Farm Income and Expense Worksheet 2015-2025 free printable template

Show details

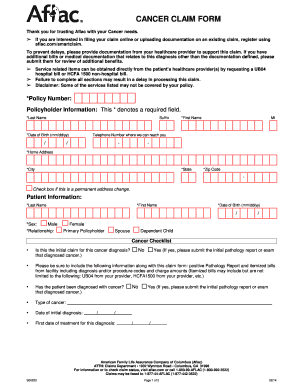

FARM INCOME AND EXPENSE WORKSHEET NAME ID# PRINCIPAL ACTIVITY PRODUCT METHOD OF ACCOUNTING (Cash or Accrual) FARM INCOME Sale of livestock and other items purchased for resale (Do Not Include Animals

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign printable farm expense spreadsheet form

Edit your farm income and expense spreadsheet download form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your farm income and expense worksheet xls form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing farm income and expense worksheet pdf online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit farm expense spreadsheet excel template pdf form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out farm expense spreadsheet form

How to fill out Farm Income and Expense Worksheet

01

Begin by gathering all relevant financial documents, including receipts and invoices related to farming activities.

02

On the worksheet, start with the income section. List all sources of farm income, such as crop sales, livestock sales, and government payments.

03

For each income source, provide the corresponding amounts in the designated columns.

04

Next, move to the expense section. Categorize your farm expenses, such as seed costs, equipment maintenance, and labor expenses.

05

Record each expense in the appropriate category and provide total amounts.

06

Ensure that all totals are calculated correctly by reviewing your entries.

07

Finally, review the worksheet for accuracy and completeness before submission.

Who needs Farm Income and Expense Worksheet?

01

Farmers and agricultural producers who need to track their income and expenses for tax purposes.

02

Individuals applying for loans or grants that require detailed financial information about their farming operations.

03

Businesses involved in agriculture that need to analyze their financial performance.

Fill

farm expense sheet

: Try Risk Free

People Also Ask about farm accounting spreadsheet

What is the farm income Schedule F Form 4835?

Landowners and sub-lessors that do not materially participate in the operation or management of the farm (for self-employment tax purposes), file this form to report farm rental income based on crops or livestock produced by the tenant.

What is the difference between Schedule F and 4835?

On an individual Form 1040, farm activity is reported either on a Schedule F or a Form 4835. A Schedule F is where active farmers report, and Form 4835 is for inactive farm landlords. What makes someone an active farmer vs.

What is the IRS form for farm expenses?

Use Schedule F (Form 1040) to report farm income and expenses. File it with Form 1040, 1040-SR, 1040-NR, 1041, or 1065. Your farming activity may subject you to state and local taxes and other requirements such as business licenses and fees.

Should I file Schedule F or 4835?

If you are involved in Renting a Farm or Farmland, you should report the income and expenses related to that activity on Form 4835, Farm Rental Income and Expense. However, if you are in the trade or business of farming, you must complete and file Schedule F, Profit or Loss from Farming, along with your IRS Form 1040.

Is Form 4835 the same as Schedule F?

Qualification for Form 4835 If you're a traditional farmer who raises crops or livestock, you're considered a self-employed business person and you would file using Schedule F, Profit or Loss From Farming.

What is Form 4835 used for?

If you were the landowner (or sub-lessor) and did not materially participate (for self-employment tax purposes) in the operation or management of the farm, use Form 4835 to report farm rental income based on crops or livestock produced by the tenant.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find farm bookkeeping spreadsheet?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific farm income and expense worksheet and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I complete farm expenses spreadsheet online?

Filling out and eSigning farm activity sheets is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit how to write off farm expenses straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing farm expense spreadsheet excel template, you can start right away.

What is Farm Income and Expense Worksheet?

The Farm Income and Expense Worksheet is a financial document used by farmers to detail their income and expenses related to farming operations. It helps in tracking the financial performance of the farm.

Who is required to file Farm Income and Expense Worksheet?

Farmers or farm businesses that generate income through agricultural activities and need to report their financial information for tax purposes are required to file the Farm Income and Expense Worksheet.

How to fill out Farm Income and Expense Worksheet?

To fill out the Farm Income and Expense Worksheet, farmers should gather their financial records, including income from sales of crops and livestock, and expenses such as supplies, labor, and equipment costs. The worksheet should be completed by entering this information into the designated sections, ensuring accuracy.

What is the purpose of Farm Income and Expense Worksheet?

The purpose of the Farm Income and Expense Worksheet is to provide an organized way for farmers to report their income and expenses, assess their financial health, and prepare for tax filing.

What information must be reported on Farm Income and Expense Worksheet?

The information that must be reported on the Farm Income and Expense Worksheet includes total income from farming activities, detailed expenses categorized by type, and any other relevant financial data that reflects the farm's operations over a specific period.

Fill out your Farm Income and Expense Worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Printable Agriculture Worksheets Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to farm expense excel spreadsheet

Related to farm expense worksheet

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.