Get the free Nationwide Life Insurance Company Actuarial Rate Submission - disb dc

Show details

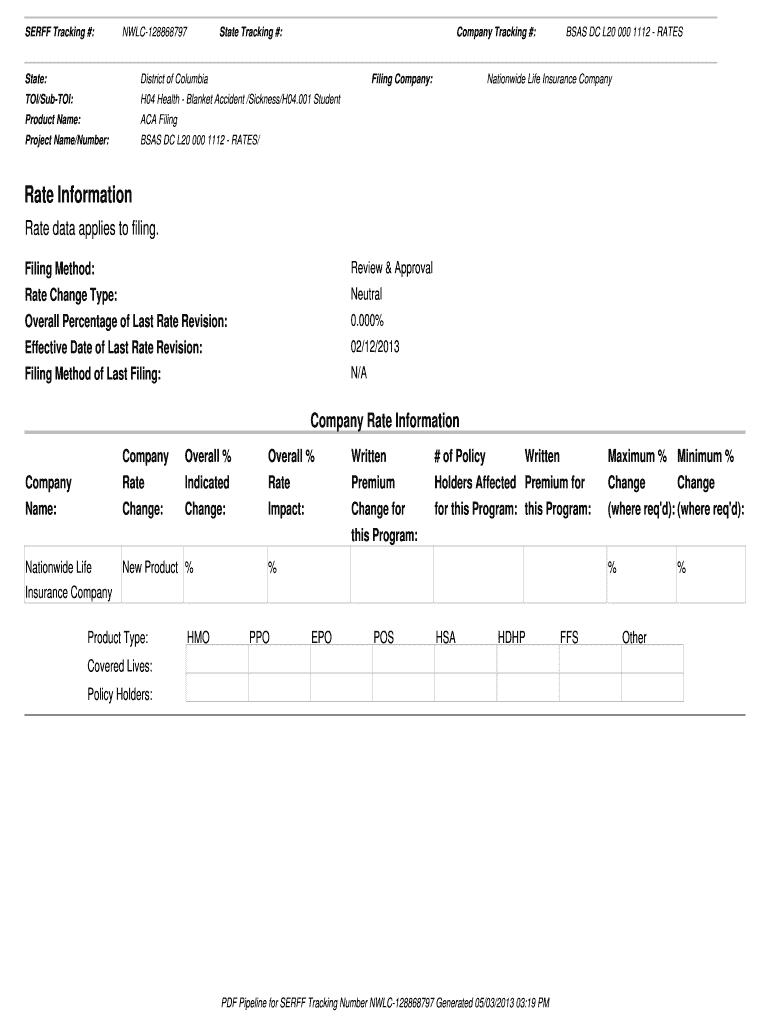

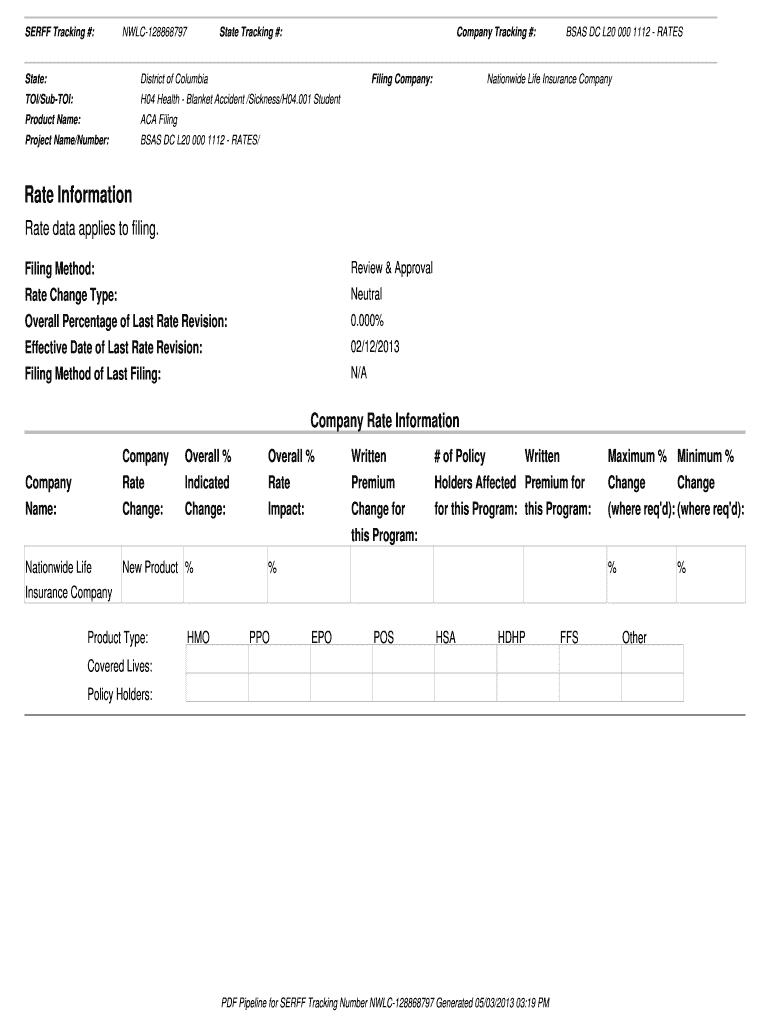

This document provides detailed information regarding the proposed rates and supporting information related to a new blanket student accident and sickness policy being filed by Nationwide Life Insurance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nationwide life insurance company

Edit your nationwide life insurance company form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nationwide life insurance company form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nationwide life insurance company online

Follow the steps below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit nationwide life insurance company. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nationwide life insurance company

How to fill out Nationwide Life Insurance Company Actuarial Rate Submission

01

Gather all relevant data needed for the submission, including policyholder information, premium rates, and claims history.

02

Review the specific guidelines provided by the Nationwide Life Insurance Company for the actuarial rate submission.

03

Complete the required forms accurately, ensuring all fields are filled in and calculations are checked for accuracy.

04

Include any supporting documentation, such as actuarial reports or statistical analyses, to justify the proposed rates.

05

Verify that all information complies with regulatory and compliance standards set forth by the governing bodies.

06

Submit the completed rate submission package through the designated channels, whether online or via mailed documents.

07

Follow up with Nationwide Life Insurance Company to confirm receipt and inquire about next steps in the review process.

Who needs Nationwide Life Insurance Company Actuarial Rate Submission?

01

Insurance companies looking to adjust their premium rates or risk assessment models.

02

Actuaries and financial analysts responsible for developing and submitting rate proposals.

03

Regulatory bodies monitoring the business practices of insurance providers.

04

Policyholders interested in understanding the factors influencing their premium rates.

Fill

form

: Try Risk Free

People Also Ask about

Are Allied and Nationwide the same company?

Company Information Nationwide Life Insurance Company is an affiliated company of Nationwide Mutual. The company offers life insurance and a range of individual annuity products, including deferred variable annuities, deferred fixed annuities, and immediate annuities.

Who is the underwriter for Nationwide Insurance?

Nationwide Home Insurance is underwritten and administered by Royal & Sun Alliance Insurance Ltd (No. 93792). How can we help you?

Who underwrites Nationwide life insurance?

Nationwide life insurance and critical illness cover is provided by Legal & General UK. It's possible to get a quote and apply for a policy online or through a Nationwide financial advisor, depending on your needs and circumstances.

Who owns Nationwide life insurance?

ALLIED Mutual Automobile Association was founded in 1929 by Harold Evans. In 1998, Allied merged with Nationwide Mutual Insurance Company, a Fortune 500 company based in Columbus, OH. Nationwide is one of the country's most extensive diversified insurance and financial services organizations.

How is Nationwide life insurance rated?

Apply for a life policy or request a quote To apply for a new life policy or request a quote, you can speak to a life insurance specialist 1-866-207-9160.

Is Nationwide insurance laying off employees?

And casualty workforce will be eliminated in a statement to TentTV. The company says quote "This isMoreAnd casualty workforce will be eliminated in a statement to TentTV. The company says quote "This is due to a variety of factors. Including associates voluntarily moving to other roles.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Nationwide Life Insurance Company Actuarial Rate Submission?

The Nationwide Life Insurance Company Actuarial Rate Submission is a formal request submitted by the insurance company to regulatory authorities, detailing the proposed actuarial rates for various insurance products they offer.

Who is required to file Nationwide Life Insurance Company Actuarial Rate Submission?

Insurance companies that offer life insurance products are required to file the Nationwide Life Insurance Company Actuarial Rate Submission to ensure compliance with regulatory standards.

How to fill out Nationwide Life Insurance Company Actuarial Rate Submission?

To fill out the Nationwide Life Insurance Company Actuarial Rate Submission, an actuarial professional must provide necessary data regarding assumptions, methodologies, rating factors, and projected financials relevant to the insurance products.

What is the purpose of Nationwide Life Insurance Company Actuarial Rate Submission?

The purpose of the Nationwide Life Insurance Company Actuarial Rate Submission is to ensure that the proposed rates are adequate, not discriminatory, and aligned with the risk and cost structure of the insurance products offered.

What information must be reported on Nationwide Life Insurance Company Actuarial Rate Submission?

Information that must be reported includes actuarial assumptions, rate development methodologies, loss experience, expense analyses, and any relevant data that underpins the proposed actuarial rates.

Fill out your nationwide life insurance company online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nationwide Life Insurance Company is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.