Get the free Consultation Paper on Family Loans and Guarantees - lawreformcommission sk

Show details

This document discusses the implications and problems associated with family loans and guarantees, particularly as they affect older adults in Saskatchewan. It explores legal backgrounds and suggests

We are not affiliated with any brand or entity on this form

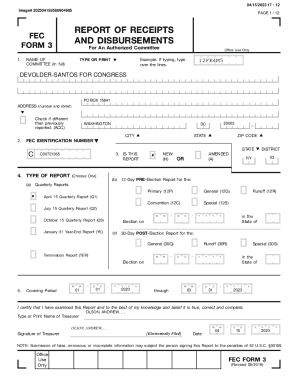

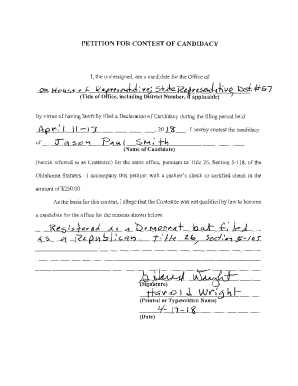

Get, Create, Make and Sign consultation paper on family

Edit your consultation paper on family form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consultation paper on family form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit consultation paper on family online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit consultation paper on family. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out consultation paper on family

How to fill out Consultation Paper on Family Loans and Guarantees

01

Begin by obtaining the Consultation Paper template from the relevant authority or website.

02

Review the instructions provided with the paper to understand the requirements.

03

Fill out the personal details section with your name, address, and contact information.

04

Clearly state the purpose of the family loan or guarantee in the designated area.

05

Provide detailed information about the loan amount, terms, and repayment plan.

06

Include the names and relationships of all involved parties in the transaction.

07

Outline the reason for the loan or guarantee to demonstrate its necessity.

08

Attach any supporting documentation as required, such as income proofs or bank statements.

09

Review the entire paper for completeness and accuracy before submission.

10

Submit the completed Consultation Paper by the deadline specified.

Who needs Consultation Paper on Family Loans and Guarantees?

01

Individuals or families seeking financial assistance through loans from family members.

02

People wanting to formally document family guarantees for financial safety.

03

Financial institutions assessing the validity of family loans for credit purposes.

04

Individuals planning to comply with legal or tax obligations related to family financing.

Fill

form

: Try Risk Free

People Also Ask about

What are the cons of family and friends funding?

Cons of Franchise Financing from Family and Friends This can put a strain on your personal relationships and make it difficult to separate business from personal life. Another con of seeking financing from family and friends is the lack of formal agreements and legal protections.

What are the disadvantages of loans?

Loans are not very flexible - you could be paying interest on funds you're not using. You could have trouble making monthly repayments if your customers don't pay you promptly, causing cashflow problems. In some cases, loans are secured against the assets of the business or your personal possessions, eg your home.

What are the disadvantages of loans from friends and family?

transactions of this nature can be complex - any misunderstandings about the arrangement can damage relationships. there is a risk your investors may offer more than they can afford to lose, or that they will demand their money back when it suits them but not your business.

How to write a loan agreement between family members?

A family loan agreement shares the same basic elements with other lending contracts. It should specify a repayment term and payment schedule, an interest rate, and other contingencies, such as how late payments or a default will be handled. Notarizing your agreement is also recommended.

What are the pros and cons of a family loan?

Pros and Cons of Lending Money to Family Members Pro #1: Teach Fiscal Responsibility. Pro #2: You May Need Help in the Future. Pro #3: Helping Someone You Love. Con #1: Becoming Known as the Family Bank. Con #2: Resentment. Con #3: Overextending Your Own Finances.

What is a disadvantage of a friends and family loan?

Disadvantages of raising finance from friends or family there is a risk your investors may offer more than they can afford to lose, or that they will demand their money back when it suits them but not your business. they may also want to get more involved in the business, which may not be appropriate.

How to formalize a family loan?

A family loan agreement is a contract that spells out the terms and conditions of the loan. A notarized and signed agreement may seem impersonal, but having things in writing can prevent misunderstandings and frustrations. Be sure to include both parties in the decision-making process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Consultation Paper on Family Loans and Guarantees?

The Consultation Paper on Family Loans and Guarantees is a document that seeks public input and guidance regarding the regulations and practices associated with financial loans and guarantees between family members.

Who is required to file Consultation Paper on Family Loans and Guarantees?

Individuals and entities involved in granting or receiving loans and guarantees from family members may be required to file the Consultation Paper, especially if such transactions impact taxation or regulatory compliance.

How to fill out Consultation Paper on Family Loans and Guarantees?

To fill out the Consultation Paper, one must provide detailed information about the loan amount, terms of the agreement, parties involved, and any associated guarantees. It is advisable to refer to specific guidelines provided by the regulatory authority.

What is the purpose of Consultation Paper on Family Loans and Guarantees?

The purpose of the Consultation Paper is to gather feedback on existing practices, identify potential issues, and develop regulatory standards that ensure transparency and fairness in family loans and guarantees.

What information must be reported on Consultation Paper on Family Loans and Guarantees?

Required information includes the identities of the parties involved, the loan amount, interest rates, repayment terms, purpose of the loan, and any security or guarantees provided.

Fill out your consultation paper on family online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consultation Paper On Family is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.