Get the free Local, State, and Federal Resources Reference Guide (PDF) - stetson

Show details

ELDER CONSUMER PROTECTION PROGRAM

RESOURCE CONTACT LIST

Lawyer Referral Services: To help you find an Attorney.

Legal Aid Services: Offering Free or Reduced Price legal representation to qualifying

We are not affiliated with any brand or entity on this form

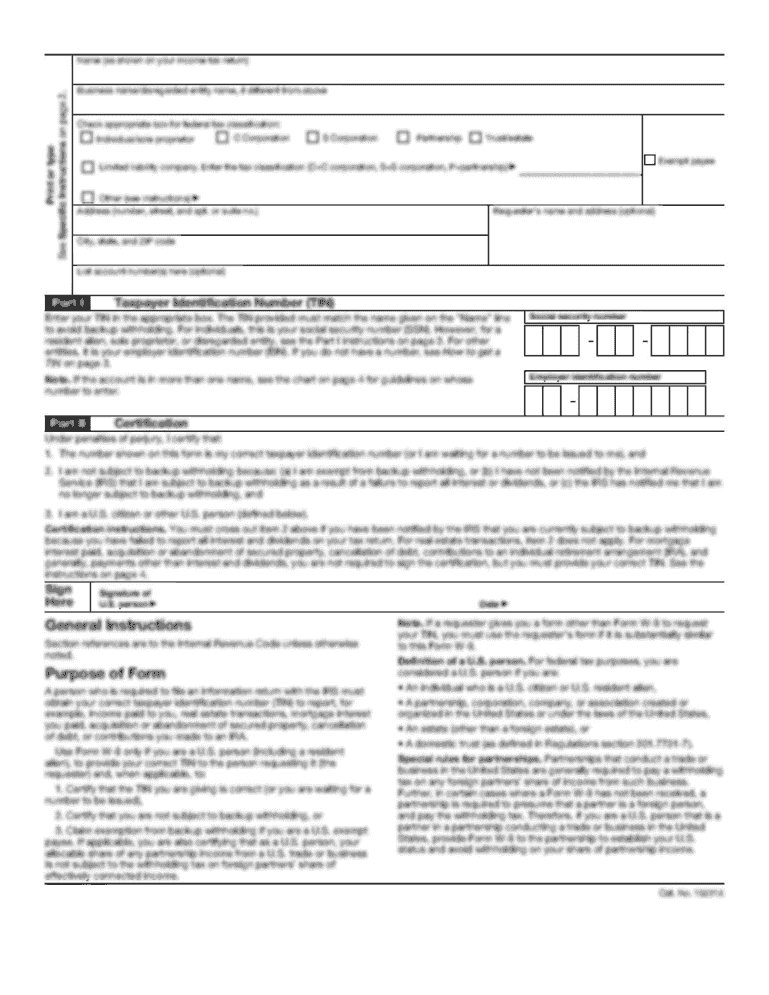

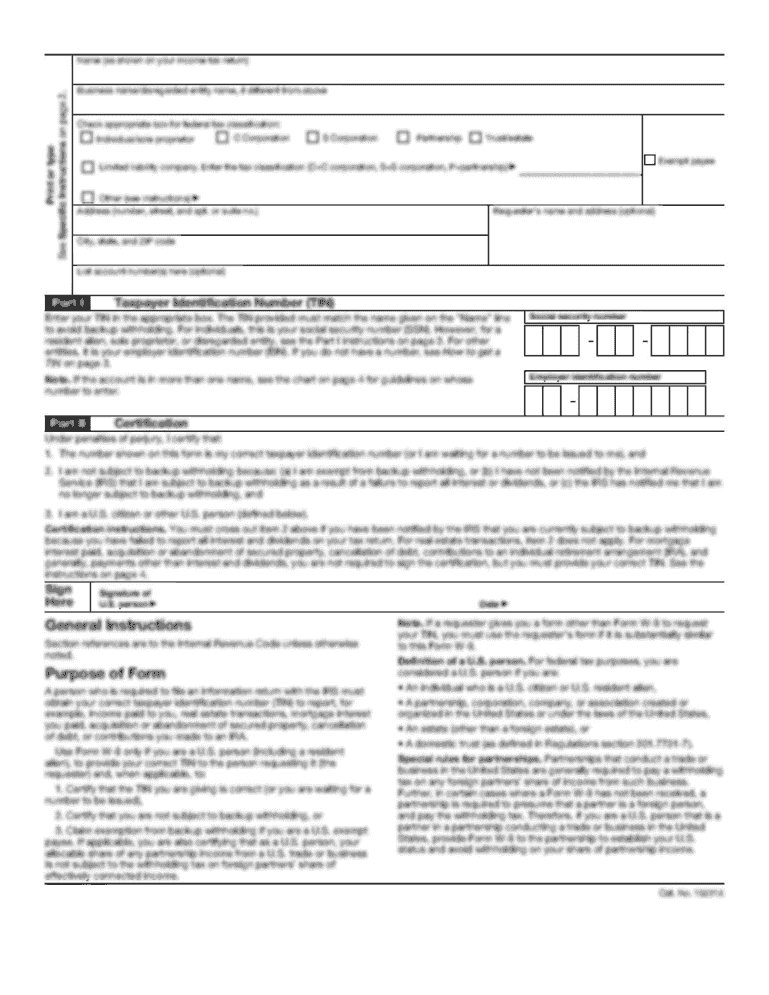

Get, Create, Make and Sign

Edit your local state and federal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your local state and federal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing local state and federal online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit local state and federal. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

How to fill out local state and federal

How to fill out local state and federal?

01

Start by gathering the necessary forms and documents. Research the specific requirements for your local, state, and federal taxes to ensure you have all the necessary paperwork.

02

Begin with the local tax forms. Most cities or counties have their own tax forms that need to be filled out. These forms typically require information about your income, property, and any local taxes you may owe.

03

Move on to the state tax forms. Each state has its own tax laws and requirements, so make sure you are using the correct forms for your state. State tax forms usually require information about your income, deductions, and any credits you may be eligible for.

04

Finally, fill out the federal tax forms. The IRS provides various forms depending on your filing status and income level. The federal tax forms typically require information related to your income, deductions, credits, and any additional schedules or forms that may be applicable.

Who needs local state and federal?

01

Individuals: All individuals who have income, property, or other taxable assets are required to fill out local state and federal tax forms. This includes both employed and self-employed individuals.

02

Businesses: All businesses, regardless of their size or structure, must comply with local, state, and federal tax laws. Business entities have additional forms and requirements to consider, such as employer taxes and withholding obligations.

03

Non-profit organizations: Even non-profit organizations are not exempt from tax obligations. They may have different forms and requirements depending on their tax-exempt status, but it is vital for them to fulfill their local state and federal tax obligations.

Remember, it is essential to consult with a tax professional or use tax software to guide you through the specific requirements of filling out local state and federal tax forms.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is local state and federal?

Local state refers to laws and regulations that apply to a specific city or region, state refers to laws and regulations that apply to the entire state, and federal refers to laws and regulations that apply to the entire country.

Who is required to file local state and federal?

Anyone who earns income or conducts business within a particular city, state, or country may be required to file local state and federal taxes.

How to fill out local state and federal?

To fill out local state and federal taxes, individuals and businesses must gather all relevant financial information, complete the necessary forms, and submit them to the appropriate tax authorities.

What is the purpose of local state and federal?

The purpose of local state and federal taxes is to fund public services and infrastructure, such as schools, roads, and public safety, as well as to regulate certain activities and industries.

What information must be reported on local state and federal?

Taxpayers may be required to report various types of income, expenses, deductions, credits, and other financial information on their local state and federal tax returns.

When is the deadline to file local state and federal in 2023?

The deadline to file local state and federal taxes in 2023 will depend on the specific tax year and jurisdiction, but typically falls on April 15th for federal taxes and varies for state and local taxes.

What is the penalty for the late filing of local state and federal?

Penalties for late filing of local state and federal taxes may vary depending on the jurisdiction and circumstances, but common penalties include fines, interest charges, and possible legal action.

How do I edit local state and federal online?

With pdfFiller, it's easy to make changes. Open your local state and federal in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I edit local state and federal straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing local state and federal right away.

How do I complete local state and federal on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your local state and federal. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your local state and federal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.