Get the free Authorization To Obtain Credit Report I hereby authorize Premier Home Brokers, Inc

Show details

Authorization To Obtain Credit Report I hereby authorize Premier Home Brokers, Inc. and/or their employee(s) to obtain my credit report electronically from one or more credit bureaus for the purpose

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

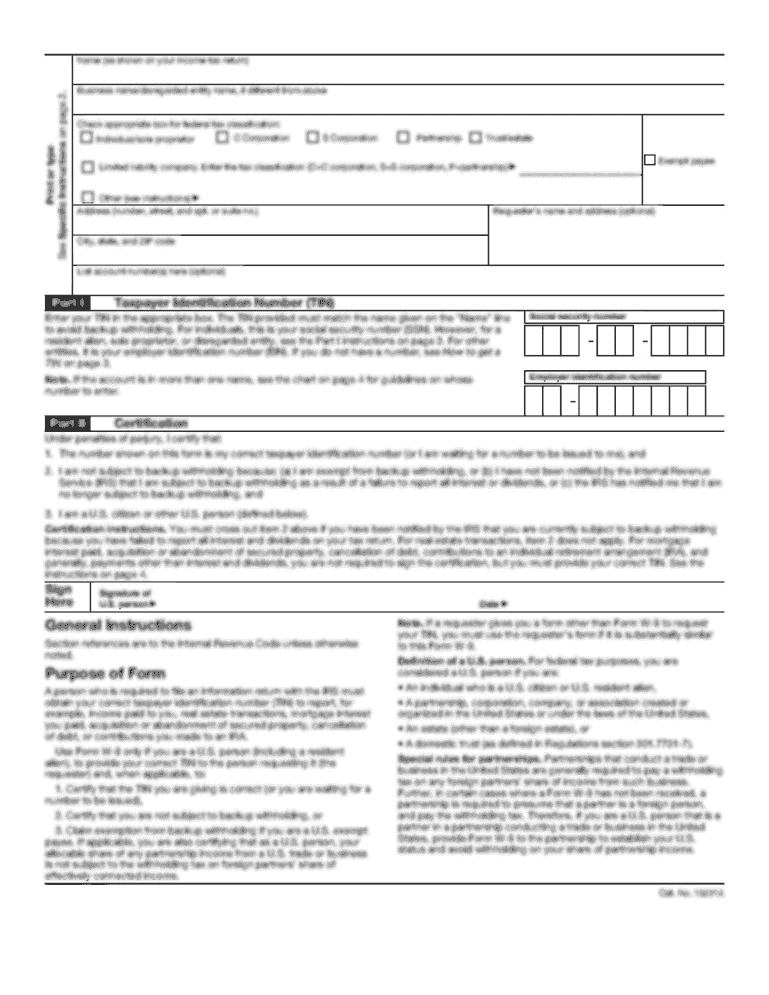

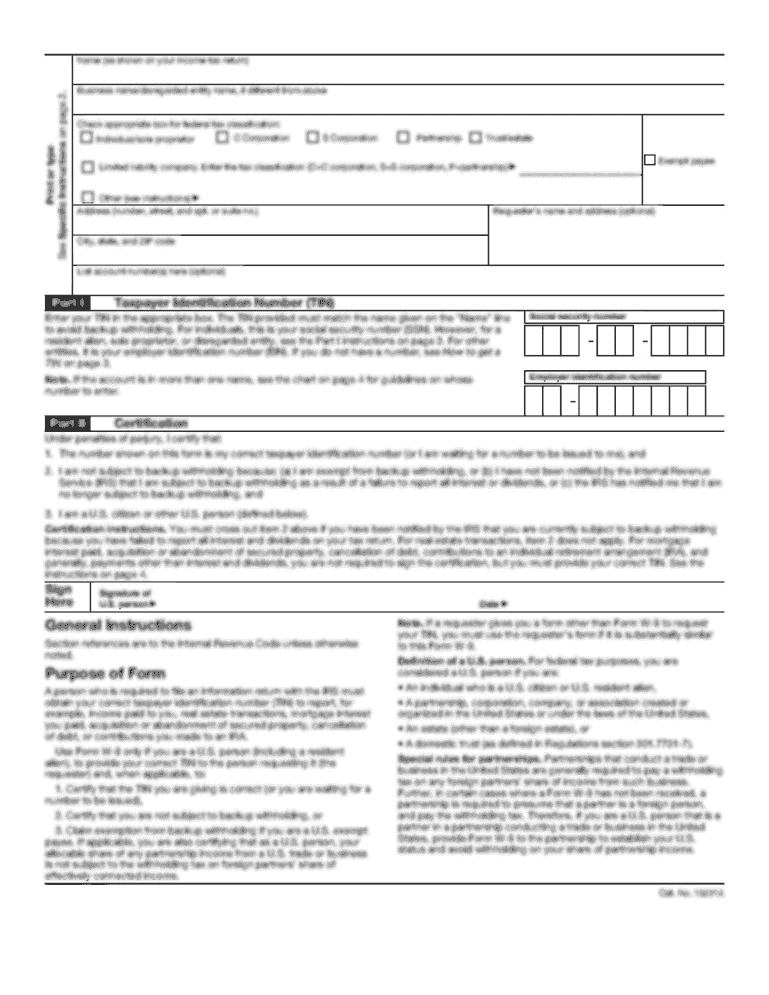

Edit your authorization to obtain credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your authorization to obtain credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing authorization to obtain credit online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit authorization to obtain credit. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

How to fill out authorization to obtain credit

How to fill out authorization to obtain credit?

01

Start by obtaining the authorization form from the relevant financial institution or lender. You can usually find this form on their website or by visiting a branch.

02

Carefully read through the authorization form to understand the requirements and instructions. Make sure you understand what information you need to provide and what your responsibilities are.

03

Begin by filling out your personal information, such as your full name, address, date of birth, and social security number. This information is crucial for the lender to accurately identify you and process your credit application.

04

Next, provide details about your employment, including your current employer's name, address, and contact information. You may also need to disclose your job position, salary, and length of employment.

05

If applicable, include information regarding additional sources of income, such as investments, rental properties, or spousal support. This will help the lender assess your overall financial situation and determine your creditworthiness.

06

Include details about your assets and liabilities. This can include information about your savings accounts, investments, real estate properties, debts, loans, and credit card balances. The lender may request this information to evaluate your ability to handle additional credit.

07

Review the form thoroughly before submitting it. Ensure that all the information provided is accurate and up-to-date. Double-check for any spelling mistakes or missing information that could delay or affect the credit application process.

Who needs authorization to obtain credit?

01

Individuals who want to apply for credit from a financial institution or lender typically need authorization. This includes individuals looking for personal loans, credit cards, mortgages, or other forms of credit.

02

In some cases, a co-signer or guarantor may be required to provide authorization as well. This is often the case for individuals with limited credit history or those who do not meet the lender's requirements on their own.

03

Depending on the jurisdiction, individuals under a certain age or without legal capacity may require a guardian or parent to provide authorization on their behalf.

04

Authorization may also be necessary for businesses or organizations seeking credit, as they need to provide information about their financial standing and ability to repay the loan.

Remember, it is vital to understand and comply with the specific requirements of the financial institution or lender you are dealing with. These instructions and requirements can vary, so always consult the provided documentation or seek assistance from the lender if you have any questions or concerns.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the authorization to obtain credit in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your authorization to obtain credit and you'll be done in minutes.

Can I create an eSignature for the authorization to obtain credit in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your authorization to obtain credit and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I fill out the authorization to obtain credit form on my smartphone?

Use the pdfFiller mobile app to fill out and sign authorization to obtain credit. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Fill out your authorization to obtain credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.