Get the free Information about Schedule O (Form 990 or 990 -EZ) and its instructions is at www - ...

Show details

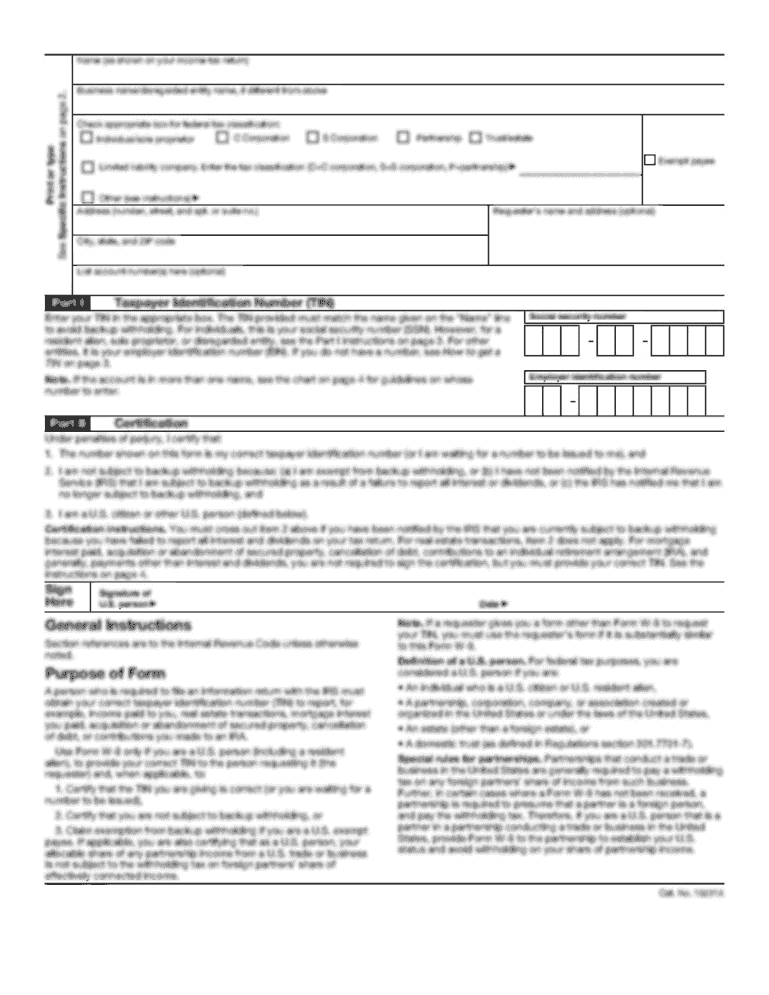

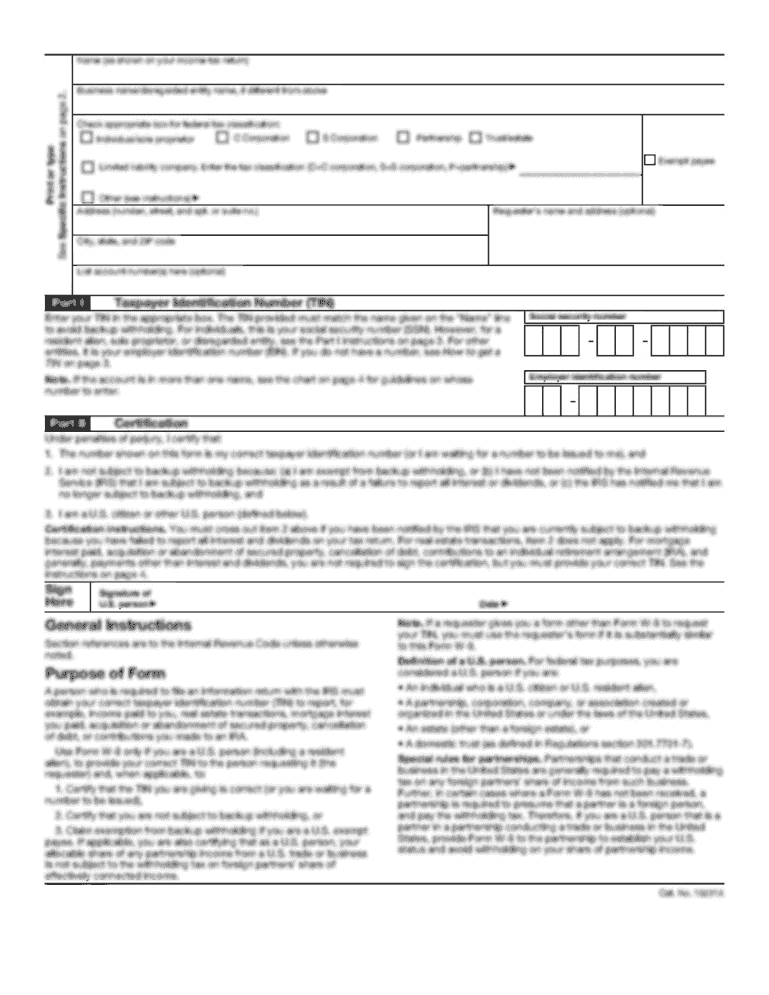

Supplemental Information to Form 990 or 990-EZ SCHEDULE O (Form 990 or 990-EZ) Department of the Treasury Internal Revenue Service OMB No. 1545-0047 Complete to provide information for responses to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your information about schedule o form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your information about schedule o form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing information about schedule o online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit information about schedule o. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

How to fill out information about schedule o

How to fill out information about Schedule O:

01

Start by gathering all the necessary documents and information related to your financial activities, such as income statements, deductions, and investments.

02

Review the Schedule O form carefully to understand the specific sections and requirements. Familiarize yourself with the instructions provided by the tax authority to ensure accurate completion.

03

Begin filling out the required fields on the Schedule O form, starting with your personal information such as your name, social security number, and address.

04

Proceed to provide details about your financial activities, including your income from various sources like salaries, investments, freelancing, or rental properties. Remember to report any adjustments or deductions that apply to you.

05

Be diligent in accurately reporting any tax credits, refunds, or payments you have received or made throughout the tax year. This includes any estimated tax payments or excessive withholding.

06

If applicable, answer any additional questions related to the particular tax situation or deductions you are claiming. Ensure that you provide supporting documentation where necessary.

07

Review the completed Schedule O form meticulously for any errors or inconsistencies. Double-check that all the information provided is correct and consistent with the related tax return.

08

Once you are confident that everything is accurate and complete, sign and date the Schedule O form before submitting it alongside your tax return.

Who needs information about Schedule O?

01

Individuals who have complex financial activities such as multiple sources of income, significant deductions, or extensive investments may need information about Schedule O.

02

Taxpayers who want to accurately report their financial information, ensuring compliance with tax laws and maximizing eligible tax credits or deductions, can benefit from understanding Schedule O.

03

Anyone who has received a request or notification from the tax authority to complete Schedule O as part of their tax return filing process will need information about this form.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in information about schedule o?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your information about schedule o and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I sign the information about schedule o electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your information about schedule o in minutes.

How do I edit information about schedule o on an Android device?

The pdfFiller app for Android allows you to edit PDF files like information about schedule o. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your information about schedule o online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.