Get the free GIFT AID DECLARATION - Nicholls Spinal Injury Foundation - nsif org

Show details

GIFT AID DECLARATION Please complete and send by post/ scan and email to: The Nicholls Spinal Injury Foundation, 30 Huston Square, London, NW1 2FB / Charlotte NSF.org.UK Details of Donor: Title: Forename(s):

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your gift aid declaration form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gift aid declaration form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gift aid declaration online

Follow the steps below to benefit from the PDF editor's expertise:

1

Check your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit gift aid declaration. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

How to fill out gift aid declaration

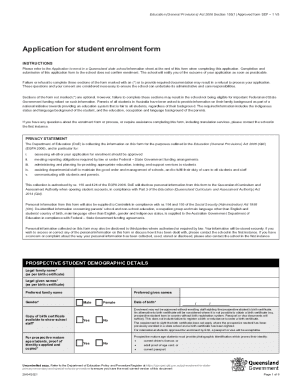

How to Fill Out Gift Aid Declaration:

01

Obtain a gift aid declaration form: Start by obtaining a gift aid declaration form from the organization or charity you wish to support. This form is typically available on their website or can be requested directly from the organization.

02

Provide personal information: Begin filling out the form by providing your personal information, including your full name, address, and contact details. Ensure that all the information is accurate and up to date.

03

Confirm your taxpayer status: Next, indicate your taxpayer status. This is important because charities can only claim gift aid on donations made by UK taxpayers. You will need to confirm whether you are an individual taxpayer, married couple/civil partnership, or a higher rate taxpayer.

04

Declare the source of your donation: Indicate the source of your donation by selecting the appropriate option on the form. You can choose whether your donation is from personal funds, joint funds with a spouse/civil partner, or income from property rental.

05

Make a declaration: Sign and date the gift aid declaration section to confirm that the information provided is accurate. By signing, you are also affirming that you understand the implications of gift aid and that you are eligible for it.

Who Needs Gift Aid Declaration:

01

Individual taxpayers: Any individual who pays income tax or capital gains tax in the UK can fill out a gift aid declaration form. This allows them to authorize charities to claim an additional amount from the government on their donations.

02

Married couples and civil partners: In the case of joint funds, both partners can complete a gift aid declaration to enable charities to claim gift aid on their joint donations. This is particularly beneficial when making joint donations to eligible organizations.

03

Higher rate taxpayers: Higher rate taxpayers who claim additional tax relief can also utilize gift aid donations to reduce their tax liability. The gift aid declaration allows the charity to claim the basic rate tax and the higher rate taxpayer to claim the difference between basic and higher rate tax.

It is important to note that eligibility for gift aid and the specific regulations may vary, so it is recommended to consult with a tax advisor or the charity itself for any specific queries.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send gift aid declaration to be eSigned by others?

When your gift aid declaration is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I edit gift aid declaration on an iOS device?

Create, edit, and share gift aid declaration from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I complete gift aid declaration on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your gift aid declaration from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Fill out your gift aid declaration online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.