Get the free CREDIT APPLICATION AND AGREEMENT

Show details

This document serves as a credit application and agreement for individuals, corporations, and other business types, outlining terms, conditions, and privacy policy.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit application and agreement

Edit your credit application and agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit application and agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit application and agreement online

Follow the steps down below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit credit application and agreement. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

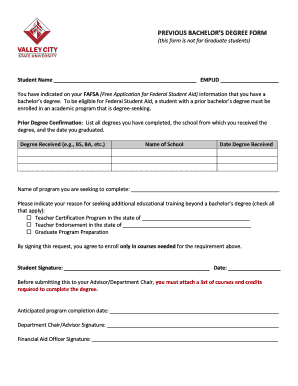

How to fill out credit application and agreement

How to fill out CREDIT APPLICATION AND AGREEMENT

01

Obtain the CREDIT APPLICATION AND AGREEMENT form from the lender or financial institution.

02

Provide personal information, including your name, address, and contact details.

03

Include your Social Security Number or Tax Identification Number.

04

List your employment information, including your current employer's name and your job title.

05

Disclose your income details, including monthly or annual salary.

06

Provide information about your monthly expenses and any existing debts.

07

Review the credit agreement terms, including interest rates and fees.

08

Sign and date the application form to confirm the information is accurate.

09

Submit the completed application to the lender for processing.

Who needs CREDIT APPLICATION AND AGREEMENT?

01

Individuals seeking to apply for credit, such as loans or credit cards.

02

Small business owners looking for financing options.

03

Anyone planning to make a large purchase that requires financing, like a car or home.

04

People looking to establish or improve their credit history.

Fill

form

: Try Risk Free

People Also Ask about

What is a credit agreement?

Changed: This means that something has changed on your electoral roll record. Credit agreement. What does this mean? Added: This could mean that you've recently opened a new account, or it might be because a lender has just shared some information relating to an old account.

Can I pay off a credit agreement early?

You have the right to cancel a credit agreement if it's covered by the Consumer Credit Act 1974. You're allowed to cancel within 14 days - this is often called a 'cooling off' period.

How do I write a credit application?

However, the following are some general items that should be included. Full Contact Details. It is important that you obtain full details of your customers. Background information. Obtain as much information about the company as you can. Business and Bank References. Other information.

What does it mean when a credit agreement is being added to your report?

When you pay off a credit agreement early, under the Consumer Credit Act the total amount you pay is reduced. If you're still within 14 days of signing the credit agreement, find out how to cancel a credit agreement instead. If you have any other debts work out which debts to deal with first.

How do you write a credit agreement?

The Lender agrees to loan (total amount of the credit) to the Borrower. The Borrower agrees to repay the total amount in full before , along with any interest incurred on the unpaid monies at the rate of _% per year, beginning on (date).

Is a credit application a legal document?

Once signed, the credit application is legally binding, including all terms and conditions outlined within the agreement.

What is the meaning of credit agreement?

A credit agreement is a legally binding contract between you and a lender that spells out the terms of your loan. It includes fees and interest rates, payment schedule and monthly due dates and consequences of late payments and default.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CREDIT APPLICATION AND AGREEMENT?

A CREDIT APPLICATION AND AGREEMENT is a document that a borrower completes to request a loan or credit. It outlines the terms and conditions under which credit is granted.

Who is required to file CREDIT APPLICATION AND AGREEMENT?

Individuals or businesses seeking credit or loans from financial institutions or lenders need to file a CREDIT APPLICATION AND AGREEMENT.

How to fill out CREDIT APPLICATION AND AGREEMENT?

To fill out a CREDIT APPLICATION AND AGREEMENT, applicants need to provide personal and financial information, including income, expenses, and details about the credit being sought. All sections of the application must be completed accurately.

What is the purpose of CREDIT APPLICATION AND AGREEMENT?

The purpose of a CREDIT APPLICATION AND AGREEMENT is to assess the creditworthiness of the applicant and to set forth the terms of the credit or loan being provided.

What information must be reported on CREDIT APPLICATION AND AGREEMENT?

Information required typically includes the applicant's name, address, Social Security number, employment details, income, existing debts, and the amount of credit requested.

Fill out your credit application and agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Application And Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.