Get the free Cash Reserve Account Agreement and Disclosure Statement

Show details

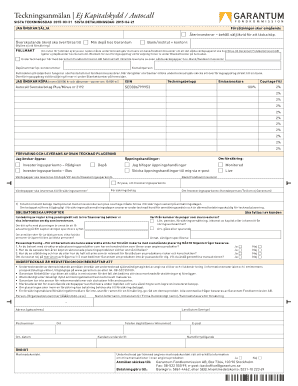

This document outlines the terms and conditions, interest rates, fees, payment procedures, and rights pertaining to the Cash Reserve Account offered by MUFG Union Bank, N.A.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cash reserve account agreement

Edit your cash reserve account agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cash reserve account agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cash reserve account agreement online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit cash reserve account agreement. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cash reserve account agreement

How to fill out Cash Reserve Account Agreement and Disclosure Statement

01

Begin by reading the Cash Reserve Account Agreement carefully to understand its terms.

02

Provide personal information such as your name, address, and Social Security number in the designated sections.

03

Review the eligibility requirements to ensure you qualify for the account.

04

Fill out the account funding options, indicating how you plan to deposit funds into your Cash Reserve Account.

05

Review and check any boxes regarding the services and features you wish to include.

06

Sign and date the agreement at the end to acknowledge your acceptance of the terms.

Who needs Cash Reserve Account Agreement and Disclosure Statement?

01

Individuals looking for a financial safety net for unexpected expenses.

02

Customers of banks or financial institutions offering cash reserve accounts.

03

Those wanting to manage cash flow and access funds quickly without high-interest loans.

Fill

form

: Try Risk Free

People Also Ask about

What does account agreement mean?

An account agreement is a legal agreement between a bank and a borrower outlining the terms and conditions of the bank acting as a securities intermediary. The bank maintains the securities and deposits of the borrower during the course of the agreement.

What is the purpose of a cash account?

A cash account is a type of brokerage account in which the investor must pay the full amount for securities purchased. An investor using a cash account is not allowed to borrow funds from his or her broker-dealer in order to pay for transactions in the account (trading on margin).

What is a cash account agreement?

Cash Account Agreement means the Cash Account Agreement delivered by each Company in favor of the Agent relating to the cash collateralization of the L/C Obligations and Interim Note Obligations, as the same may be amended or otherwise modified from time to time.

What are the downsides of a cash account?

The major drawback of cash accounts is the limit on profit opportunities. Borrowing to buy shares increases leverage, which can significantly boost returns.

Does Bank of America accept cash deposit into someone else's account?

Cash Reserve is available for you to select through your brokerage account by indicating your election to Betterment, while Betterment Securities utilizes the Transfer Sweep Program to automatically deposit, or “sweep,” your funds into deposit accounts pending the investment of those funds into securities or other

What is a cash management agreement?

A cash management agreement is a contract between a bank and its customer used to manage the customer's funds. This agreement can include providing liquidity, asset-liability matching, or other services. A cash management agreement often includes maintaining certain balances with the bank and meeting financial ratios.

How does a cash reserve account work?

Cash reserves are the money a company or individual keeps on hand to meet short-term and emergency funding needs. For instance, organizations, banks, and individuals can draw on money market funds or Treasury Bills to meet emergency needs or provide short-term financing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Cash Reserve Account Agreement and Disclosure Statement?

The Cash Reserve Account Agreement and Disclosure Statement is a financial document that outlines the terms and conditions related to a cash reserve account, including fees, interest rates, and withdrawal policies.

Who is required to file Cash Reserve Account Agreement and Disclosure Statement?

Individuals or businesses opening a cash reserve account are typically required to file the Cash Reserve Account Agreement and Disclosure Statement as part of the account setup process.

How to fill out Cash Reserve Account Agreement and Disclosure Statement?

To fill out the Cash Reserve Account Agreement and Disclosure Statement, one must provide personal or business information, details about the account type, and agree to the terms outlined in the document.

What is the purpose of Cash Reserve Account Agreement and Disclosure Statement?

The purpose of the Cash Reserve Account Agreement and Disclosure Statement is to inform account holders of their rights and obligations, ensure transparency regarding fees and terms, and provide legal protection for both the financial institution and the account holder.

What information must be reported on Cash Reserve Account Agreement and Disclosure Statement?

The information that must be reported includes account holder's personal or business information, account type, interest rates, fees, withdrawal limits, and other important terms regarding the cash reserve account.

Fill out your cash reserve account agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cash Reserve Account Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.