Get the free ELECTRONIC FILING A

Show details

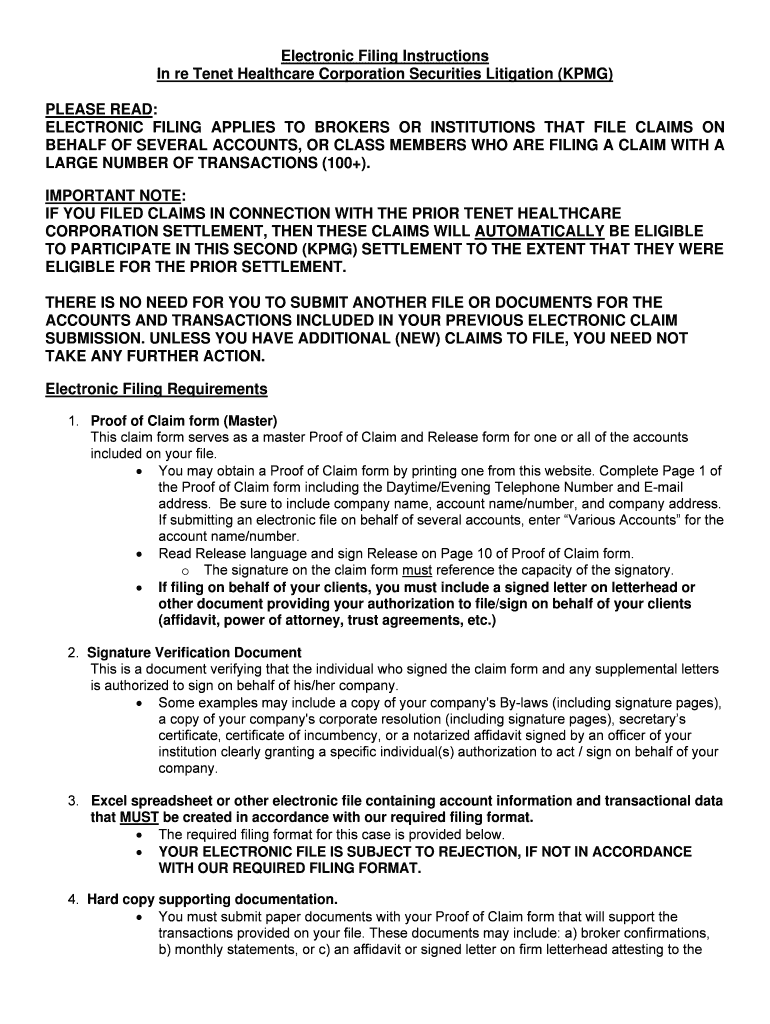

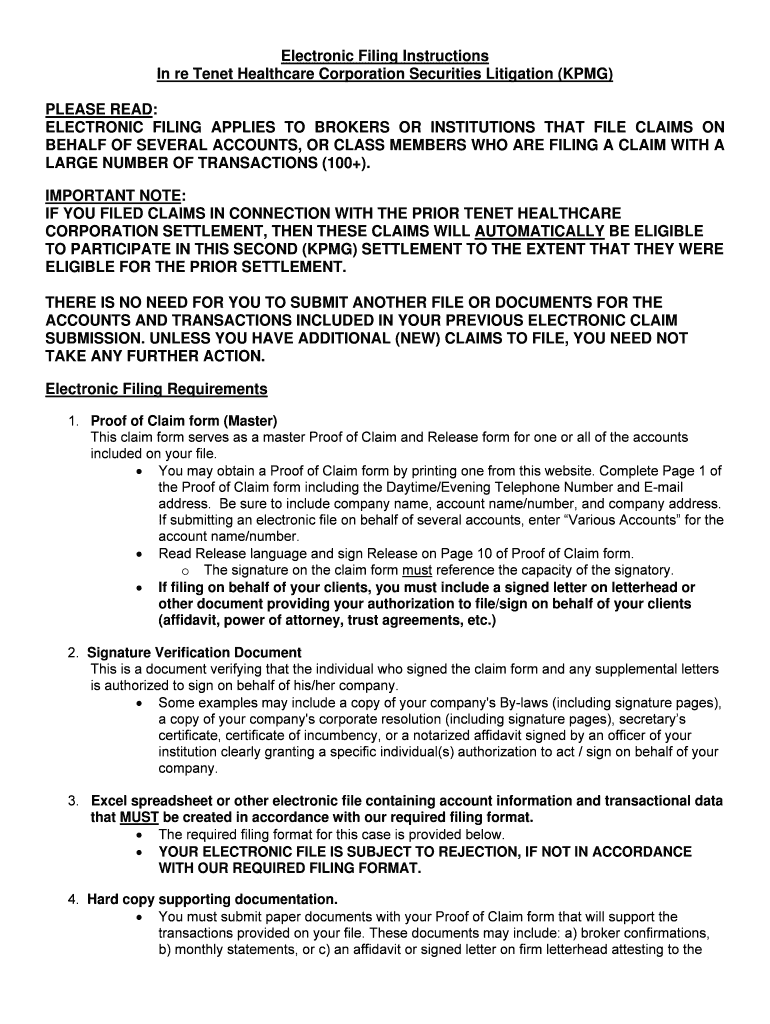

Electronic Filing Instructions

In re Tenet Healthcare Corporation Securities Litigation (KPMG)

PLEASE READ:

ELECTRONIC FILING APPLIES TO BROKERS OR INSTITUTIONS THAT FILE CLAIMS ON

BEHALF OF SEVERAL

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your electronic filing a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your electronic filing a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing electronic filing a online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit electronic filing a. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is electronic filing a?

Electronic filing, also known as e-filing, is the process of submitting documents and forms electronically, usually through an online platform or software.

Who is required to file electronic filing a?

The requirement to file electronically may vary depending on the specific jurisdiction and the type of filing. Generally, businesses, individuals, and organizations mandated by law or regulations are required to file electronically.

How to fill out electronic filing a?

To fill out electronic filing, the specific instructions and procedures provided by the relevant authority or platform should be followed. This generally involves creating an account, providing the required information and documents, and submitting them electronically.

What is the purpose of electronic filing a?

The purpose of electronic filing is to streamline and modernize the filing process, making it more efficient, accurate, and accessible. It eliminates the need for paper-based submissions, reduces administrative burdens, and promotes faster processing and data management.

What information must be reported on electronic filing a?

The specific information required to be reported on electronic filing can vary depending on the type of filing and the jurisdiction. Generally, it includes relevant personal or business information, financial details, documentation, and any other required data specified by the authorities.

When is the deadline to file electronic filing a in 2023?

The deadline for filing electronic filing in 2023 may vary depending on the jurisdiction and the specific form or report being filed. It is important to consult the official guidelines, notifications, or deadlines provided by the relevant authority or platform.

What is the penalty for the late filing of electronic filing a?

The penalties for late filing of electronic filing can vary depending on the jurisdiction and the specific regulations in place. These penalties may include monetary fines, interest charges, late fees, or other repercussions as determined by the respective authorities.

How can I modify electronic filing a without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including electronic filing a, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I send electronic filing a for eSignature?

When you're ready to share your electronic filing a, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I fill out electronic filing a on an Android device?

Use the pdfFiller mobile app to complete your electronic filing a on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

Fill out your electronic filing a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.