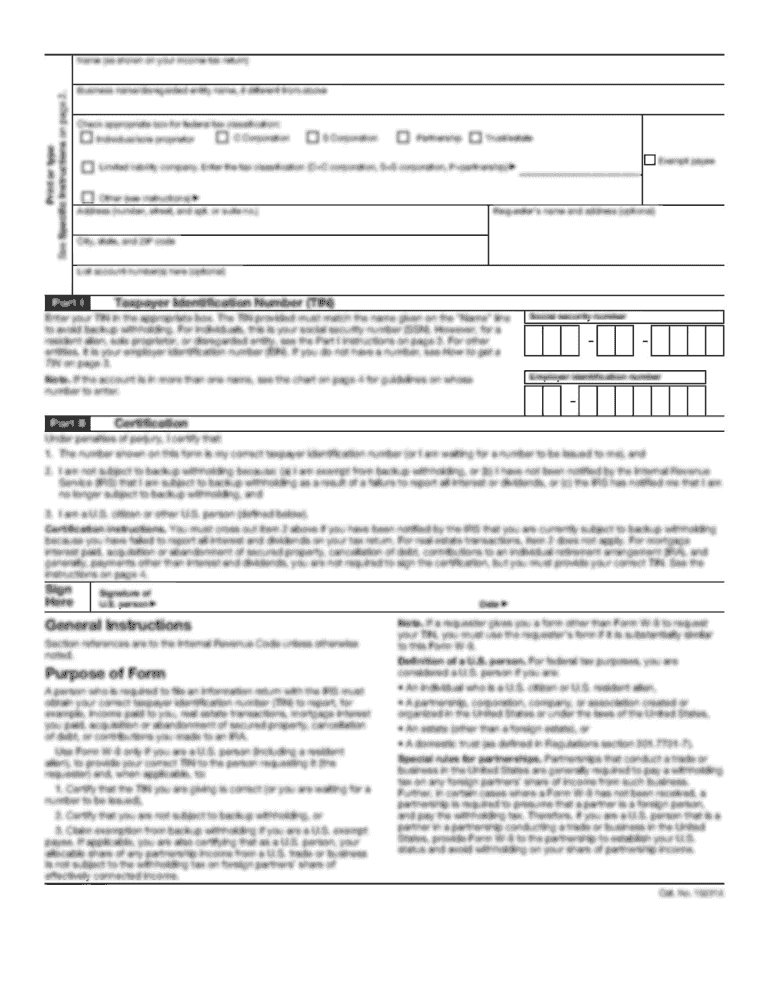

Get the free factory costs such as cleaning supplies form

Show details

Includes factory costs such as cleaning supplies, taxes, insurance, and janitor wages. Your answer is correct. Manufacturing overheard about this×Indirect labor Direct materials Period costs Challenge

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your factory costs such as form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your factory costs such as form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit factory costs such as cleaning supplies online

In order to make advantage of the professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit factory costs such as cleaning supplies. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

How to fill out factory costs such as

How to fill out factory costs such as:

01

Identify all direct costs: Begin by listing and quantifying all direct costs incurred in the production process. This includes raw materials, labor costs, and any other expenses directly associated with manufacturing.

02

Allocate indirect costs: Determine the indirect costs that are relevant to the factory. These costs are not directly tied to the production of a specific product but still affect the overall operation. Indirect costs may include facility rent, utilities, equipment maintenance, and administrative expenses.

03

Analyze overhead costs: Break down the overhead costs to understand how they are allocated to each product or production process. This may involve studying the production flow, identifying cost drivers, and using appropriate allocation methods.

04

Track depreciation: Factory equipment and machinery depreciate over time. It is important to factor in the depreciation costs when filling out factory costs. Calculate depreciation expenses using appropriate methods (such as straight-line or accelerated) and allocate them accordingly.

Who needs factory costs such as:

01

Manufacturing companies: Factory costs are crucial for manufacturing companies as they help in analyzing the overall production expenses, identifying areas for cost optimization, and evaluating the profitability of different products. Accurate factory cost tracking enables manufacturers to make informed decisions regarding pricing, production volume, and resource allocation.

02

Financial analysts: Financial analysts assess the performance and financial health of manufacturing companies. Understanding factory costs allows them to analyze cost structures, profitability margins, and overall operational efficiency. This information helps them provide valuable insights to investors, management teams, and stakeholders.

03

Regulatory authorities and tax departments: Factory costs provide essential details for regulatory compliance and tax filings. Government agencies rely on accurate cost data to ensure companies adhere to accounting standards, report taxes correctly, and meet regulatory requirements.

In conclusion, filling out factory costs involves identifying direct and indirect expenses, analyzing overhead costs, and tracking depreciation. Manufacturing companies, financial analysts, and regulatory authorities are the primary beneficiaries of factory cost information.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my factory costs such as cleaning supplies in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your factory costs such as cleaning supplies right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I fill out factory costs such as cleaning supplies using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign factory costs such as cleaning supplies and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Can I edit factory costs such as cleaning supplies on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute factory costs such as cleaning supplies from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your factory costs such as online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.