Get the free CHAPTER 2 DISADVANTAGED BUSINESS ENTERPRISES Table of Contents - dot state fl

Show details

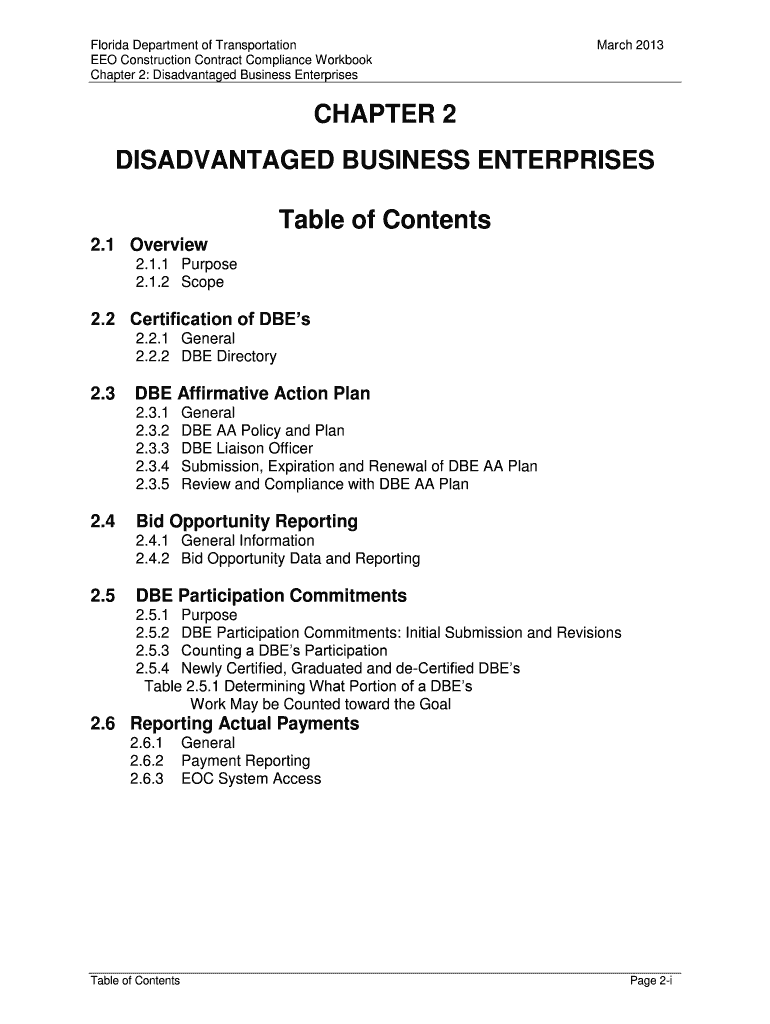

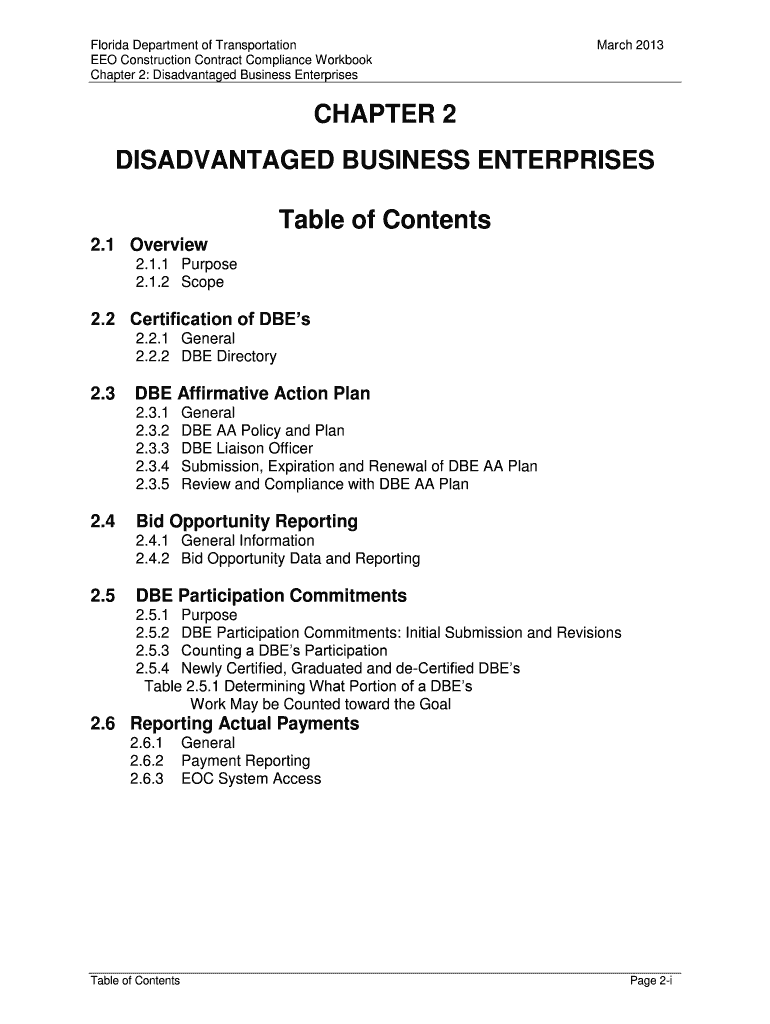

Florida Department of Transportation EEO Construction Contract Compliance Workbook Chapter 2: Disadvantaged Business Enterprises March 2013 CHAPTER 2 DISADVANTAGED BUSINESS ENTERPRISES Table of Contents

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign chapter 2 disadvantaged business

Edit your chapter 2 disadvantaged business form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your chapter 2 disadvantaged business form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing chapter 2 disadvantaged business online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit chapter 2 disadvantaged business. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out chapter 2 disadvantaged business

How to fill out chapter 2 disadvantaged business:

01

Start by gathering all the necessary information and documentation required for the application. This may include your business entity documents, ownership and control information, financial statements, tax returns, and any other relevant records.

02

Familiarize yourself with the requirements and guidelines outlined in Chapter 2 of the disadvantaged business program. This chapter typically provides instructions on eligibility criteria, certification requirements, and the application process. Read through the chapter thoroughly to ensure you fully understand the expectations.

03

Complete the application form provided by the disadvantaged business program. This form will likely ask for detailed information about your business, such as its legal name, address, contact information, and ownership details. Make sure to provide accurate and truthful information during this step.

04

Pay attention to any supporting documents that may be required as part of the application. These could include copies of your business licenses, certifications, or other evidence of your disadvantaged status. Ensure that all documents are properly attested and up to date.

05

Double-check your application for any errors or missing information. It's crucial to review your submission thoroughly to ensure that all required fields are completed and all supporting documentation is attached. Mistakes or omissions may result in delays or rejection of your application.

Who needs chapter 2 disadvantaged business?

01

Small businesses owned and controlled by individuals who are socially and economically disadvantaged may need to utilize chapter 2 of the disadvantaged business program. This program is designed to provide opportunities for these individuals to compete in the marketplace on a level playing field.

02

Those who seek to participate in government contracts or procurements, especially those that have specific requirements or preferences for businesses owned by disadvantaged individuals, would benefit from understanding and complying with chapter 2 of the disadvantaged business program.

03

Individuals or businesses aiming to access resources, support, and opportunities available exclusively or primarily to disadvantaged businesses would need to be aware of chapter 2 and its provisions.

The chapter serves as a guide and resource for businesses to understand the eligibility criteria, certification requirements, and application process necessary to leverage the benefits offered to disadvantaged businesses.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send chapter 2 disadvantaged business to be eSigned by others?

Once you are ready to share your chapter 2 disadvantaged business, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Where do I find chapter 2 disadvantaged business?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the chapter 2 disadvantaged business in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I create an electronic signature for signing my chapter 2 disadvantaged business in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your chapter 2 disadvantaged business and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is chapter 2 disadvantaged business?

Chapter 2 disadvantaged business refers to a section of government regulations that provide opportunities for businesses owned by individuals who are economically or socially disadvantaged.

Who is required to file chapter 2 disadvantaged business?

Businesses that meet the criteria for being classified as disadvantaged, as determined by government guidelines, are required to file chapter 2 disadvantaged business.

How to fill out chapter 2 disadvantaged business?

To fill out chapter 2 disadvantaged business, businesses must provide information about the ownership and disadvantaged status of the business owners, as well as details about the company's operations and revenue.

What is the purpose of chapter 2 disadvantaged business?

The purpose of chapter 2 disadvantaged business is to promote economic opportunities for individuals who have historically faced barriers to business ownership and success.

What information must be reported on chapter 2 disadvantaged business?

Businesses must report information about the ownership structure of the company, the economic and social disadvantage status of the owners, and details about the company's operations and revenue.

Fill out your chapter 2 disadvantaged business online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Chapter 2 Disadvantaged Business is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.