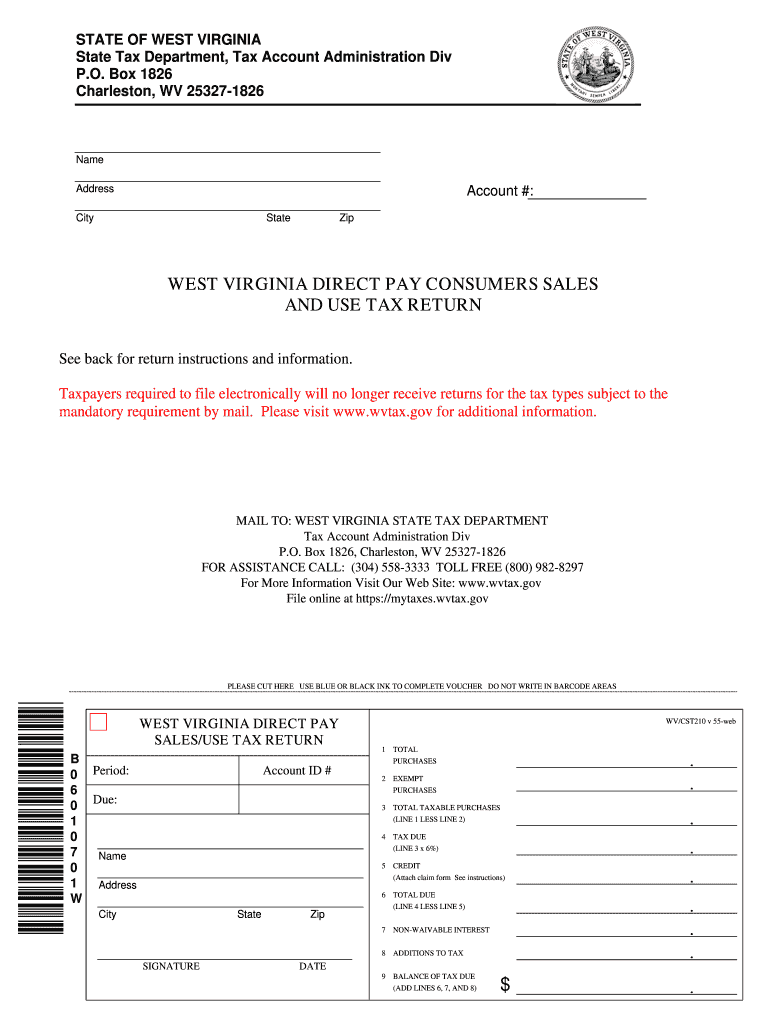

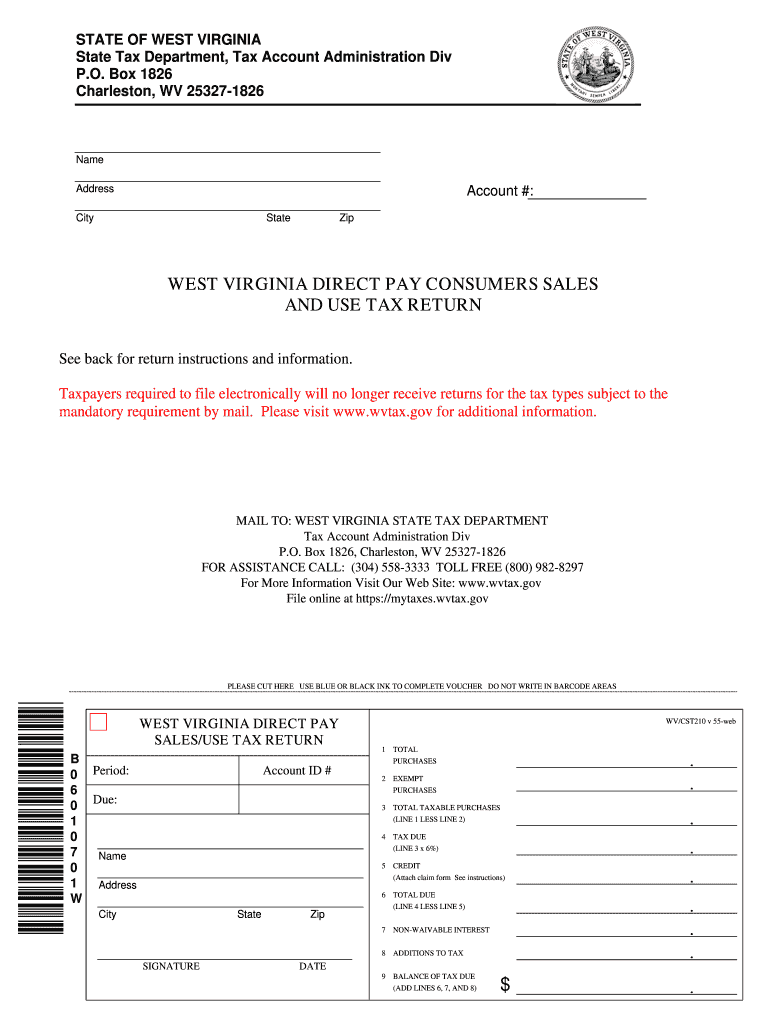

Get the free WEST VIRGINIA DIRECT PAY CONSUMERS SALES AND USE TAX RETURN

Show details

This document is used for filing the Consumers Sales and Use Tax in West Virginia for direct pay permit holders. It provides instructions for tax calculations and payment submissions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign west virginia direct pay

Edit your west virginia direct pay form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your west virginia direct pay form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing west virginia direct pay online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit west virginia direct pay. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out west virginia direct pay

How to fill out WEST VIRGINIA DIRECT PAY CONSUMERS SALES AND USE TAX RETURN

01

Obtain the WEST VIRGINIA DIRECT PAY CONSUMERS SALES AND USE TAX RETURN form from the West Virginia State Tax Department website or your local tax office.

02

Fill in your name, address, and other required identification information at the top of the form.

03

Provide your West Virginia tax identification number in the designated field.

04

List all taxable purchases made during the reporting period in the appropriate section of the form.

05

Calculate the total amount of taxable purchases and apply the correct sales tax rate to determine the amount of tax owed.

06

If applicable, enter any deductions or exemptions you are claiming in the designated area.

07

Review all information for accuracy to ensure there are no errors.

08

Sign and date the form before submitting it to the West Virginia State Tax Department.

09

Pay any taxes owed along with the completed form by the due date to avoid penalties.

Who needs WEST VIRGINIA DIRECT PAY CONSUMERS SALES AND USE TAX RETURN?

01

Any businesses or individuals in West Virginia who make taxable purchases and are responsible for remitting sales and use tax directly.

02

Entities that qualify for direct pay permits and choose to self-assess sales and use tax on their purchases.

Fill

form

: Try Risk Free

People Also Ask about

Does West Virginia require you to file a tax return?

For employees and/or students living and/or working in West Virginia, anyone required to file a federal income tax return is generally also required to file a West Virginia state income tax return.

Is West Virginia a no tax state?

How does West Virginia's tax code compare? West Virginia has a graduated state individual income tax, with rates ranging from 2.36 percent to 5.12 percent. There are also jurisdictions that collect local income taxes. West Virginia has a 6.5 percent corporate income tax rate.

What is the direct pay sales tax?

Direct pay permits, which allow taxpayers to pay sales tax directly to the state rather than sellers, are becoming more common. Many businesses see direct pay as an essential element to the management of their state and local tax obligations, however there are still many questions.

Is it mandatory to file a tax return?

Generally, you must file an income tax return if you're a resident , part-year resident, or nonresident and: Are required to file a federal return. Receive income from a source in California.

What is a consumer use tax return?

Consumer Use Tax is a tax on the purchaser and is self-assessed by the purchaser on taxable items purchased where the vendor did not collect either a sales or vendor use tax. The purchaser remits this tax directly to the taxing jurisdiction.

What is the new tax law in WV?

West Virginia Governor Jim Justice signed into law S.B. 2033 which, effective January 1, 2025, lowers the graduated income tax rates from a range of 2.36% to 5.12% to a range of 2.2% to 4.82%.

Do I have to file a WV state tax return?

You are required to file a West Virginia return even though you may not be required to file a federal return if: Your West Virginia adjusted gross income is greater than your allowable deduction for personal exemptions ($2,000 per exemption, or $500 if you claim zero exemptions).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is WEST VIRGINIA DIRECT PAY CONSUMERS SALES AND USE TAX RETURN?

The West Virginia Direct Pay Consumers Sales and Use Tax Return is a tax form used by eligible consumers to report and pay sales and use tax on purchases made directly from vendors in the state of West Virginia.

Who is required to file WEST VIRGINIA DIRECT PAY CONSUMERS SALES AND USE TAX RETURN?

Individuals or entities that qualify for direct pay status, typically large businesses or organizations, are required to file the West Virginia Direct Pay Consumers Sales and Use Tax Return on purchases where they self-assess and remit sales tax.

How to fill out WEST VIRGINIA DIRECT PAY CONSUMERS SALES AND USE TAX RETURN?

To fill out the West Virginia Direct Pay Consumers Sales and Use Tax Return, taxpayers must provide detailed information regarding their purchases, including the total amount of purchases, the applicable tax rate, and calculate the total sales and use tax owed.

What is the purpose of WEST VIRGINIA DIRECT PAY CONSUMERS SALES AND USE TAX RETURN?

The purpose of the West Virginia Direct Pay Consumers Sales and Use Tax Return is to allow eligible consumers to report and remit sales and use tax directly to the state, streamlining the tax collection process for significant consumers.

What information must be reported on WEST VIRGINIA DIRECT PAY CONSUMERS SALES AND USE TAX RETURN?

The information that must be reported on the West Virginia Direct Pay Consumers Sales and Use Tax Return includes the name and address of the taxpayer, details of purchases made, taxable amounts, tax rates applied, and total tax due.

Fill out your west virginia direct pay online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

West Virginia Direct Pay is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.