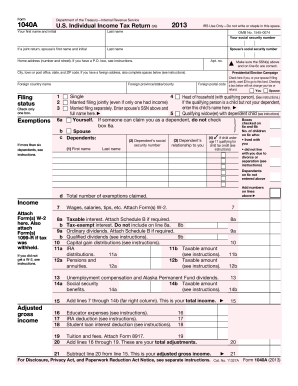

Get the free 1040a 2013 form

Show details

Form 8554-EP (Rev. April 2012) Department of the Treasury Internal Revenue Service Application for Renewal of Enrollment to Practice Before the Internal Revenue Service as an Enrolled Retirement Plan

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 1040a 2013 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1040a 2013 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 1040a 2013 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 2013 1040a form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

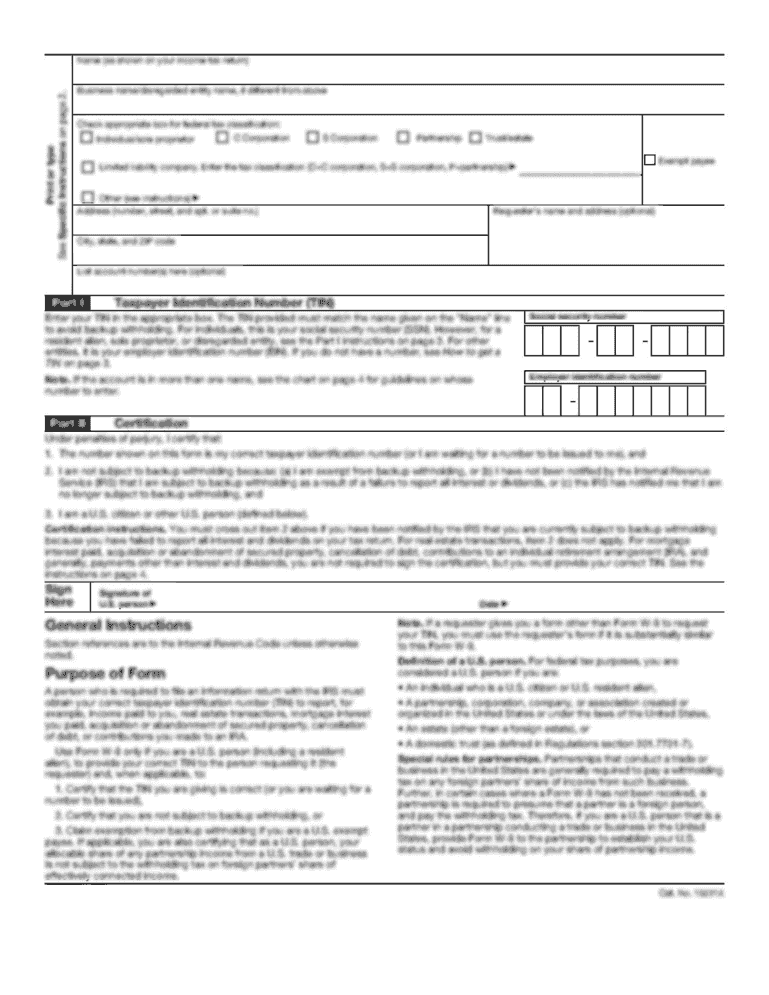

How to fill out 1040a 2013 form

How to fill out 1040a 2013?

01

Gather all necessary documents: Before filling out the 1040a form for the year 2013, make sure you have all the required documents such as your W-2 forms, 1099 forms, and any other income or deduction records.

02

Provide personal information: Start by entering your name, social security number, and filing status on the top of the form. This information helps the IRS identify and process your tax return correctly.

03

Report your income: Move on to the income section of the form and enter all your income sources for the year 2013. This may include wages, interest earned, dividends, and any other taxable income. Make sure to accurately report each income source and carefully follow the instructions provided on the form.

04

Claim deductions: If you qualify for any deductions, check the appropriate boxes on the form and enter the amounts as instructed. Deductions can include student loan interest, IRA contributions, and certain education expenses. Review the instructions and eligibility requirements to ensure you are claiming the correct deductions.

05

Calculate your tax liability: Once all your income and deductions are reported, follow the instructions on the form to calculate your tax liability. The 1040a form provides a tax table that you can use to determine the amount of tax you owe based on your income and filing status. Take your time to accurately calculate your tax and double-check your math to avoid errors.

06

Claim tax credits: If you are eligible for any tax credits, enter them in the designated section of the form. Common tax credits include the child tax credit, education credits, and the earned income credit. Make sure to provide all necessary information and attach any required schedules or forms.

07

Sign and submit the form: After completing all the sections of the 1040a form, sign and date it before sending it to the IRS. If you are filing electronically, follow the instructions provided by your chosen method of e-filing. If you are mailing a paper copy, make sure to include any other required documents and keep a copy for your records.

Who needs 1040a 2013?

01

Individuals with simple tax situations: The 1040a form for the year 2013 is specifically designed for individuals whose tax situations are relatively straightforward. It is ideal for those who do not have significant investments or complex deductions.

02

Those earning below a certain income threshold: The 1040a form is generally suitable for individuals with a taxable income below $100,000. This form allows for various adjustments and specific tax credits, making it a good option for individuals in lower income brackets.

03

Individuals who do not need itemized deductions: Unlike the 1040 form, the 1040a form does not require itemizing deductions. This simplifies the tax filing process for those who do not have substantial itemized deductions to claim.

Overall, the 1040a form is suitable for individuals with less complicated tax situations, lower incomes, and a preference for a simpler tax form.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 1040a?

1040a is a simplified tax form used by individuals with certain tax situations to file their federal income tax returns.

Who is required to file 1040a?

Individuals who have a taxable income of less than $100,000, no dependents, and who meet certain other criteria are eligible to file 1040a.

How to fill out 1040a?

To fill out 1040a, you need to gather your income statements, such as W-2s, and any applicable deductions. Then, follow the instructions provided on the form to enter the required information, calculate your tax liability, and sign the form before mailing it to the IRS.

What is the purpose of 1040a?

The purpose of 1040a is to provide a simplified tax form for individuals with relatively straightforward tax situations, helping them report their income, claim deductions, and calculate their tax liability accurately.

What information must be reported on 1040a?

On 1040a, you must report your income from various sources, such as wages, salaries, or dividends, and may need to include information on certain deductions, tax credits, and exemptions based on your eligibility.

When is the deadline to file 1040a in 2023?

The deadline to file 1040a in 2023 is typically April 15th, unless it falls on a weekend or holiday. In that case, the deadline would be the next business day.

What is the penalty for the late filing of 1040a?

The penalty for late filing of 1040a can vary depending on factors such as the amount of tax owed and the duration of the delay. It is generally calculated as a percentage of unpaid taxes per month, starting from the original due date of the return.

How do I edit 1040a 2013 online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your 2013 1040a form to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit form 1040a 2013 straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit 1040a 2013.

How do I edit 2013 1040a form on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign form 1040a 2013 right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Fill out your 1040a 2013 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 1040a 2013 is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.