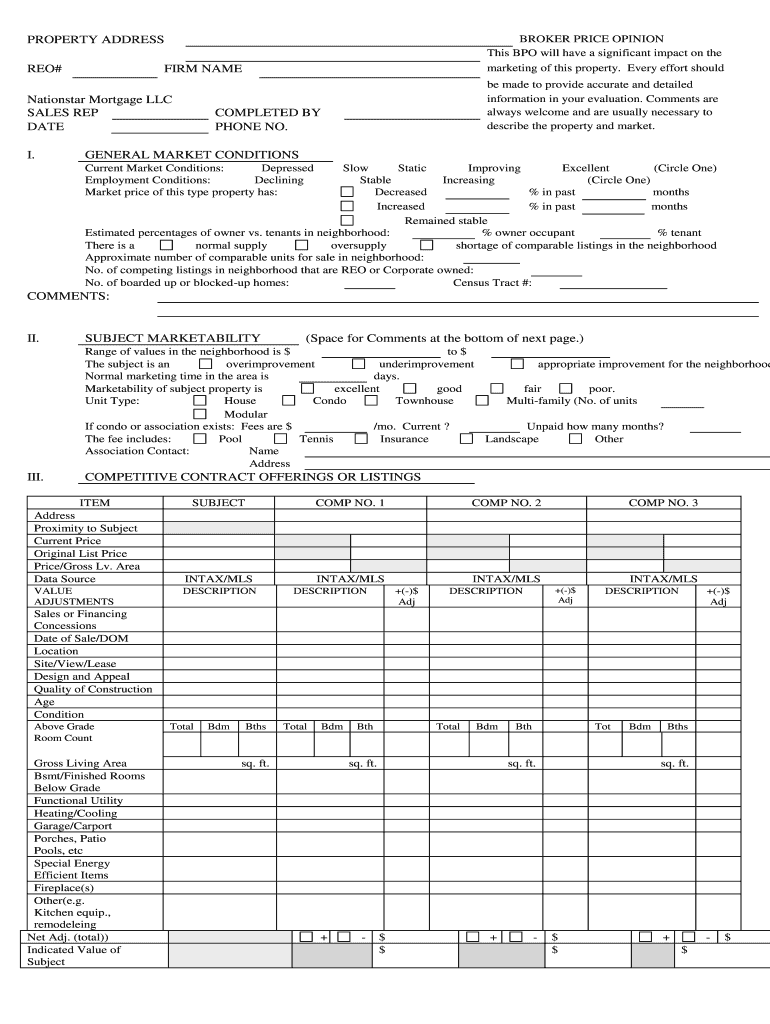

Get the free fannie mae bpo form pdf

Get, Create, Make and Sign

How to edit fannie mae bpo form pdf online

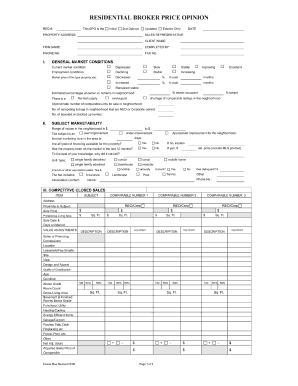

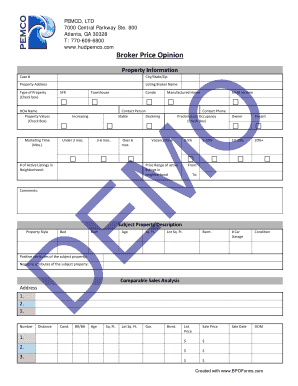

How to fill out fannie mae bpo form

How to fill out Fannie Mae BPO form:

Who needs Fannie Mae BPO form:

Video instructions and help with filling out and completing fannie mae bpo form pdf

Instructions and Help about fannie mae bpo form

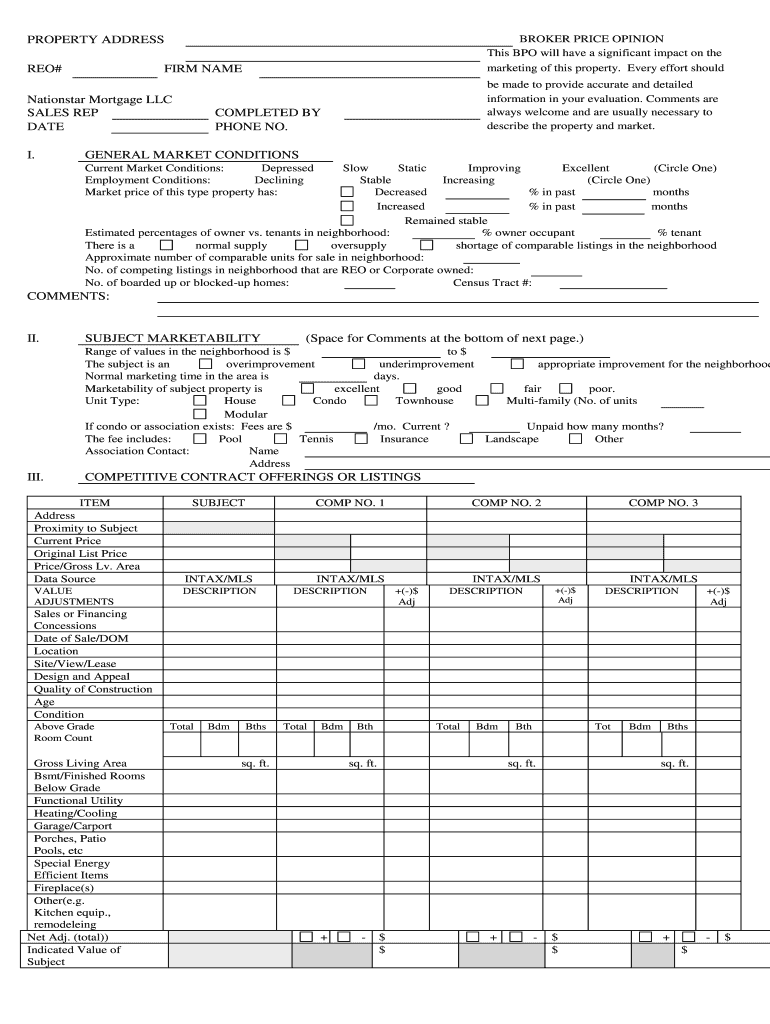

Hi folks Rob Kristin here at the BPO RED Academy and today I'm going to talk to you about Brooke recruits at any time or BPO companies they are companies are hired by banks lenders or mortgage holders to determine the value of real estate a BPO or broker price opinion is completed by a licensed real estate professional enter is or her opinion of value of real estate BPO company serve as liaisons between the broker price opinion professionals and the ordering institution there are a lot of BPO companies in today's market due to all the stress properties these companies receive large groups of orders from bank lenders or mortgage holders that need to know the current value of these properties the banks or mortgage holders or BPO's rather than appraisals because they're cheaper than a phrasal typically costs around three hundred and fifty dollars, and they can get a BPO done between 100 and 150 dollars and in these situations that they're ordering them they just want to know the current market value they don't use exact cradle appraisals are still ordered but typically ordered after the property for closes before the bank of desktop but during the limbo process that the property is in for sometimes up to five years the bank wants to stay on top of what that property its work so typically during a short sale or a distressed property there'll be four to five BPO's that are ordered that could spend the two to five year window so as you can see with the 8 million foreclosures coming that's about 32 million BPO's and if you can't take into account, but all eight million properties are going to be sold as or forgers that's about 42 billion dollars that's going to be paid to real estate professionals over the next four to five years so broker price opinion companies have networks of real estate professionals they receive the orders they have the real estate professionals go to the property visit the properties take photos and complete an online form that consists of three properties that are comparable that are for sale and then three properties that are comparable than its older than the past three to four six months the companies make money because they charge the bank's anywhere from 120 to 150 for order, and they pay the agent anywhere from 50 to 75 dollars four or so for them, you're making a perfect income as a result of that real estate professionals can also make a great income as a result of this because if you averaged about 50 to say $55 for order if you're doing 20 30 of those a week as a considerable income to make especially in today's challenging real estate market, so that's all I have to talk about today about BPO company I look forward to seeing you soon if you have any questions, or you're interested in learning more about BPO's broker price opinion or BPO company please visit my website at WWE p 0 re o academy com hope you have a great day

Fill bpo form : Try Risk Free

People Also Ask about fannie mae bpo form pdf

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your fannie mae bpo form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.