Get the free HT-016 Schedule B, Form 101, Stock and Bonds (1/01). HT-016

Show details

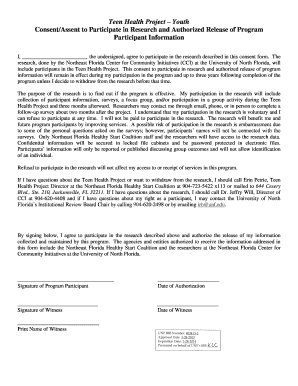

SCHEDULE FORM 101 B STOCK AND BONDS Page of Schedule Estate of: B Report Jointly Owned and Survivorship Marital Property on Schedule E1 or E2 Item No. Value at Date of Death Description See instructions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your ht-016 schedule b form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ht-016 schedule b form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ht-016 schedule b form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ht-016 schedule b form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out ht-016 schedule b form

How to Fill Out HT-016 Schedule B Form:

01

Start by obtaining a blank copy of the HT-016 Schedule B form from the relevant source, usually a government agency or organization.

02

Begin by entering the required information at the top of the form, such as your name, contact details, and any other identifying information requested.

03

Carefully read the instructions provided with the form to understand the purpose and requirements for each section.

04

In Section A, fill in the details of the individual or organization that will be the recipient of the form. This can include their name, address, and any other relevant information.

05

For each item or category in Section B, accurately provide the requested information. This may include descriptions, quantities, values, or any other applicable details. Ensure that all information is complete and legible.

06

If required, continue providing the necessary information in subsequent sections of the form, following the instructions provided.

07

Review the completed form thoroughly to check for any errors or omissions. Make any necessary corrections before finalizing the document.

08

Sign and date the form, if required, to certify the accuracy and completeness of the information provided.

09

Make a copy of the filled-out form for your records, if necessary, before submitting it to the proper authority or entity.

10

Submit the HT-016 Schedule B form as specified by the instructions provided, ensuring it reaches the intended recipient by the designated deadline.

Who Needs HT-016 Schedule B Form:

01

Individuals or organizations involved in international trade or commerce may need to fill out the HT-016 Schedule B form.

02

Businesses engaged in the import or export of goods often require this form to report detailed information about the commodities being shipped.

03

Customs authorities, government agencies, or relevant regulatory bodies may generally request the HT-016 Schedule B form as part of their procedures for monitoring international trade and ensuring compliance with applicable laws and regulations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ht-016 schedule b form?

HT-016 Schedule B form is a tax form used for reporting specific information related to certain transactions or activities. It is typically used by individuals or businesses to provide detailed information to the tax authorities.

Who is required to file ht-016 schedule b form?

The requirement to file HT-016 Schedule B form may vary depending on the specific tax laws and regulations of a particular jurisdiction. Generally, individuals or businesses engaged in specific transactions or activities, such as certain types of financial transactions or international trade, may be required to file this form. It is recommended to consult with a tax professional or refer to the relevant tax authority for specific filing requirements.

How to fill out ht-016 schedule b form?

To fill out HT-016 Schedule B form, you will typically need to provide specific information as requested on the form. This may include details such as transaction dates, descriptions, amounts, and any applicable codes or identifiers. It is important to carefully review the instructions provided with the form and ensure accurate and complete reporting of the required information. If you are unsure about any aspect of the form, it is advisable to seek guidance from a tax professional or refer to the relevant tax authority.

What is the purpose of ht-016 schedule b form?

The purpose of HT-016 Schedule B form is to gather detailed information about specific transactions or activities for tax reporting purposes. This form helps tax authorities to monitor and ensure compliance with tax laws and regulations, as well as to identify any potential discrepancies or tax obligations.

What information must be reported on ht-016 schedule b form?

The specific information that must be reported on HT-016 Schedule B form may vary depending on the applicable tax laws and regulations. Generally, this form requires reporting of details such as transaction dates, descriptions, amounts, parties involved, and any applicable codes or identifiers. It is important to refer to the instructions provided with the form and follow the reporting requirements of the relevant tax authority.

When is the deadline to file ht-016 schedule b form in 2023?

The specific deadline to file HT-016 Schedule B form in 2023 may depend on the tax jurisdiction and the tax year for which the form is being filed. It is recommended to consult the relevant tax authority or refer to the instructions provided with the form for the accurate deadline information.

What is the penalty for the late filing of ht-016 schedule b form?

The penalty for the late filing of HT-016 Schedule B form may vary depending on the tax jurisdiction and the specific tax laws and regulations. Typically, late filing may result in penalties, such as fines or interest charges, imposed by the tax authority. It is important to comply with the filing deadlines to avoid such penalties. If you have missed the deadline, it is advisable to promptly file the form and contact the tax authority to inquire about any applicable penalties or procedures for rectifying the late filing.

How do I edit ht-016 schedule b form online?

With pdfFiller, it's easy to make changes. Open your ht-016 schedule b form in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I edit ht-016 schedule b form straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing ht-016 schedule b form, you need to install and log in to the app.

How do I edit ht-016 schedule b form on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign ht-016 schedule b form on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Fill out your ht-016 schedule b form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.