Get the free Cash and Liquidity Management Processing Receivables and

Show details

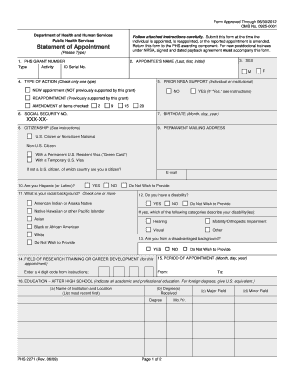

Cash and Liquidity Management (Processing Receivables and Payments) SAP Business Design Cash and Liquidity Management (Processing Receivables and Payments) Table of Content 1 About this Document .......................................................................................................................

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cash and liquidity management

Edit your cash and liquidity management form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cash and liquidity management form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cash and liquidity management online

Follow the steps down below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit cash and liquidity management. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cash and liquidity management

How to fill out cash and liquidity management:

01

Evaluate your current cash position: Begin by assessing your current cash balance, both in terms of available funds and any outstanding obligations. This will give you a clear picture of your current liquidity situation.

02

Create a cash flow forecast: Develop a forecast of your expected cash inflows and outflows over a specific period, such as a month or a quarter. This forecast will help you anticipate any potential shortfalls or excesses in your cash position.

03

Monitor cash inflows: Keep track of all the sources of cash coming into your business, such as customer payments, investment returns, or loans. By tracking your inflows, you can ensure that you have a steady stream of cash to meet your obligations.

04

Track cash outflows: It is equally important to monitor and control your cash outflows. Categorize and prioritize your expenses, considering both fixed costs and variable costs. This will enable you to allocate resources efficiently and avoid unnecessary expenses.

05

Implement cash management strategies: Utilize various cash management strategies to optimize your cash position. These may include techniques like accelerating cash inflows by offering early payment incentives to customers or negotiating longer payment terms with suppliers.

06

Manage working capital: Assess and manage your working capital effectively. Working capital is the amount of cash tied up in daily operations, such as inventory, accounts receivable, and accounts payable. By optimizing your working capital, you can improve your overall liquidity.

Who needs cash and liquidity management:

01

Small and medium-sized businesses: Cash and liquidity management is crucial for businesses of all sizes, particularly smaller ones. These businesses often have limited resources and cannot afford to have cash tied up unnecessarily or face cash shortages.

02

Startups and growing businesses: Cash flow management is particularly critical for startups and growing businesses. These companies often experience rapid changes in their revenue and expenses, making effective cash management vital for their survival and growth.

03

Financial institutions: Banks and other financial institutions also require effective cash and liquidity management. They need to balance their cash inflows and outflows, manage reserve requirements, and mitigate liquidity risks to ensure their operations run smoothly.

04

Individuals and households: Cash and liquidity management is not solely limited to businesses. Individuals and households also benefit from managing their personal finances effectively. It helps them maintain sufficient funds for daily expenses, savings, and unexpected emergencies.

05

Non-profit organizations: Non-profit organizations, just like businesses, need to effectively manage their cash and liquidity. They rely on cash inflows, donations, and grants to fund their operations, programs, and initiatives. Prudent cash management ensures their financial sustainability and helps them fulfill their mission.

In conclusion, cash and liquidity management is essential for individuals, businesses, and organizations of all types. By properly managing cash inflows, outflows, and working capital, one can maintain financial stability, meet obligations, and make informed decisions for future growth.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in cash and liquidity management?

With pdfFiller, it's easy to make changes. Open your cash and liquidity management in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I make edits in cash and liquidity management without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your cash and liquidity management, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I edit cash and liquidity management on an Android device?

You can make any changes to PDF files, such as cash and liquidity management, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is cash and liquidity management?

Cash and liquidity management refers to the process of monitoring, managing, and optimizing the amount of cash and liquid assets held by a business to meet its financial obligations.

Who is required to file cash and liquidity management?

Cash and liquidity management is typically required to be filed by financial institutions, large corporations, and any other entities with significant cash holdings.

How to fill out cash and liquidity management?

Cash and liquidity management is typically filled out by compiling information on cash flows, liquidity ratios, and funding sources to provide an overview of a company's financial position.

What is the purpose of cash and liquidity management?

The purpose of cash and liquidity management is to ensure that a company has enough cash on hand to meet its financial obligations while also maximizing returns on its liquid assets.

What information must be reported on cash and liquidity management?

Information reported on cash and liquidity management typically includes cash flow statements, balance sheets, liquidity ratios, and details of funding sources.

Fill out your cash and liquidity management online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cash And Liquidity Management is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.